Foreward

“Every company will be a fintech company.” That phrase traces its roots back to a presentation given by Angela Strange in November 2019. Since then, many different versions of this idea have been splashed around in the media, all driving home the same point that banking isn’t just for banks anymore. This notion, that any brand can get into financial services, is a powerful one. But it misses a very significant point — for nonregulated companies in the US to offer financial products, they generally have to partner with an actual bank.

Banking-as-a-Service, or BaaS, centers on this kind of partnership, by which a regulated bank provides its charter to a nonregulated brand, enabling the latter to offer financial services to their customers. If this sounds like white-labeling, that’s because it is. But it’s also more than that — there are a slew of operational and compliance components that go into launching “bank,” and the actual bank underneath needs full oversight and visibility into how those components are being managed. That’s where BaaS providers come in. These technology-first facilitators help the bank to manage their BaaS operations, while working with fintechs or brands to set up all of the components they need to get to market, from their risk stack to their ledger.

Today, most of the chatter around BaaS tends to focus on the fintech or brand partners. This makes sense, because the ability for these players to get to market with financial products is changing what banking means for consumers. For example, if I can get a bank account through Venmo (partnered with The Bancorp Bank), that fundamentally changes how I manage money that comes in from friends or family. What’s often left out of the conversation, though, is what it means for the bank. How did they do it? What are the benefits and risks? And what can others do to follow suit?

This report attempts to provide banks interested in getting into BaaS with an understanding of how these partnerships work, the considerations necessary to be successful, as well as the BaaS provider landscape. There is a great deal of value in outsourcing parts of this process, but there are different options for different kinds of banks, especially when it comes to balancing offloading operations and minimizing risk. We’ve spent many hours in conversation with bank executives, BaaS providers, and their fintech partners to truly grasp how these relationships work. What follows is the result of that effort. We hope you enjoy it.

Kate Drew

Director of Research

There are few trends today more poised to change the face of banking in the US than Banking-as-a-Service, or BaaS. It’s emerged in full force over the last couple of years as fintechs and other nonbank players increasingly began looking for ways to operate in the banking space without going through the grueling process of acquiring a charter. Enter banking institutions with those charters looking for greater distribution. BaaS is effectively a way for banks to white label their regulated banking services and deploy them through a third party that manages the front-end customer experience.

A BaaS business model allows a bank to outsource two very important elements: customer acquisition and the customer experience. Both of those areas are extremely difficult to do well in an environment that’s highly competitive and driving rapidly toward a digitally advanced future. However, much of the hype around BaaS at the moment focuses on what it means for brands and how it easy it will be in the future for “anyone to become a bank.” It’s an important area, because the ability for brands to easily add banking services is what will eventually transform financial services as we know it. But what about from the bank perspective? If you are a bank today, how do you prepare your business to participate in this future ecosystem?

This report will explore what the BaaS model looks like from the bank perspective, what institutions need to consider to tackle BaaS successfully, and how an emerging crop of BaaS vendors is setting the standard for this new way of distribution.

What is BaaS — and why is it so hot, right now?

