Industry pundits have said for years that digital account opening is a key to success for banks and credit unions — of all the apps on the smartphone, only the bank app asked customers to go to a specific physical location to complete the process. But today, according to Raj Patel, COO and cofounder of MANTL, only 20% of banks and credit unions allow accounts to be opened online.

MANTL provides a suite of products for banks and credit unions, but it’s best known, Patel said, for its account-opening software. MANTL can interface with any core and be up and running quickly to help financial institutions begin bringing in customers the only way that matters today — through their smartphones.

The crisis for banks and credit unions — and an upcoming episode of this podcast will focus specifically on credit unions — is that younger customers, both millennials and Gen Z, overwhelmingly choose one of the Big 4 banks — 45% of millennials, according to Patel. They do this because the big bank apps offer convenient features, not least the ability to open an account from the app.

Listen to the podcast below to hear more of Patel’s insights on the community banking and credit union spaces. One trend he pointed out was that community banks are pooling resource to share a CTO between them, which is a new spin on outsourcing tech talent.

Read the full transcript here:

Phillip Ryan [00:00:00] Hello and welcome to another episode of Bank FinTech Fusion. This is Phillip Ryan, Director of Communications with CCG Catalyst, and I’m here with Raj Patel, COO and co-founder of Mantl. Welcome, Raj.

Raj Patel [00:00:12] Thank you very much for having me.

Phillip Ryan [00:00:13] Thanks for coming. Tell us a bit about Mantl and tell us what drew you into financial services. You could have been anything in the world and here you are working in FinTech. Why is that?

Raj Patel [00:00:22] Sure, yeah. So Mantl is an enterprise software company based in New York. We exclusively build technology for community, regional banks and credit unions across the United States. We don’t derive any of our revenue from money center banks. We don’t drive any of our revenue from fintech clients. It is primarily for community and regional banks, which is hopefully some of the audience on this podcast. We originally got drawn to the idea by setting off to try to build a Challenger bank, which is a very, very popular thought. There’s a few of those are a few of those around. And there were still a few of those around in 2016 when we kind of first thought about this idea, when we were investigating that one of the things we realized when we were look at the competitive landscape was that actually you’ve got the money set of banks that have the infrastructure and the resources to invest and build technology. And you’ve got the neo banks and the challenger banks that are coming through and also building really interesting technology. And then you had the middle and who was getting squeezed in the middle. It was community and regional banks and credit unions in the United States. Twenty five years ago, they had the money set of banks, had 16 percent of all deposits in the United States. Now that’s 59 percent. And where’s that coming from? It’s coming out of the community, regional banks, and it’s going to those money centers in those neo banks. And what’s happening is that’s squeezing competition in the market, is giving customers less choices and it’s really hurting the industry. And that’s not a good thing for the country.

Phillip Ryan [00:01:49] The fear of those banks every day.

