Bank Execs Waver on Tech Confidence

June 1, 2023

By: Kate Drew

Banks and Technological Preparedness

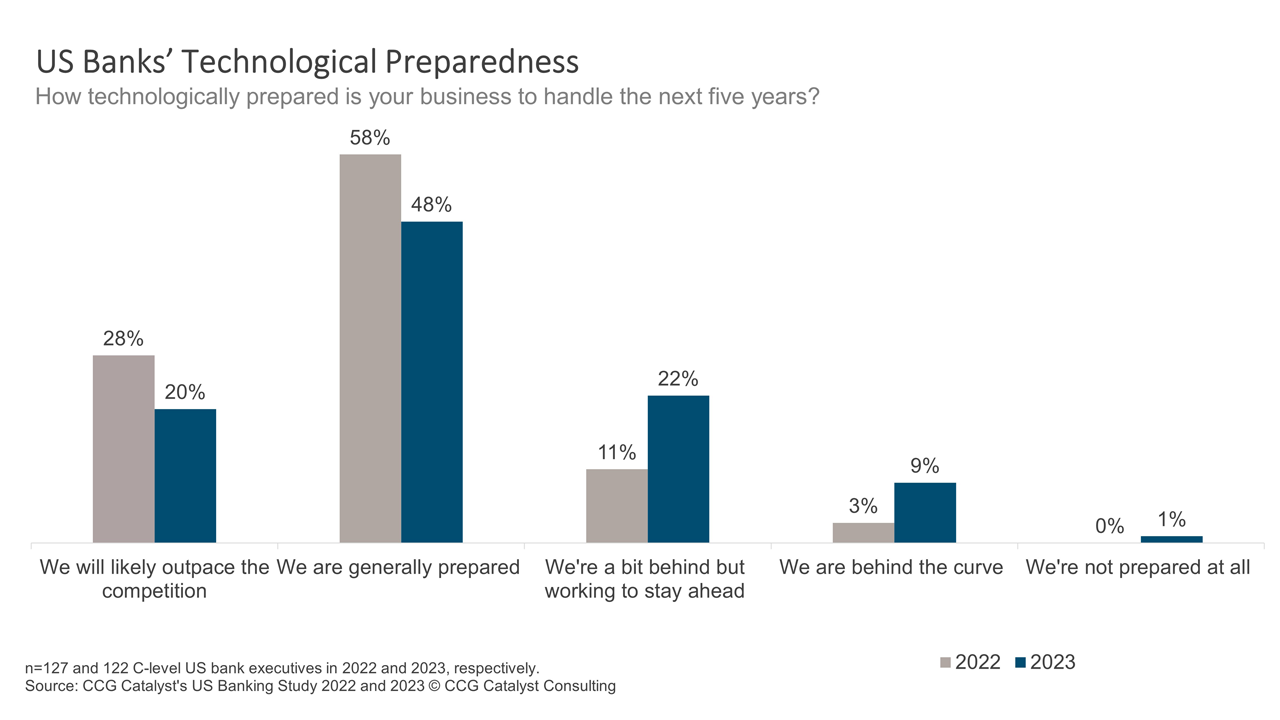

US banks may be wavering on their confidence from a technology standpoint. Specifically, while 68% of C-level executive banking respondents to our 2023 US Banking Study reported feeling at least generally technologically prepared for the next five years, that’s down 18 percentage points from last year’s survey. (This study forms the basis of our latest report, The Banking Battleground 2023: Pulling Back and Pushing Ahead.) Meanwhile, those who believe their bank is slightly behind rose from 11% to 22%, and those who feel they are behind the curve moved from 3% to 9%.

Of course, it’s good news that a majority of respondents still think they are in a positive place, but the drop-off is a bit concerning. Ideally, we’d like to see more respondents moving to the left side of the chart above over time, not to the right. This shift is likely attributable to a number of dynamics, including regulatory and capital pressures hitting the fintech market (a huge source of innovation for banks over the last several years) and a turbulent economic backdrop that could make it harder to prioritize technology investment. Another factor might be the recent leaps forward in advanced areas of technology like artificial intelligence (AI) that are perhaps making executives feel as though things overall are moving ahead at a much faster pace than they’d anticipated.

The why here, though, is not as important as the what. As in, what do we do next? It’s okay to feel the pressures of an evolving market, and to take a step back and reconsider your own position. But the risk is that bankers will succumb to these pressures, allowing themselves to slip further behind. For instance, it may be tempting to look at the current environment and say, “It’s impossible to get prepared because we can’t tell what’s going to happen,” leading a lot of institutions to take a wait-and-see approach. The problem with that is things aren’t going to stop moving just because you have. Instead, executives should be looking for ways to position themselves for the unknown. And, generally, technological agility is a key way to do that. That means investing in flexible infrastructure and areas that will allow you to achieve speed. Think application programming interfaces (APIs), microservices, cloud etc.

The goal should be to fight the urge to pull back on technology initiatives as uncertainty increases and focus on more evergreen elements, those that will bring you into the future no matter what that future looks like. And probably the biggest part of that is going to be making sure to have a well-defined strategy that looks at the big picture and maps to the long-term needs of the bank. It’s time to think about how to build a foundation that is capable of shifting with the tides — a foundation that is trend and opportunity agnostic. That’s the way forward.