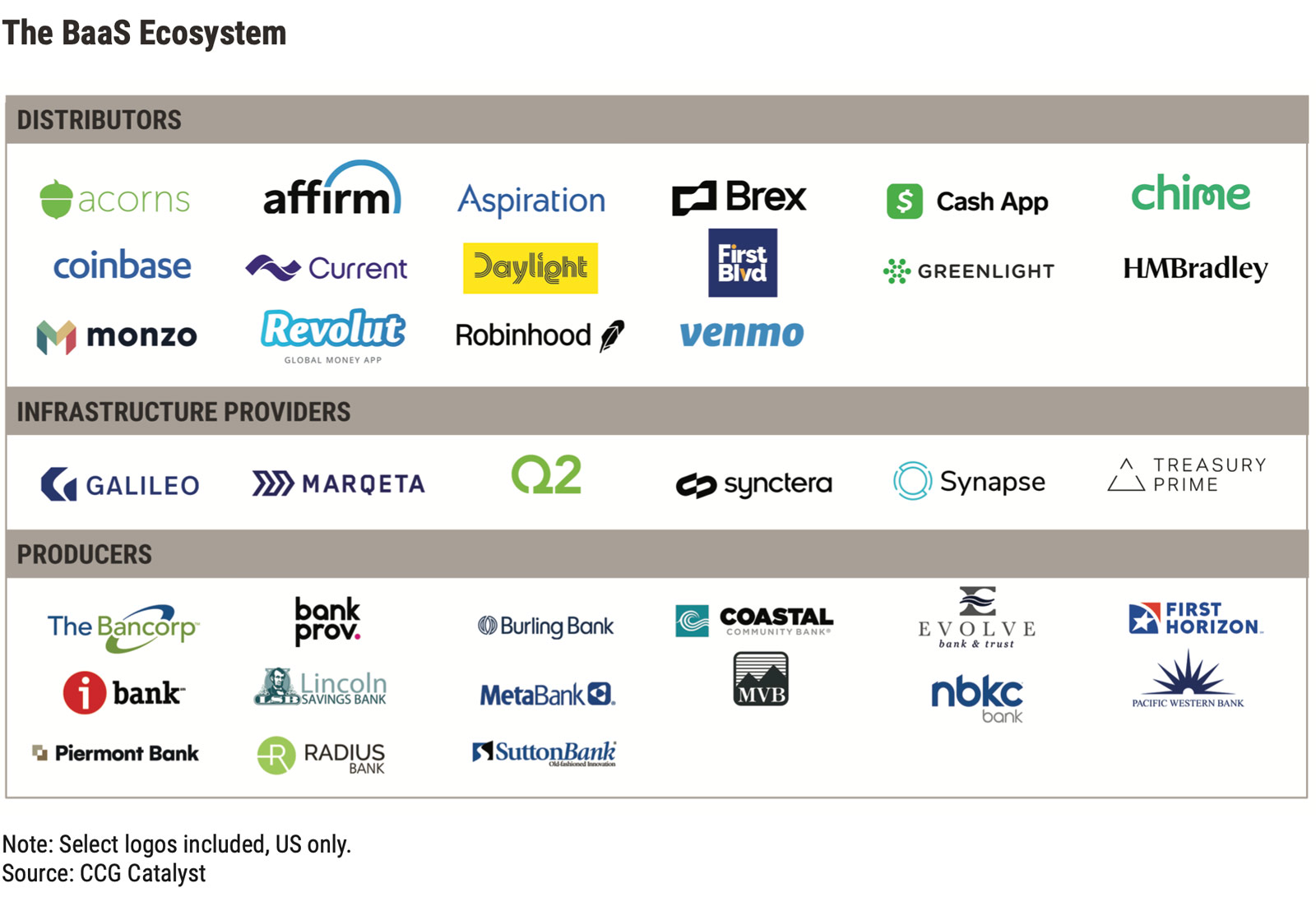

BaaS is a distribution model by which regulated banks deploy their products through nonbank brands, effectively licensing their charters. Under this scenario, the bank partner provides regulated infrastructure to a brand, often a fintech, looking to offer financial products, and, in turn, gains access to new revenue streams. Banking products provided by some of the biggest fintechs in the country are powered by bank partners: Unicorn neobank Chime, for example, is backed by a few partners including The Bancorp Bank and Stride Bank, while digital wealth manager Acorns offers a debit card powered by Lincoln Savings Bank. This allows these fintechs to provide Federal Deposit Insurance Corporation (FDIC)-insured accounts to their customers. In practice, this has generally amounted to a large For Benefit Of (FBO) account in the name of the fintech, with customer accounts held as sub-accounts underneath, though the market is now beginning to embrace full demand deposit accounts (DDAs). In addition, banks are providing other products like card issuing, payments, and lending via BaaS.