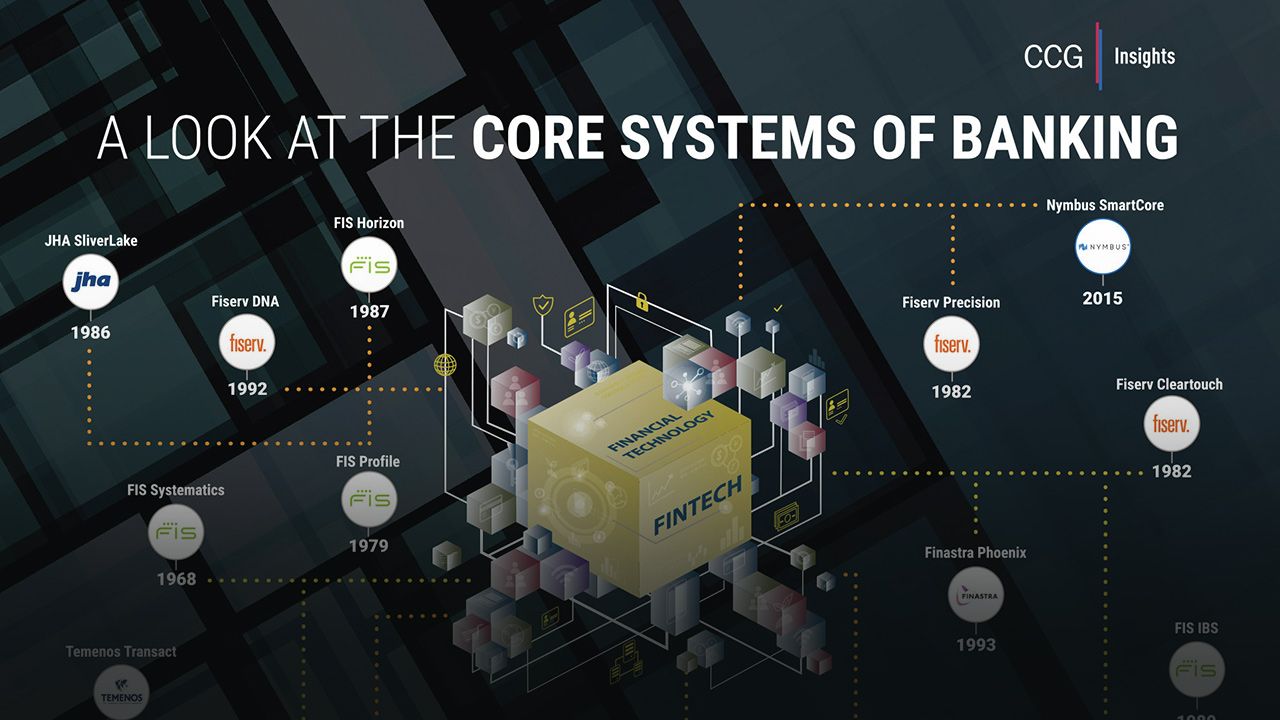

Raj Patel [00:01:51] There are a few of those banks every day. And one of the primary reasons for that is the technology gap. Right, because those banks and credit unions are providing excellent service. They’re providing more compelling products. Right. Where they’re not being able to compete is on the technology side. Ninety six percent of all technology community regional banks is outsourced. And unfortunately, it’s outsourced to an oligopoly. And those players have been around since the 60s, 70s and 80s. That’s when they were founded. And they don’t have necessarily an incentive to innovate because they’ve got a captive market. And so we saw a really big opportunity to bring the mindset of fintech and our banking backgrounds to that space and really help and provide a genuine alternative to the core providers and and hopefully help really reinvigorate and continue to grow the industry, because we think that’s a really good thing for the country and consumers.

Phillip Ryan [00:02:43] And so what exactly is the product you’re selling?

Raj Patel [00:02:46] Absolutely. So we have a number of different products, but probably the one we’re most known for is our account opening suite of software. So we started primarily in consumer account opening because that was an area where we saw a really big need. You know, only 20 percent of all banks and credit unions in the United States have account opening online. Right. And obviously, we know that the Internet is where the world does business. And so if you can’t meet the customer where they are, you can’t hope to compete or retain those customers, particularly for the millennial generation, the newest generation.

Phillip Ryan [00:03:18] Who are all going to the big banks? Because that’s where they can do that.

Raj Patel [00:03:21] Absolutely right. Like forty five percent of millennials identify one of the big four as one of as their primary banking relationship. So the next generation is literally walking out the door and going to those and they’re going to own them for life. If community regional banks that compete. So where we could we drive the biggest value for the industry really quickly, it was accountably. And so today we’re fortunate enough to work with dozens of institutions across the United States helping them attract more customers, more consumer customers. And we’ve since expanded our product line to also do, you know, business customers as well.

Phillip Ryan [00:03:53] And you’re providing more software as well for banks right in between the core and the customer?

Raj Patel [00:03:59] Absolutely. So, you know, what are the what are the things we needed to do to innovate in the industry versus potentially the existing players was to bring a much newer approach and put a modern technology stack on the industry, which is sometimes difficult. So there’s a lot of legacy systems. Everything in our ecosystem is API first. So we have an abstraction layer that we can put on top of any core operating system. Importantly, our code base is unified, so it’s truly enterprise software. So one code base which goes across every single customer, whether you’re a bank at four hundred million or a credit union at twenty five billion, you get the same code base, Fremantle, and that means that every Wednesday you get an update from us. We did 40 updates last year. Instead of sort of the paradigm that you might see in the industry one or two regulatory updates each year. And so what that lets us do is it lets us continue to stay extremely relevant and very cutting edge. And that’s the type of technology that is being used in industries outside of banking. And needs to come to banking.

Phillip Ryan [00:05:03] How much of a challenge is it to work with the cores? Is it a kind of one and done thing or is it a constant struggle?

