AS PUBLISHED IN INTERNATIONAL BANKER by Paul P. Schaus, Managing Partner, CCG Catalyst

Breaking Into The US Payment Market Requires A Unique Approach

The size of the payment market in the United States has made it a valuable target for international companies looking to expand their offerings. North America is the second-largest payment market in the world. Although market maturity steadies growth, revenues are expected to expand in the neighborhood of $200 billion between 2022 and 2027, as per McKinsey & Company. That revenue is a direct reflection of increasing volumes across channels. E-commerce alone is set to grow at an annual rate more than double that of in-person payments, Worldpay found.

Companies looking for a rapid path to scale want to take advantage of this growth, especially if they operate in saturated markets or have reached a critical mass of users in their home countries. UK-based Checkout.com’s president, Céline Dufétel, told TechCrunch last year that she saw the US having “extensive, untapped opportunity for growth”, for example. But getting off the ground in the US payment market isn’t easy. To follow in the footsteps of firms that have successfully launched in the market, such as Canada’s Shopify and Sweden’s Klarna, providers must understand the market’s nuances and quirks related to payment habits, regulatory requirements and innovation.

Cater to US payment trend discrepancies vis-à-vis other markets.

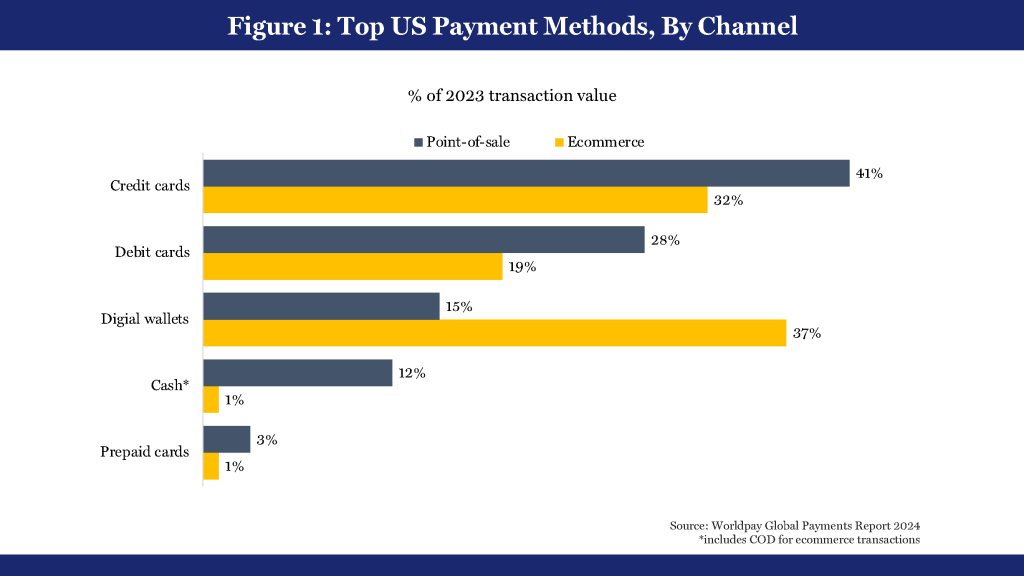

Cards dominate consumer payments in the US. In 2022, just over two-thirds of the average consumer’s monthly purchases were made using a credit, debit or prepaid card, according to the Federal Reserve (the Fed). Even by value, cards comprised more than 60 percent of purchases, despite other digital payment methods being more popular for high-ticket transactions. And while cash isn’t disappearing in the market, it’s not the powerhouse it once was. Physical currency makes up less than a fifth of the average consumer’s payments and is used predominantly for small-dollar transactions, comprising just 5 percent of the average spender’s monthly payments. These trends accelerated in 2023, as per Worldpay, with cards continuing to reign supreme for high-ticket transactions and cash starting to fade.

New methods have been slower to take hold. Mobile payments were made by only two-thirds of users monthly in 2021. Usage remains infrequent. Although wallets have been more popular online, just 7.8 percent of eligible in-store transactions used Apple Pay in 2023, PYMNTS found. And the share of consumers using mobile payments monthly ticked down in 2022, as per the Fed, signaling that some pandemic-era adoptees may have reverted to old payment habits as the world reopened.

These habits differ drastically from those in other markets. In Asia-Pacific (APAC), digital wallets dominate, holding a 70-percent share of e-commerce and a half share of point-of-sale (POS), according to Worldpay. Likewise, in Europe, even as digital wallets have grown online, debit cards continue to reign supreme at the POS—and cash remains top-of-wallet in several of the region’s countries. And in Latin America (LATAM), digital wallets such as PIX are surging for in-person transactions, creating major swings that could threaten the health of card providers in the region. Understanding how home markets differ from the US and centering support for top US consumer payment methods into offerings is the first, and arguably most important, hurdle to a successful launch in the region.

Prepare to navigate a complex licensing environment.

In the US, licensing and regulation are anything but standard. There is no national mechanism to get approved to process payments. Instead, moving into the region often requires companies to apply for 50 individual state-by-state licenses—an approach used by companies such as PayPal, Block, Circle and even X, as Elon Musk tries to turn the app into a payment power-player. And though there’s more multistate cooperation than in the past, the system remains complex and often requires a dedicated US engine with considerable resources.

An alternative option is becoming a bank because of the sector’s dominance in the market’s payment ecosystem: Banks made up four of the top seven US merchant acquirers last year, per The Nilson Report. However, just a handful of charters are granted annually in the market. This makes entry challenging on both paths. Major global fintechs (financial-technology firms) such as Monzo and N26 withdrew from efforts to launch in the US market because of licensing issues and market competition.

To Continue reading the article, follow the link