Banks Need a New Approach to Teen Banking

October 12, 2023

By: Tyler Brown

Fintechs and Gen Z

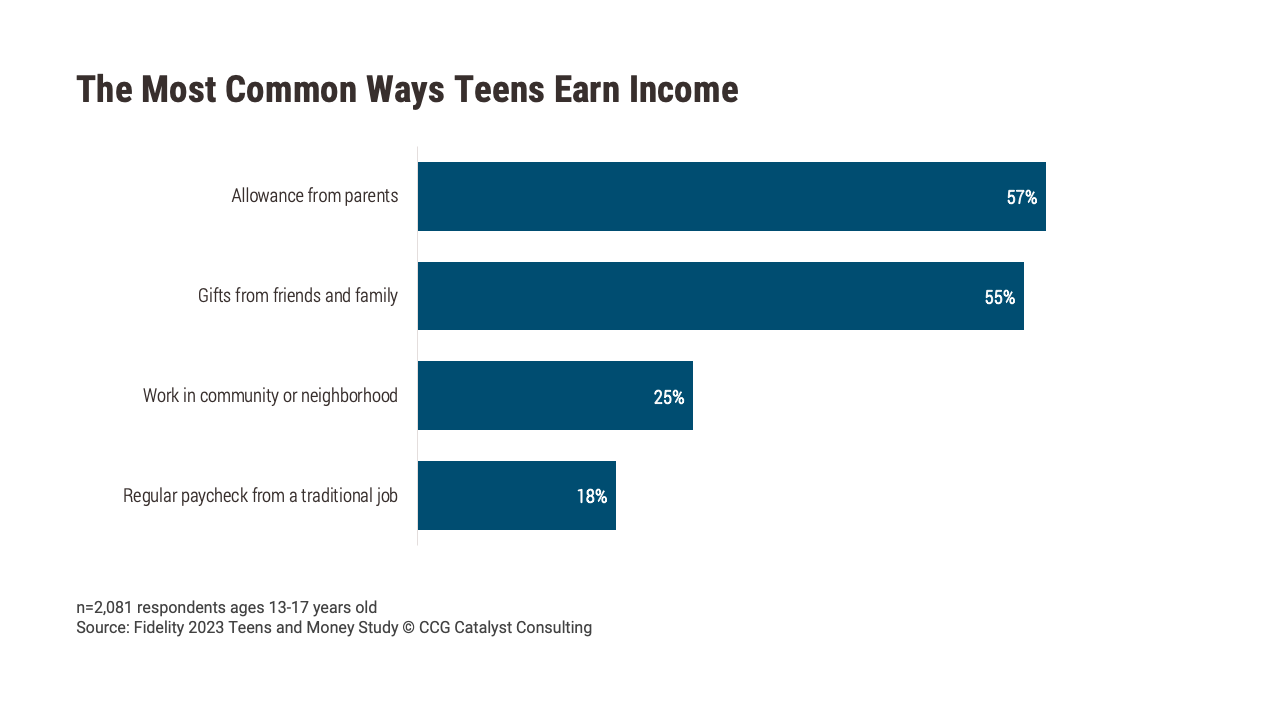

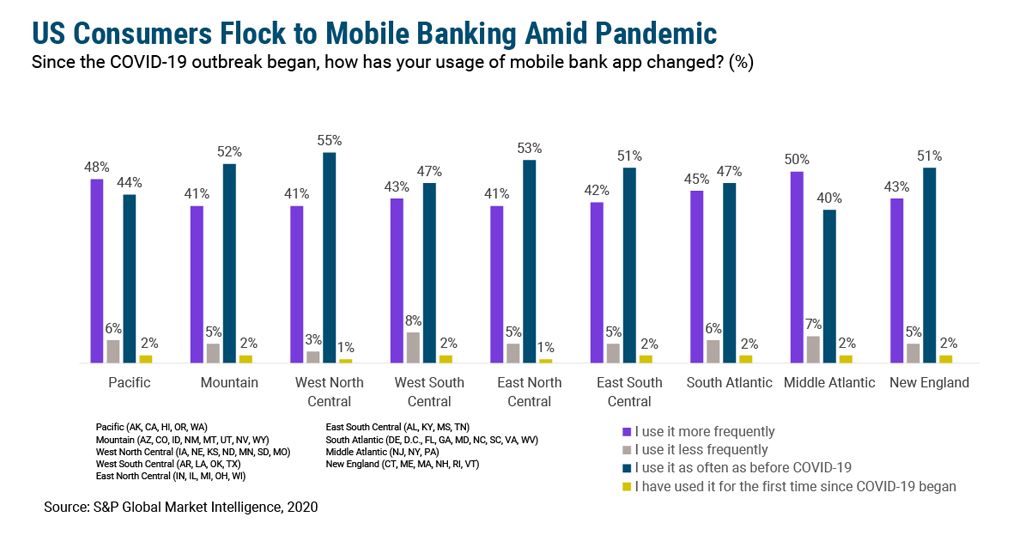

More than half (57%) of teens have income via allowance from parents, according to a Fidelity study conducted by Big Village, followed closely by gifts from friends and family (55%). As teens find income through one source or another, they will most likely need digital banking services to accept, store, and spend it. But in their smartphone-centric world, especially one in which their late-Gen X and early millennial parents use Venmo and Zelle to exchange money between family and friends, the 20th-century initiation to teens’ personal finance via traditional bank accounts is dated. Children will be mobile users for years before becoming of legal age to open an account themselves, and their first introduction to personal finance needs to be a digital experience designed for them and their specific needs.