Raj Patel [00:05:10] Yes, so there’s no shying away from it. The expertize to interact with a core operating system is very unique. And we do see a lot of fintechs and new entrants to the market try to abstract away from that and not do it because it’s difficult. But it’s required. It’s just required. You can’t innovate in this industry without a good understanding. The core operating system, they are entrenched. They’re not going anywhere. There is an amazing alternative right now for banks to switch, credit unions to switch off it. And so you need to be able to integrate with them. We have we built that capability from day one. So we have team members that built, you know, across our team. We’ve had each of our engineers has been one of the first five technical hires at various core operating systems, like 5000 flights of DNA. And to date, we’ve done over a dozen different core banking systems, successfully integrated lives. So it’s a challenge. It’s an area you have to invest in and understand it’s not the sexiest area of the technology stack for our engineers to work on. But you have to own that and you have to understand that that’s a challenge and you have to be a safe pair of hands there.

Phillip Ryan [00:06:20] And bank customers understand nothing about it, which is probably a good thing.

Raj Patel [00:06:24] Yes, exactly. We don’t talk too much about abstraction, layer API set in sort of bank sales conversations, but sometimes with the technology folks, they would get really excited about what it can do.

Phillip Ryan [00:06:38] What’s the most important lesson that you’ve learned in your in your brief career so far?

Raj Patel [00:06:43] Sure. I think in my career, as opposed to sort of just working in this industry, I think the thing that I learned way back when sort of eight years ago when I started my first company was and I think it serves me well today and Mantl as an organization is we often get comfortable leaning on what we like doing or what we know how to do. And that often isn’t actually the thing you need to do to grow your business or be the client. As I like the tangible examples in my first company, my background was I went my undergrad was in finance and I went to law school when I was an investment banker for a little while off the college before I saw the light and became an entrepreneur. And when I started my first company, I spent a lot of time in legal documents and financial models because that’s what I knew and that’s what I thought was what made a difference. And actually it makes very little, if any, difference. And what actually makes a difference is getting out and talking to customers and understanding what to build and solving problems for them and bringing solutions and selling and delivering. And if that’s the most important thing in the business then that’s where you as one of the more important people in the company and as one of the founders needs to run to and make that your own. And it might be something that you’re uncomfortable doing, maybe not particularly good at, but you need to get comfortable. You need to get good at it. And so that was a personal growth thing for me. And I think it also says Mantl, because just like we were talking in the last question about the core operating system, that’s not something that, you know, a normal modern full stack engineer is wanting to understand or typically wants to work on. But it’s the unsexy thing that is not comfortable, but it’s the thing that makes a really big difference. And so Mantl is an organization that runs towards those sorts of things.

Phillip Ryan [00:08:25] So with so many problems to choose from, how do you how do you choose which problem you’re going to tackle?

Raj Patel [00:08:31] Yeah, the customers tell us. Right. And so, you know, we have to stay very close to our customers. You know, they know their problems best. We need to be good at understanding and passing through what they’re telling us. We often have individuals tell us, and this is no fault of their own because this is how they express it. We often have banks and credit unions come to us with the solution and not the problem. So we’ll be like, oh, it would be great if you built this right. And that’s good. That’s good feedback. But even better than that is I have this problem right, because of the what the solution that they jump to imbeds a whole bunch of assumptions of what is possible. But we actually know a whole nother set of things are possible. And so if we have the underlying problem to start with, we can start with a blank piece of paper. And other people necessarily might not because of just the paradigm that they need. And so it’s listening. It’s a lot of listening. It’s a lot of asking leading questions. It’s a lot of talking about what’s happening now. What are you struggling with? Technology problems and non technology problem, sometimes the biggest insights we’ve gained from conversations that have nothing to do with technology because the person doesn’t even realize that technology can solve it.

Phillip Ryan [00:09:39] What is the biggest challenge facing Mantl right now?