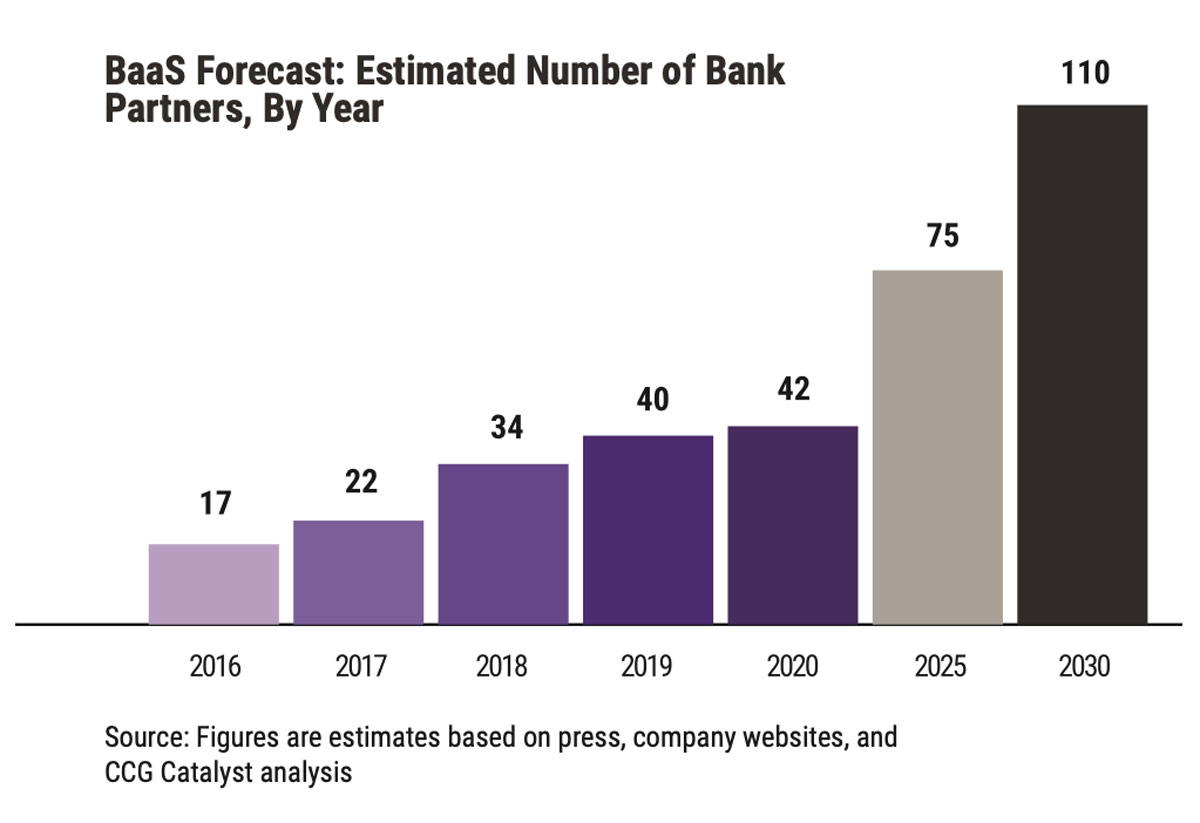

The popularity of BaaS is tied to its promise to handsomely benefit parties across the financial services spectrum: traditional banking institutions, the producers; fintechs or brands, the distributors; and customers, the users. Nonchartered brands that want to move into financial services often have the customer experience nailed but need a license to get to market; banks may struggle on customer experience but have the license and compliance expertise. Marrying these two together gives customers the experiences they are looking for under a regulatory umbrella. This synergy is putting BaaS in the spotlight and leading to deal announcements almost daily. Meanwhile, the number of partner banks has increased dramatically over the last few years, jumping from 16 in 2016 to over 40 in 2020, according to data compiled by CCG Catalyst. And that’s likely going to continue to climb as more banking institutions wake up to the opportunity BaaS presents: Partner banks tend to operate at return on equity (ROE) and return on asset (ROA) levels that are two to three times above average, per Andreesen 1 Horowitz data.1 However, it’s likely those banks that enter this market early that will reap the most gains and benefit from the most favorable agreement terms. That means it’s important to have a strategy today, for the future.

A key benefit to banks is in the lower customer acquisition costs the BaaS model provides. BankMobile, which is behind T-Mobile MONEY, boasts customer acquisition costs as low as $10 per new account, 3 compared with an industry average of about $300, 3

for example. Additionally, banks with under $10 billion in assets are exempt from the Durbin Amendment, which means they are not subject to a cap on interchange fees and can therefore build their BaaS models around customer swipes. As a result, BaaS is especially popular with banks that fit this bill. We’re also seeing additional revenue models emerge, including pay-as-you-go and subscription options.

This probably all sounds like a no brainer from a benefit standpoint. But there are a number of considerations that need to be worked through in order to implement BaaS well. Many of the early BaaS tie-ups between banks and their partners were direct agreements that came with technological and operational hurdles, especially when the bank hadn’t done any deployments before. More recently, BaaS infrastructure providers have stepped in to abstract some of the complexity in these relationships and streamline the process. These providers sit between the bank partner and the brand, handling the technology and operational issues in between. This can be a helpful option, but it requires outsourcing and a strong understanding of the landscape. There is considerable risk in white-labeling regulated products, and it’s the bank’s responsibility to manage that risk in the selection and oversight of its partners.

Banks just beginning to explore BaaS need to examine the ecosystem around them in order to be successful. Ultimately, it’s those banks that have taken a strategic approach here, and fully thought through how BaaS can complement their existing business while maintaining the proper controls that will make the most of this opportunity.

Getting ready to tackle BaaS

The first step to tackling BaaS is to determine how you are going to approach the market. There are two core paths into the BaaS ecosystem that banks can take: direct or through a BaaS provider. (Some also pursue a combination of both.) Banks that go direct manage their own BaaS relationships and operations in-house. This route gives banks greater control over their ecosystem but also requires considerable resources. Examples of institutions that have taken a direct way in are BBVA and Green Dot, as well as Cross River Bank. We will cover this approach in detail a subsequent report, while here we will focus on the ecosystem of BaaS providers.

