Digital is no doubt top of mind for bank execs today. Even as many look to cut costs in an uncertain environment, technology remains one area where investment continues to flow — and, according to Bank Director’s 2020 Technology Survey, a good chunk of that is going into improving digital channels for customers. In fact, of the more than half of respondents surveyed who reported adjusting their technology plans as a result of Covid-19, nearly three-quarters were focused on enhancing online and mobile banking capabilities. Meanwhile, 55% have added or plan to add new digital lending capabilities. This sharp focus on digital suggests institutions are eager to ensure they can continue to serve customers at home in the new age of remote life and work.

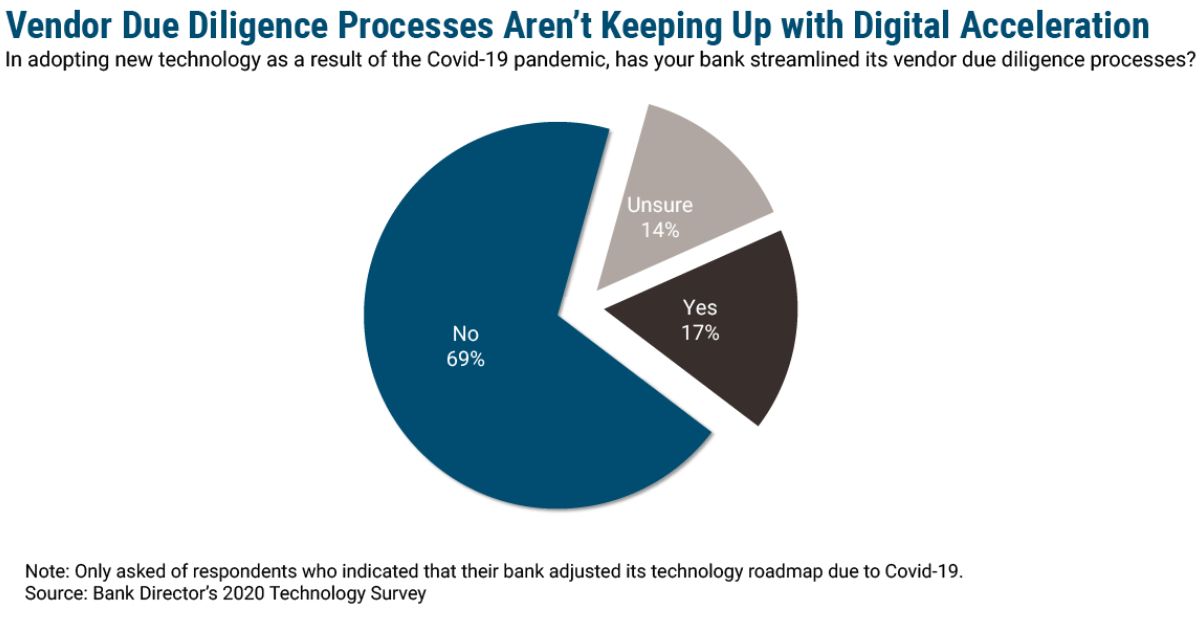

Acceleration toward digital, especially among those that had been lagging behind, is a positive and much-needed development that will push the entire industry forward. But creating this lasting impact will be about more than just a willingness to invest. Banks will have to rethink their processes for acquiring technology and how they work with outside help to improve their offerings. For example, while respondents are committed to improving their digital channels, only 17% have streamlined their vendor due diligence processes in adopting new technology as a result of the pandemic. That creates a mismatch between the strategy driving the business and the tactical elements needed to put it into practice.

Streamlining processes like vendor due diligence can go a long way in smoothing new technology implementations, especially given that some of the most cutting-edge propositions are coming from fintech startups and other new entrants that banks are hankering to work with. Moreover, in an environment where everyone is now on the digital train, the ability to get new capabilities out the door, quickly will be paramount to staying competitive. The upfront commitment to digital is good, but it’s not enough. Institutions that truly want to embrace digital for their customers will need to make sure their own operations are prepared to support that strategic vision, as well.