Raj Patel [00:09:47] Yeah, I’d say it’s the way the industry generally thinks about technology. I think for a long time and I certainly feel this in some of my conversations, certainly sometimes I don’t know that the industry views technologies as an expense, which makes absolute sense, because on the PNL, if you’re talking to a bank CFO, it is on the expense line item. Right. It’s reported to the FDIC is data processing. It’s an expense. It’s right next to payroll and rent and utilities. And so it’s the expense. It’s an expense from an accounting construct. But if you think about technology in other industries, a lot of the buying decision in technology is talking about it as a capital investment. Right. And it’s a lot of institutions look at investing in technology just like they look at investing in opening a new branch or new division or acquiring something. I can spend a million dollars technology. I could spend a million dollars on headcount. I can spend a million dollars acquiring this business. I can spend a million dollars investing in marketing. It’s capital allocation. And often the questions we get when people are looking to purchase technology is expense questions, not investment questions. And what do I mean by that? It’s what’s this going to cost me? How do I minimize the cost versus what’s it going to cost me? How do I minimize the cost? But also what is the expected return from the technology? If I go and buy a million dollar technology, whether it’s with Mantl or anybody else. How is my business economically going to be better off? Am I going to drive five hundred thousand dollars of cost efficiency? Am I going to increase my revenue growth or in this case, deposit growth or asset growth or whatever it is that banking context? Am I going to increase that by X percent next year? What is the economic return that I’m going to get on my economic investment? And I think the banks certainly understand that concept and opportunity cost and capital investment because they do these sort of calculations all the time, whether to build a new branch or buy a competitor or return money to their shareholders. But in the past, they haven’t thought about technology that way because usually the options they’ve gotten never express or articulate to them what their expected return should be. They don’t see any expected return from all the technology they bought in the past. And so when we come in and say, well, here’s the cost of our technology, but here’s the results, we would like you to see or hear the efficiencies, you should get quantified. I think that changes the paradigm. And so that moving the industry in that way to start by asking investment questions versus expense questions, I think is the really big thing, holding back a lot of institutions from really innovating here.

Phillip Ryan [00:12:29] And do you see a lot of disparity? Do you see some institutions that are really looking at this in a more enlightened way?

Raj Patel [00:12:35] Exactly right. And I would say the people that are first over the wall and the fast followers are asking the question, what’s all the fuss about over here? And they’re looking at it critically, of course, because you absolutely should. But I’m looking at it more in that way. And I think that those that are potentially not in that bucket, who are a little bit more wait and see, are still thinking about it as an expense question. The proof is going to be in the pudding, right? If enough institutions make these investments and drive real returns, which I think the Chases of the world are, et cetera, you will see more and more do this. I mean, the the BB&T merger with SunTrust, I mean, the biggest rationale that one of the two biggest rationales was cost efficiency and the ability to invest more in technology. That was a second one, right. They literally cited J.P. Morgan and said they’re spending billions a year on technology. We need more. What is it, 11 billion or something? Exactly. And by the way, technology expense is the fastest growing line item of expenses in the industry, right? It is. There’s an expense reduction push in the industry. But technology is, you know, growing at a double digit Kaga because banks are realizing that if they don’t invest here, they’re going to see attrition in their customer base. And so it’s very topical.

Phillip Ryan [00:13:52] Right? A lot of banks describe themselves as technology companies, but really they’re customers of technology right. They are some of the largest buyers of technology across

Raj Patel [00:14:04] The banking industry is one of the single biggest buyers of technology. I mean, think about it. It supports over one hundred and twenty billion dollars of market cap for just technology companies that sell primarily to banks.

Phillip Ryan [00:14:19] Yeah, incredible. So what does success look like for bank fintech partnerships? Is it that straight up revenue like you were saying?

Raj Patel [00:14:26] I think it’s we find that the banks that we think about it the best and often achieve the best results have a numerical goal in mind. And it’s more than just you know, a lot of times we talk to institutions like I’d like to improve my customer experience. And of course, absolutely, we want to improve the customer experience. But what is that going to do for the customer and what’s it going to do for the institution? Right. We should be able to measure that. So let’s set a goal that’s measurable. Let’s find what the control is today. Let’s make some changes, invest and then let’s see what the measurement moves to and what the change in economic outcome is. Right. And that can be as simple as net promoter score or survey results. It could be more complex, like deposits raised, the amount of accounts you open to new members or customers, whatever it happens to be for your institution. If we think that every time a bank or credit union is investing in technology, they suggest that set a goal for that technology. They should then talk to their vendors about how the technology is going to help them achieve their goals and the likely expected results. And then they should measure the project and the technology against that. And what you should be hoping for six months, 12 months down the line, you’re looking at the KPIs or what we all went into this relationship for. Right. And we should see those results better. Here’s how we’ve done versus where we wanted to be. Right. Here’s what we’ve achieved. And guess what that does. I mean, not only does that mean that internally the bank can show that this investment was successful to show to its investors it can show it to its itself. Right. It knows that it’s having an impact on its customers. But also, the next time you’re trying to make a technology investment, you have a track record. Right. It’s a much easier conversation internally.