BaaS providers are technology-first facilitators that allow the bank to outsource all or part of the process. The bank defines all of its policies and procedures for its BaaS operation, including target customers, onboarding, and risk assessment, with the BaaS provider, which then handles the day-to-day management of activity and reporting back to the bank. The bank will usually set up a single integration point to this provider, eliminating the need to integrate multiple times with many different partners. In a fully outsourced scenario, the bank manages a single relationship with the BaaS provider, which then manages all of the partner relationships on the other side. Some providers will handle everything all the way down to cardholder disputes and customer service.

This approach takes a lot of the burden off of the bank, but it also means sacrificing control, especially when it comes to relationship management. In fact, in some cases, the bank may not have any direct relationship with their fintech or third-party partners at all. Banks that take this path are likely to be those willing to trade control for help getting started, or those with experience now looking to scale beyond what they feel they can reasonably manage on their own. Additionally, in the conversations we had with these BaaS providers, most of them tended to refer to fintechs or brands as their customers. This is telling because it suggests this is the market they are serving, while their banking partners are just that, partners. Because of this, BaaS providers often do not need to partner with many banks, making the environment somewhat competitive.

Most of these providers are also newer market players, and their BaaS propositions are even more novel. Each is currently working with only a small number of banks on BaaS today. Banks that are looking to go this route will need to thoroughly evaluate the vendor risk associated with such a proposition, and whether or not it’s suitable for their business. For those that decide it is, selecting the right partner and determining the right level of outsourcing for your bank will be key. These providers can do a lot to streamline the process, but the compliance burden ultimately sits with the bank, always.

The BaaS provider landscape

In the world of BaaS, a fintech or third-party distribution arrangement is typically called a program. The program manager in a direct relationship would be the fintech or third party. When a BaaS provider is involved, they will often take on some, or even all, of the program management activities. These activities include things like reporting and oversight, relationship management, and, in some cases, operational components like cardholder support. The level of management the BaaS provider takes on depends on the provider and the preferences of the bank.

