Banks Are Struggling Across Customer Lifecycle

May 4, 2022

Banks and Customer Lifecycle Challenges

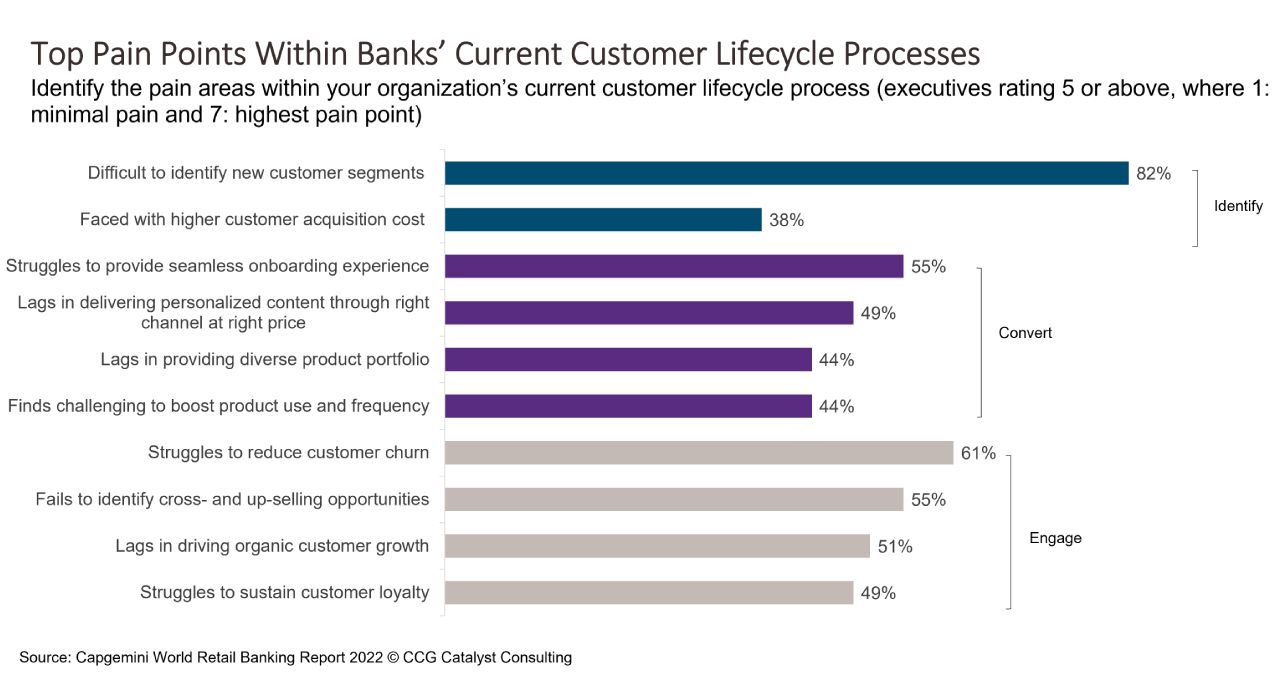

Banks are struggling to identify, onboard, and retain new customers, according to Capgemini’s newly released World Retail Banking Report 2022. Specifically, a whopping 82% of executives surveyed reported difficulty identifying new customer segments, while 55% are struggling to provide a seamless onboarding experience, and 61% are facing challenges keeping customer churn at bay. At first glance, it may be tempting to look at this data and decide that banking institutions are experiencing a myriad of difficulties throughout the customer lifecycle, with no particular area where they are excelling over others, signaling a slew of remedies that need to be put in place. However, that may not be exactly the case — while the numbers might indicate a series of problems on the surface, it seems probable that these difficulties are linked. In fact, we’re quite likely looking at one larger problem related to the overall customer journey.

Perhaps the key is to look at this data — and the customer lifecycle itself — holistically. How can we improve the entire customer journey, rather than breaking it up into parts? After all, identifying customers, onboarding them well, and keeping them happy should all be part of the same overarching process, shouldn’t it? One potential problem is likely that those within a banking organization who are identifying target customer groups may be different from those designing onboarding workflows and other experiences, and those who are actually interacting with customers on a regular basis are probably from yet another part of the bank. This means that the customer lifecycle itself is being broken up at the institutional level, and that fragmentation could be what’s causing the splinters. For example, isn’t the onboarding experience likely to be different depending on who your target customers are? If you are targeting millennials or Gen Z, you will be looking at things like speed and ease, whereas if you are targeting older generations, you may want to put a bit more emphasis on clarity in your interface. This idea pulls through to all facets of customer experience at a bank. It matters who your customers are and what they want at each point of contact they have with the institution, so all of those touchpoints need to be connected through a single strategy.

It would be easy to look at where you stand in relation to this data and immediately start thinking about how to better target customers, how to onboard them more creatively, and how to keep them from leaving you. But that would be missing the point in a big way. Instead of designing micro-strategies around each of these areas, let’s try thinking about what it would mean to create a truly well-defined strategy for the entire customer lifecycle. Let’s really map it out and link all of these pieces together. The most important part of this is going to be data; the ability to inform all of these choices and tie the different components together will require sharing insights back and forth across systems and people in a seamless way. As a result, a good customer lifecycle strategy will undoubtedly require a good data strategy, as well. But that’s a bigger conversation. The general idea here is that we have to stop thinking piecemeal about these different operations. From a strategic standpoint, they need to be treated as one.