Phillip Ryan [00:16:13] Right. So what’s the largest challenge of working with banks and the banks that the ones who say no, the ones you don’t get, what are they what are they telling you?

Raj Patel [00:16:24] Yeah, it’s usually two things. It’s whichever one of them I’ve already spoken about. They think about it as an expense. It’s still an expense minimization. Yeah. The second biggest and I think this is structural and the industry will change, just like I think they’ll change about their thinking on expense versus and I’ve already started to see it. Expense versus investment is capability inside the bank. You know, some institutions and this is absolutely no fault of their own because they haven’t needed it and they’ve been very, very successful until now. Is digital marketing capabilities right? Right. You know, you wouldn’t be surprised if Casper or other great direct to consumer brands that we have here in New York, have excellent digital marketing capabilities and a community retail bank that maybe has twenty branches and has operated in 12 counties and hasn’t done anything online. You wouldn’t be surprised if they don’t have these digital marketing capabilities. And that makes sense because they didn’t need it. But in the new world, they will. Right, whether they use Mantl or anybody else, whether they acquire customers online or not, you need to be there and you need to have that capability. And so that’s just one of a number of different capabilities that, you know, banks and credit unions will need to build as the industry changes and technology comes, a bigger and bigger part of it. If you want to be a technology company, you need to let people know that you’re it. Well, it’s not it’s just it’s not just high technology stuff. Right? It changes the nature of operations. It changes the nature of compliance. It changes the nature of marketing as well.

Phillip Ryan [00:17:59] Yeah, so do you often advise people, look, you’re building this great thing, but no one is going to know about it? So you have a great account opening software, how will how are people going to know? Or are they thinking about it? Are their marketing people thinking about this level?

Raj Patel [00:18:15] I mean, you know, don’t get me wrong, these individuals are very self aware and they understand the challenges. They understand how they make money and lose money. They understand the challenges of technology. They’re just on different places on the curve of adoption. Right. And I don’t think I ever really go into a conversation and somebody says to me, you know, we have the skills to do this, but it’s obvious that they don’t. That’s not usually the conversation. It’s usually like, you know, we want to do this. But we also know we have to change this, you know, improve the skill set at FTD, you know, additional training, etc. We don’t need to learn this is a new capability for the institution. Like I said, only 20 percent of basic credit unions in America have online account openings. So that means 80 percent of them have no existing capability. They have to learn it right in some form. And so it’s not you know, it’s not particularly revolutionary to think that’s going to need to happen. And that’s not a two week process. Hiring people and I know this and Catalyst, you guys for sure say this is you know, that takes time.

Phillip Ryan [00:19:25] Are you seeing a lot of outsourced it at these at the banks you’re talking about?

[00:19:29] We are seeing that more and more. And actually, I was in an interesting regulatory conversation recently with a Fed regulator, and particularly they were talking to smaller banks and credit union institutions and with obviously increasing regulation, which is also very topical in the industry. One of the things that the examiner said is, you know, cybersecurity is a big risk. And, you know, one of the sort of bankers shot his hand up and said, look, I can’t in particular in a room setting, I can’t even get really a good CIO with cybersecurity expertize to apply to work at my institution. Right. And they might be a 400 million dollar bank in a potentially rural community. That’s difficult to find that talen there.

Phillip Ryan [00:20:11] Absolutely.

Raj Patel [00:20:12] And the regulators said, oh, I hear that one hundred percent and I have no objection to five of you getting together and and getting a fifth of a CIO outsources resources. Right. And so I think you’re going to see that more and more, particularly at the lower asset level, where it’s just so burdensome.

Phillip Ryan [00:20:36] It sounds more like a credit union thing. Just on the face of it, there they are a little bit more about the sharing, sharing resources.