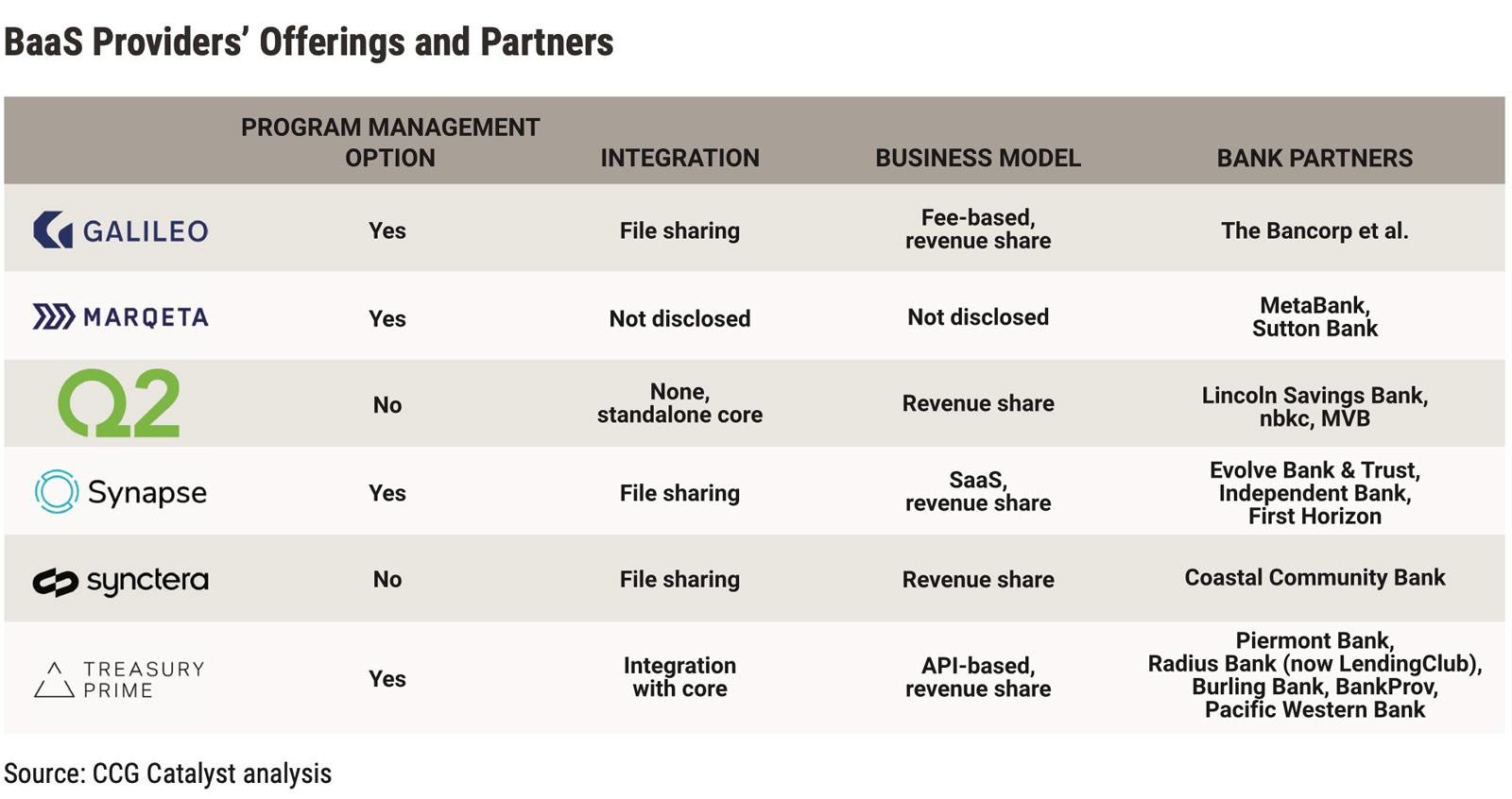

Below, we take a look at a few notable BaaS providers in the market today. While all of these players participate in the BaaS ecosystem, their offerings and approaches differ in certain ways. As such, banks exploring this market should keep in mind that it’s less about finding the winning provider and more about finding the right partner for your bank. The following is meant to provide an overview of the landscape and in no way serves as a set of recommendations by CCG Catalyst.

Galileo

Galileo, a subsidiary of fintech unicorn SoFi, is known primarily for its application programming interface (API)-based payment processing platform used by big-name fintechs like Varo and Monzo. However, its central position within the fintech tech stack has made the company well suited to morph into a full-scale BaaS provider. It currently works with about 20 issuing banks across its two core BaaS offerings:

Galileo Pro. Banks on Galileo Pro manage their own fintech or third-party relationships and leverage Galileo’s platform to enable the operational components. The bank holds an FBO account for each of its programs that run on Galileo’s ledgering system, and the company provides a live dashboard as well as flat files each day for reconciliation. It works with the bank to build out the reporting and policy requirements before launch. All of the vendors for things like KYC are selected by and agreed to by the bank and their fintech or third-party partner, and all activity is tracked within the platform, giving the bank full visibility for compliance oversight. In addition to debit accounts, Galileo Pro supports a range of products including secured credit and prepaid.

Galileo Instant. The company’s full-service offering is called Galileo Instant and launched 10 months ago. 4 Galileo Instant allows fintech or brand partners to issue debit cards through Galileo, which then handles all of the reporting back to the bank as the program manager. The key difference between this offering and Galileo Pro is that bank’s relationship is with Galileo, and all procedures and vendors for areas like KYC are agreed to with and managed by Galileo. “With Galileo Instant, all of the parameters are fixed, and we are laying out with the fintech or brand what all of the procedures are, who all of the partners are, as well as handling things like call center traffic and disputes,” Mike Douglas, VP of strategy at Galileo explained.

Galileo Instant has seen tremendous uptake among businesses looking to offer financial products, with over 1,500 signing up since it launched. However, this service is quite new and just beginning to demonstrate where Galileo may go in the future. The company currently has only one bank partner for Galileo Instant, The Bancorp Bank. Galileo Instant is also a heavily outsourced proposition; meaning the bank is giving up quite a lot of control. Galileo Pro, meanwhile, is best suited to banks that have already identified fintechs or brands they want to work with, and are looking to get to market quickly, while streamlining reporting and compliance. The business model for Galileo Instant is a revenue-sharing agreement, while Galileo Pro is fee based. Banks on Galileo Pro have their own revenue agreement with their fintech or brand partner.

Marqeta

Similar to Galileo, Marqeta was a big-name in fintech long before BaaS came into the spotlight. The company built its business on its card issuing and processing capabilities, which landed it major deals with the likes of Goldman Sachs and put it on the path to an initial public offering. More recently, it’s started branching into BaaS program management, with its two current bank partners, MetaBank and Sutton Bank. It’s a multi-month undertaking to onboard a new bank, explained Justin Wee, head of digital banking at Marqeta, one that includes understanding all of the bank’s procedures, approving vendors, and aligning with the bank’s risk team. The fintech signs an agreement with Marqeta, which then determines which bank is best equipped to handle the program. Marqeta has an independent revenue arrangement with the bank, as well.

Marqeta is certainly well positioned to serve as a one-stop-shop for BaaS, but it’s quite tight-lipped on its plans for this offering. The company declined to provide further specifics on this part of the business, likely because it is so new and still firming up. Many experts we spoke with believe that heavyweights like Galileo and Marqeta, with their deep experience providing elements of the fintech stack, are likely to become major winners in the BaaS infrastructure game. In fact, most say that’s already happening. It will take time for some of these newer initiatives to take shape in the market, though, especially from the bank point of view.