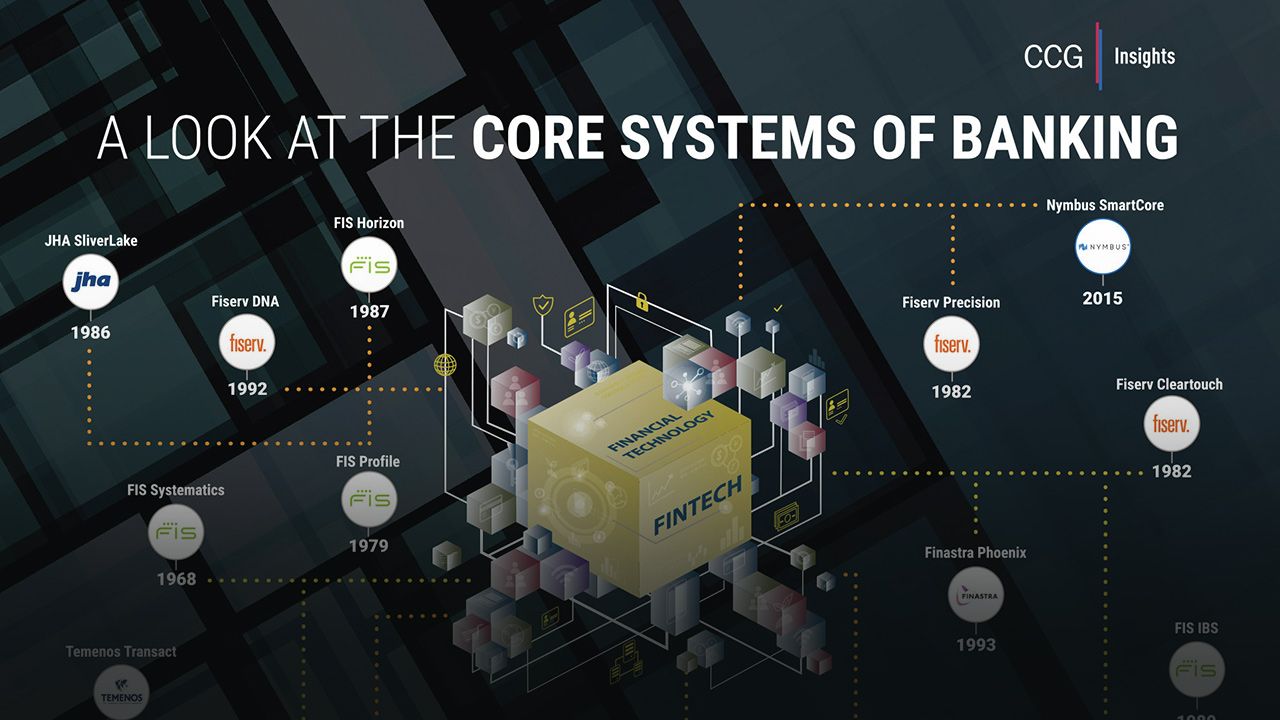

In response to this, apps are emerging which market the ability to help parents instill good financial habits in their children while allowing for parental oversight. Features can include budgeting tools, spending analytics, task management, and goals, on top of enriched transactions, peer-to-peer (P2P) payments, and mobile connectivity. Often these come from the fintech community and larger institutions: Apps in the US designed for teen banking and financial wellness include Revolut <18, Step, GoHenry, Greenlight, Copper, and Current; Chase offers First Banking, and Capital One offers MONEY. For many outside these buckets, such services may siphon off parents and establish teens as engaged early customers. As such, getting financial education and banking tools for today’s teens is crucial for banks of all sizes.

Ways these institutions can approach mobile banking for teens are threefold: As the direct providers of teen banking services (Capital One MONEY); as the Banking-as-a-Service (BaaS) partners with the fintechs that offer banking services to teens (a long list); or as customers of a white-label solution offered by some of those fintechs (Greenlight cobrands the Greenlight platform for banks or white labels it entirely, like for Chase First Banking).

The most efficient teen banking opportunity in the near term for retail banks is probably white labeling — it saves most of the upfront cost of building and provides a toehold for a relationship with teen customers while contemplating more complex, modern digital banking solutions. Regardless, a one-size-fits-all bank account for consumers of all ages is in the past. Savvy banks consider their customer’s life stage when they try to personalize the sale of products and services (like an IRA to a consumer who just entered the workforce or a mortgage to young parents). But for consumers so young they aren’t likely to turn a profit on their own for years, banks need to pay particularly close attention to tailoring the experience.