Raj Patel [00:20:41] But I you know, that’s something that I heard regulators say to a group of banks. And the banks are nodding and saying that’s a very practical approach to this, because you write like this, expertize needs to happen. It needs to happen from a growth perspective with something like Mantl. But it also needs to happen from a security perspective, from an infosec perspective, from a cybersecurity perspective. These banks need to to have that expertize or somebody to call on. So I am definitely seeing it outsourced more and more. I’m also seeing digital marketing outsourced. And I also think that is one of the better ways for banks to learn to start with. Right, have somebody come in do for a little while to get going, but also while they’re doing they’re training, the talent that you have internally? Yeah, right. It’s not to say that somebody that’s in marketing or in IT that is an expert at the core banking system is an expert, you know, outdoor advertising, cannot learn digital. They absolutely can. They just need some time to get up the curve on it. Right. And so we’re seeing that a lot.

Phillip Ryan [00:21:40] Yeah, it does seem like you’re giving something up once it’s outside your walls. And I think a lot of these guys I can understand the reluctance, I guess, to first for a lot of people to outsource in that sense. But yeah, the challenges that you can’t have everything inside your walls. What new technology are you most excited about? What are you what are you keeping your eye on that you think is going to have a positive impact in banking?

Raj Patel [00:22:07] Yeah, so I’m a little different in that. I don’t necessarily think, you know, I’m not going to sit here and say all, you know, block chain is going to change everything or anything like that. Although I do think it’s an interesting thought experiment. If the US dollar was on a block chain.

Phillip Ryan [00:22:22] Right. China is going to do that. Right. China is cutting.

Raj Patel [00:22:24] And I think that’s the bull case for four block chain technology is, you know, because it would avoid you know, it would then have perfect taxation and no money laundering because the Federal Reserve could see every dollar moved in the economy. Right. But I think that the two things that I look at and I think are really interesting over the next twenty four months, which I think is a little bit more actionable of these, everybody’s talking about payments. Payments are getting faster, the flip side of payments getting faster and community regional banks don’t have this capability today. The big guys are starting to is real time transaction monitoring. If you increase the velocity of payments, you need to increase the velocity of the checks you’re doing on those payments. Right now, the big AML providers that are feeding a lot of these SaaS and things like that and all the regulatory requirements from ASML perspective. Bache and so banks are finding out about transactions. Twenty four forty eight hours after they’re initiated when they’re already out in the ether. Now, that’s okay. Potentially potentially in a world where it takes two to three days to settle. But that is absolute death from a risk perspective and a compliance perspective, you know, real time world. So, I think a lot of attention goes to the real time payments and not enough attention is going to real time transaction monitoring is an area that we’ve been working on with a great friend and partner of ours called Allo here in New York real intereesting fintech. Tommy, Charles and Laura are awesome. And I think that that’s something that’s going to be really interesting. And then kind of the flip side, and I think, you know, institutions go out with real time and don’t have that other piece they’re going to unfortunately get hurt. I think the other thing and that’s and that’s now you can do that today, right? Real time. Now, if you could have done that last year, but it would have cost a arm and a leg. Right. And the big guys could afford it. That cost structure start to come down. And I think it’s going to go mainstream as real time payments go mainstream. So that’s interesting. The second thing I’d say is that the industry generally has had has made huge leaps and bounds on the consumer side in terms of automation and customer experience. And you’re seeing that with a lot of the newer banks coming through the money center banks. Chase just did a new version of mobile at Wells Fargo’s investing quite significantly now and the customer experience between now and ten years ago, the mobile app, the digital experiences are night and day. That ramp or that change has not been fully reflected on the business side, on commercial, and whether it’s small business all the way up to Fortune five hundreds and anywhere in the middle, even in mid markets. Right.

Phillip Ryan [00:25:07] And these are some of your most important customers.

Raj Patel [00:25:09] Absolutely. These are the most profitable customers of a bank or credit, right. And the technology is coming and is here to do that, and you’re starting to see a lot of the challenger of banks and the new challenger banks move into the commercial side, Grasshopper Breck’s. Yeah, this great company called Ramp that I’d keep an eye on. And there’s others.

[00:25:37] And I think you’re going to start seeing technology vendors come to banks with ready to market, ready to go pieces of technology on the business side and on the commercial side that is going to vastly improved the customer experience and provide some automation that right now doesn’t exist in an industry that’s going to drastically change the cost structure of running and supporting a commercial bank. And I think that in the next twenty four months is going to be a big trend as well.

Phillip Ryan [00:26:03] I remember talking to one of the cores and I won’t say which one, and they were saying, no, we have we have no kind of out of the box, off the shelf product for small businesses like zero.