Q2

Q2’s been dancing around the BaaS space for a while, including via Cambr, a joint venture with deposit network StoneCastle that it dissolved last year. 5 It’s since repositioned its offering to focus on its CorePro system. A bank can use CorePro to run a white-label business in parallel with its existing systems, and it’s the same core system that Q2’s fintech partners run on. This setup alleviates integration issues on the bank side, as the proposition is completely standalone from its traditional business. The company works with the bank to put in place policies and procedures in areas like AML and disclosures. The goal is to simplify all of the operational and technical components for the bank, so it can focus on the compliance elements, like Tier 2 escalations, reporting back to auditors, managing audits, and overall program oversight, Ahon Sarkar, Senior Director, Product & Strategy at Q2, told CCG Catalyst.

The company’s banking clients are matched with fintech partners based on competencies. For example, a bank partner with considerable experience with white labeling and high-volume customer onboarding would likely be matched with a larger fintech partner that handles deposit accounts at scale. A bank just looking to get its feet wet might be matched with a smaller player with 10,000-50,000 users or so, perhaps more focused on savings and less on transactions, Sarkar explained. The business model is a three-way revenue split between Q2, the bank, and the fintech. And, while Q2 helps to connect and advise the parties, the bank maintains direct relationships and operational oversight over its partners’ programs.

Q2’s proposition is a bit different to others in the market because it includes a dedicated, real-time core that a bank can use to run its white-label business. As a result, all of the accounts are ledgered on Q2’s system, all of the diligence checks are handled within the Q2 platform, all of the transactions are handled through the Q2 platform. None of the backend processing is handled by the bank or by the third-party partner, and Q2 provides tools to simplify and automate reconciliation. That’s obviously attractive in theory. It’s worth pointing out, though, that the Cambr venture was only sunset in the last 12 months, so Q2’s BaaS strategy is likely very much still evolving. Integration with Q2 systems takes 3-4 months for an FBO or savings product, while a DDA could take up to 6 months.

Synapse

Synapse sits between its three banking partners (soon to be five) and ~150 fintech partners. It offers banks on its platform, which currently include First Horizon, Independent Bank, and Evolve Bank & Trust, the ability to issue DDA and FBO accounts as well as transaction processing and card issuance services. All of the company’s fintech partners run on its technology stack, including its core, and reporting back to the bank is handled by Synapse. It also works with banks to integrate into their existing file transfer system, meaning no API connection is required. The process typically takes 30-45 days.

The first step for a new bank partner is to work with Synapse to set out all of the policies and procedures that will govern the relationship. The bank and Synapse will share sample reports and agree on formats, lay out policies for daily compliance including for KYC, sanction screenings, AML monitoring, unusual activity, and daily ledger reporting, as well as work through nuances like how interest accrual will be handled and when a credit or debit will post to the general ledger, explained Sankaet Pathak, Synapse CEO.

Once all of these procedures are set out with Synapse, they are used for every third-party partner onboarded to that bank, standardizing daily compliance and program oversight. All of the controls flow through the platform; Synapse’s role is to maintain those controls, while the bank’s role is to maintain oversight on Synapse. Like with other full-service offerings, that means the bank is outsourcing quite a lot, including oversight of its partners, which requires a high appetite for risk. That’s likely to be especially true here given the company tends to target early stage fintechs, which typically have less experience overall, and manages such a large number of relationships.

Underneath the hood, Synapse is one general ledger entry at the bank, with sub-accounts that pertain to partners and their users. Each day, Synapse provides a reconciliation report that includes data on all of the transactions for each of those sub-accounts. Banks are matched with fintech partners based on capabilities, though they can also bring their own partners to the table. Revenue agreements are negotiated upfront, and those terms are applied to all fintech partners for the bank.

Synctera

Synctera’s proposition is unique in that it’s specifically designed for banks, and in particular for community banks that have never done this before. It’s also extremely new; the company is currently working with just one bank and one fintech, Coastal Community Bank and One Finance, respectively. Synctera provides a platform that matches banks with third-party partners based on their preferences and core competencies, as well as acts as a translation, billing, reconciliation, and reporting layer in between those parties once they’ve entered into an agreement. It connects to the bank’s existing file sharing system and provides a dashboard housing all activity happening on the platform, including matching all activity happening inside of a third-party app to policies laid out by the bank.

While Synctera will act as an advisor, providing best practices for policies and templates as well as helping banks conduct due diligence, the agreement is ultimately between the bank and the fintech or brand. Synctera has a separate revenue-sharing agreement with the bank. The platform’s central role is to translate the policies that banks need to govern their relationship with a fintech into actions that can be monitored by the bank’s compliance teams; it provides real-time quality control on everything the fintech does, Dominik Weisserth, head of product at Synctera, explained. For example, the platform will track each end user’s onboarding journey to ensure all regulatory requirements are being hit and flag any activity that is outside of the expected parameters. The company provides a single set of market-facing APIs that all third-party partners connect to.

