The CX and Security Conundrum

May 6, 2025

By: Kate Drew

Customer Experience and Security

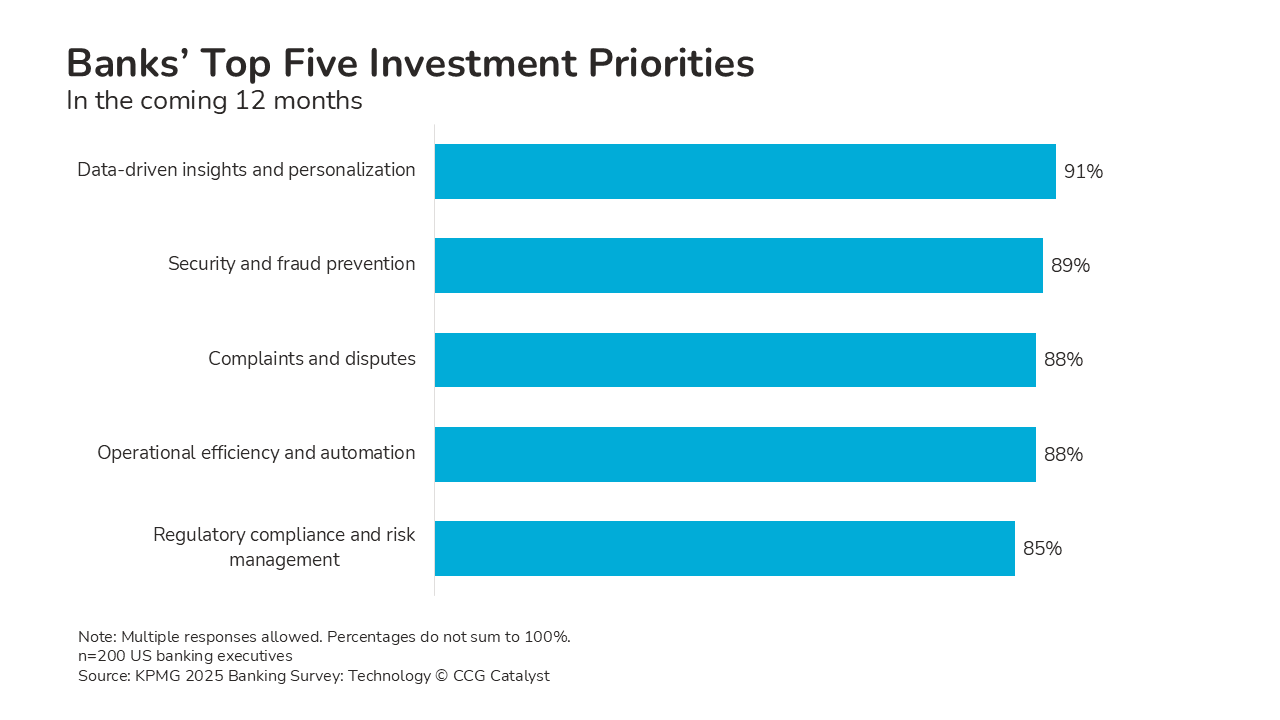

US banks’ investment priorities for the year ahead aren’t all that groundbreaking. According to KPMG’s latest banking survey, the usual suspects top the list — personalized, data-driven insights, fraud prevention, etc. However, based on our analysis, the top five categories of investment that KPMG lists can be largely grouped into two buckets: those dealing with customer experience and those dealing with security and compliance. That’s where things get a bit more interesting.

The customer experience bucket includes data-driven insights and personalization and complaints and disputes (#1 and #3 on the list, respectively) while in security and compliance, we have security and fraud prevention (#2) and regulatory compliance and risk management (#5). The only one that doesn’t fall neatly into a bucket is operational efficiency and automation (#4), although you could argue that it applies to either or both.

Now, you may be thinking, why does this matter? Why bother with this exercise? The reason it matters is because, if we abstract these priorities up a level, to customer experience and security and compliance, we can see that banks’ key drivers are likely to run up against one another. And that is because of one thing: friction. We toggle friction when we address either customer experience or security — dial it down, and you will improve the customer experience, dial it up, and you will improve security. See the problem?

Financial institutions are in a tricky spot — they need to compete on customer experience and meet demands being shaped by other industries (think, Amazon and Netflix) while also maintaining enough friction to ensure security. This is hard. Getting this right means striking a very delicate balance between the two. As one provider told me a long time ago, you want to ask for exactly as much information as you need to make the right decision, not one element more, not one element less.

There is no one answer to this conundrum, and it will not cease to be a pain point for banks — at least not in the foreseeable future. But there are things institutions can do to get the right balance. First, and most important, is understanding that there is a balancing act to begin with and keeping it in mind when making decisions. Second is working to create a data-driven organization, because that is what will enable your bank to operate with a level of confidence that, ultimately, results in less friction for the consumer.

The good news is that banking providers aren’t really competing with Amazon and Netflix. They are competing with other banking providers. Yes, this includes the big banks and fintechs, but those are also at the mercy of this balancing act. The bad news is that understanding this issue well enough to do something about it is a place many institutions fall short. And, when it comes to data, few are hitting the mark.

As such, it would be wise for institutions to make this conversation central to planning discussions, and to commit to building a well-defined data strategy. The goal doesn’t need to be perfection, but constant and ongoing progress also should not be optional.