Raj Patel [00:26:13] It’s incredibly, incredibly difficult. The regulations are more burdensome. The document requirements are more significant. And today in a normal bank, it’s paper. Right. And that can take anywhere from forty five minutes for a single member LLC and a chase branch up to four hours, four days, four weeks for more complicated entities. When you are coming in and you’re running a real estate business and you have, you know, 17 different buildings, you know, and maybe 400 different tenant accounts where you got escrows, that’s a really complicated business to onboard for a bank. And that takes weeks and months. Right. And that’s going to come down in days over the next 24 months. And so I think that is that’s going to be really big. It’s not particularly sexy. It’s not consumer facing like real time payments of blockchain. But I think from a sort of a brick and mortar traditional banking perspective, I think that they’ll look at that and say, wow, that’s really going to move the needle for us right now.

Phillip Ryan [00:27:12] If you’re talking about customer experience, it help your important customers have a better experience to be a differentiator. If the guy down the street doesn’t have. What is your ideal customer? What size is your sweet spot or who’s your perfect customer?

Raj Patel [00:27:31] Sure. Today, as small as an institution is about four hundred million in assets and we go up to about 50 billion today.

Phillip Ryan [00:27:40] Big range.

[00:27:40] Yeah, big range. And we have you know, there’s a thousand banks and credit unions inside that space and in the United States today. And we have people all across that spectrum on a median basis. I think it’s around around five billion. It’s a pretty substantial and then kind of within that range, as I said at the start, you know, we’re not really interested in doing work for JP Morgan, Wells Fargo and Money Center banks. I think that they’re you know, they have their own teams and they’re investing quite significantly. And that’s great. And I think they’re doing some really interesting things and leading the way. So we are really, really focused laser focus on community and regional banks in that midmarket, and we think that there’s a real opportunity for them to compete. So we’re really looking for anyone in that space that that wants to do something different and really try to, you know, make a step change in their capabilities.

Phillip Ryan [00:28:30] And last question, where do you see community banks and credit unions 10 years from now? Obviously, it’s a challenging environment right now. But how do you see things developing in the next decade?

Raj Patel [00:28:42] Yeah, look, I see what everybody else sees, which is consolidation. That’s what you see every day, every week, if you read American Banker, that’s what you see in the you know, the FDIC call reports, we’re seeing consolidation. Interestingly enough, the number of banks and credit unions below a billion is falling, but between one in 10 is increasing and due to consolidation of the of that kind of bottom quartile, so to speak. And then there’s that interesting coalescence right below 10 billion because of the regulatory jump, it’s like 10 and then you want to be in 20, right. So you’re seeing, you know, a lot of people jump there. So I think that there’s going to be more consolidation. I just don’t see how that reverses itself unless is a significant change in consumer behavior, which I’m not forecasting. I think that banks and credit unions will be able to replicate the technology advantage that neo banks and money center banks have over time, because I think the industry is ripe for disruption. It’s an oligopoly. It’s you know, it’s the technology’s been around for a long time. There’s vendors like myself and others, I’m sure, that are looking at this problem and thinking it can be solved. So I think that there’s going to be a huge efficiency gain from technology in the sector in that in that segment, I think. That will lower the cost structure for those entities and allow them to compete more against the economies of scale, the bigger guys, you know. Beyond that, I think that there’s likely to be a reskilling of the industry in some portion around the technology, and I think they’ll adapt and evolve. I don’t think it goes away. I think it’s healthy for the country and I think it’s healthy for consumers. And it’s the stated and, you know, a lot of people don’t realize this, but it’s actually the stated goal of the regulator to foster smaller community regional banks, because what it does is competition. I’m originally from Australia and in Australia we have four big banks and they own, I think, three quarters of the banking market in Australia. And it’s one of the most expensive banking markets in the entire world for consumers. America has significantly more competition. And on things like home equity mortgages, that really matters. And so for the health of the economy, we need community regional banks to exist, thrive.

Phillip Ryan [00:31:22] They built a lot of the wealth of the of the country.

Raj Patel [00:31:25] Yeah. And a lot of places that those big banks don’t want to go. Right. And it’s really, really important and I think very topical. And I think that they’re just super important to the structure of the economy.

Phillip Ryan [00:31:39] Raj, thank you so much. Yeah. A pleasure talking to you. Thank you so much. Thank you for listening to Bank FinTech Fusion. And if you enjoy the podcast, please subscribe on Apple podcast or wherever you listen to your favorite podcasts. Bye.

Subscribe to CCG Insights.