Synctera supports only the FBO model and provides reporting on all of the individual account activity for reconciliation purposes. All reporting and policy requirements are defined with the bank and implemented by Synctera. The fintech is responsible for complying with those policies, and the bank is responsible for oversight. The platform provides a channel for monitoring the activity in between.

Treasury Prime

Treasury Prime works with five bank partners across 40 fintechs. It integrates directly to the bank’s core and other necessary systems in a 6-8 week process and then provides a single API to the market. The company works with the bank to understand what products it wants to offer, which systems need to be involved and reporting requirements, as well as all of the KYC and fraud protocols that will be required, including deciding on pre-approved vendors. Each setup is specific to the bank but is delivered through Treasury Prime’s API endpoint to all third-party partners. Treasury Prime also provides a dashboard with a real-time view of all information flowing through the platform. The platform is an API layer and workflow engine, which means that all of the activity happens on the bank’s systems and is overseen by its compliance teams.

There are two ways third-party partners can operate: either by connecting directly to the bank’s core through the API or by using the Treasury Prime ledger. Those that connect directly can originate individual accounts on the bank’s core, while those on the Treasury Prime ledger will leverage an FBO account. For those doing the latter, the ledger keeps track of all transaction history for the FBO and provides connection to payment gateways. Reconciliation is only necessary for those on the alternative ledger, and all of the transaction activity is provided through the platform.

Additionally, the economic implications are different for each option. It can cost the bank more money to open many accounts versus a single FBO, which means that, for partners with small average deposit sizes, this is a more viable path. The business model includes a services component for the integration and monthly payments for the API usage by the bank’s partners. Based on the bank’s preference, fintechs either sign their own contract with the bank or Treasury Prime, which includes payment for API calls as well as any interchange component, of which Treasury Prime gets a cut.

Treasury Prime will act as program manager in some instances, while in others the bank will handle the program management; it depends entirely on the bank’s preference. In cases where it acts as the program manager, Treasury Prime takes on everything from sourcing partners and relationship management to handling disputes and customer service. According to Remy Carole, head of business operations at Treasury Prime, the company is seeing more interest in its program management services from both newer banks as well as those that by this point have many fintech or brand partners and are looking to scale further.

Treasury Prime’s been in this space for some time, and, like Synctera, it puts more focus on its bank relationships than other providers, as evidenced by the time it takes to integrate on the backend. Similar to Synapse, it serves smaller fintechs (most of which are under the FBO model), creating some of the same risks and considerations, though it generally takes on much less from an oversight perspective.

BaaS in practice

Understanding how these relationships work in real life is critical to charting a path forward. We asked each of the providers we talked to if they were interested in supplying a bank partner to share their perspective. Below, we profile a couple of banks’ approaches to BaaS and how they work with BaaS providers to streamline the process.

nbkc bank

nbkc bank began its BaaS journey about three years ago, and it now has around 15 fintech partners. The goal for the bank was to bring itself closer to the fintech ecosystem, while also obtaining access to low-cost deposits, explained Melissa Eggleston, chief deposit officer, EVP at nbkc. It benefits from holding its partners’ deposits on its balance sheet and also collects fee income from interchange as well as things like program management and oversight. nbkc offers an FBO, savings, and DDAs currently and expects to move into other products like lending in the future.

The bank runs its current BaaS operation on Q2’s CorePro, which means it is managed separately from its traditional core banking business. It also means that all of its fintech partners today need to be running on the CorePro ledger. All of the necessary reporting comes through Q2, and it’s integrated with approved vendors, such as for KYC and other critical components. As a result, it’s a relatively light lift for the bank to get setup with a new partner from a technical standpoint, according to Eggleston. New partners come to the bank a variety of ways including word of mouth and Q2 referrals.

nbkc does not outsource program management activities; it has a dedicated partnership team that manages all of its BaaS relationships. That team is charged with vetting partners for fit, conducting due diligence based on defined requirements for different BaaS products (the bank’s FBO product does not have a card attached, for example, which means the diligence requirements are slightly less stringent), and providing compliance oversight throughout the life of the relationship. Once due diligence is complete and contracts are signed, this team holds a kickoff and works through an implementation plan. That includes the fintech making API calls in a sandbox environment, building to CorePro, and working with the bank on disclosures, wireframes, and satisfying all contractual elements. From there, the program will go into beta with friends and family before finally going live. For a debit card product, this process typically takes between 6 and 9 months.

The nbkc model centers on creating a stand-alone BaaS operation that functions as its own business unit with its own technology stack. As a result, the bank didn’t have to go through any cumbersome integration work involving its existing core, and while it needs to dedicate resources to managing the operation and ensuring proper reporting, it benefits from the simplicity of not having fintech account activity sitting on two different ledgers. The bank also has a fintech committee that is responsible for oversight of the BaaS portfolio and ultimately reports up to the bank’s board of directors. Q2 is a strategic and operational partner for the bank, as well as an advisor.

Piermont Bank

Piermont Bank is a relatively new bank; it received its charter in 2019 and operates nationally, though it is licensed in New York. The bank is primarily focused on servicing small- to medium-sized businesses, both when it comes to its traditional business as well as its BaaS proposition. On BaaS, however, it is also open to working with fintechs on the consumer side. Its initial offering includes DDAs, ACH/wires, and debit cards. In the future, it plans to expand to other products including credit. Piermont is a de novo bank, 6 and it’s worked closely with regulators on its BaaS plans from the start.

Like nbkc, Piermont Bank is heavily involved in the contractual and relationship management of its BaaS proposition. The bank has a standardized list of requirements that fintech partners need to meet from a due diligence standpoint, and it’s compiled a team of four executives that reviews each potential partner, explained Rodrigo Suarez, head of innovation at Piermont Bank. It works with Treasury Prime early on in these conversations, and in some cases, the BaaS provider will bring fintech partners to the bank for consideration.

The bank works with Treasury Prime to define all reporting parameters as well as on vetting and approving vendors. All of the workflows necessary to make the relationship work, from KYC to account opening, are mapped out with and implemented by Treasury Prime. Once the fintech or third-party partner has launched, the bank has a dedicated compliance team that oversees all activity flowing through the platform. The bank receives reporting from every fintech relationship, including on all transactional activity, and it compares those reports to the parameters agreed to, including in areas like KYC and AML.

Piermont Bank is operating a similar model to nbkc by which it uses a BaaS provider for the technological and operational components necessary to make its partnerships work but retains all of the oversight in-house and manages its own relationships. The bank has separate revenue-sharing agreements with its fintech partners and with Treasury Prime. According to Suarez, Piermont leverages Treasury Prime as a partner on the technology side and the business side, but it believes in playing an active role, especially when it comes to compliance. Suarez also emphasized the risk that comes with fully outsourced models, saying, “Delegating compliance can be problematic. There are a lot of issues around it. We wanted the ability to monitor our relationships and own the relationship with the fintech at all stages.” As mentioned earlier, the level to which a bank delegates will depend on the bank and its risk appetite, but it’s important for institutions to understand the different options available to them. Piermont and nbkc are good examples of banks working with BaaS providers to streamline the process without giving up control entirely and retaining touchpoints where it makes sense.

The bank currently has a very active fintech pipeline and is also launching a program that works with fintechs in beta stages to quickly launch products in the marketplace. Additionally, Piermont has not ruled out adding additional BaaS providers. “Right now, all reporting comes through Treasury Prime. But, over time, that could change, Suarez said. “We may use different channels depending on what we consider makes sense.”

Choosing the right path

Relationships between BaaS providers and banks come in many different shapes and sizes; it’s not one-size-fits-all. Knowing how you want to approach the market can go a long way not only in defining your relationships, but also in selecting the right partners to begin with. For example, while banks like nbkc and Piermont would likely steer clear of those focused on full-service solutions, others may only want to consider a BaaS provider willing to take on full program management activities. It’s also worth pointing out that this space is only set to get more crowded, with international players like Mambu and new entrants like Bond planning to enter the market in the near future. And, as some of the existing players get bigger, they could opt to acquire their own licenses and cut out the bank entirely, employing a model more common in Europe. 7 This is still very much a changing landscape, and those banks looking to get involved need to take time to deeply understand the dynamics before jumping in.

Most experts suggest that having a dedicated team in place to run these initiatives and take the lead on these decisions is key. That team will be instrumental in defining everything from what products the bank will offer to how they might work with a BaaS provider, and everything in between. While there are many different flavors of BaaS, and many ways to outsource, ultimately the business falls under the bank’s umbrella, and there is no getting around that. Having dedicated resources and a strategy going into it is critical, especially as it’s that strategy that will define who your partners are, in the middle and everywhere else.

Citations

1. The Partner Bank Boom, a16z

2. Megalith Financial Acquisition Corp. Press Release, August 2020

3. Efma

4. Galileo News, February 2021

5. Finextra, May 2020

6. Piermont Bank Press Release, July 2019

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read Banking-as-a-Service: Navigating a New Frontier, Part II ![]()

Read What’s Next for BaaS: Revisiting Risk, Infrastructure, and Channels ![]()