Banks’ Business Relationships Depend on Data That Flows Freely

February 29, 2024

By: Tyler Brown

Digital Banking and APIs

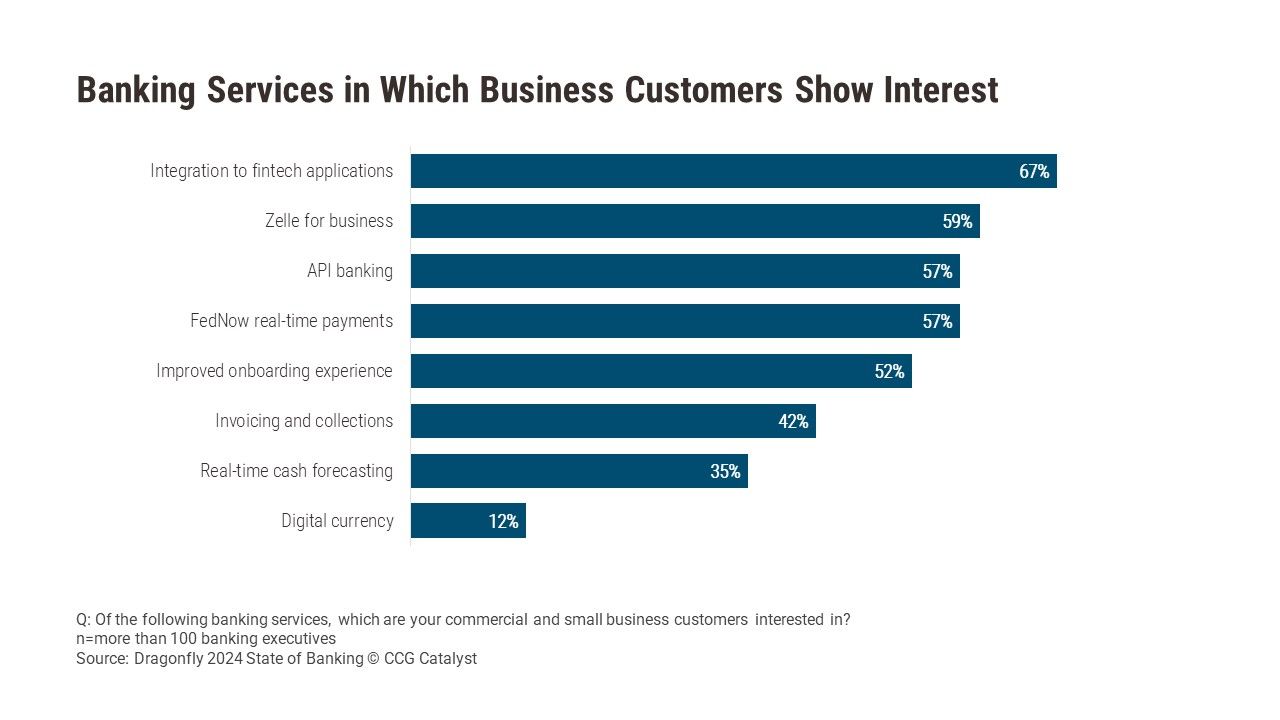

Nearly 70% of banks’ commercial and small business customers show interest in integrating with fintech applications, according to a study by Dragonfly. For business banking customers, integration may mean that banks provide businesses with the technical capabilities to use data held at the bank in near-real time with third-party services. Those might be software for accounting, invoicing, expense management, and reporting, for example. Integration may also mean that the bank’s digital banking solution aggregates data from those services.

A bank’s strategy may dictate a specific balance between investment in the digital banking experience and the infrastructure that makes it possible to connect business software quickly and easily to bank data like application programming interfaces (APIs). One approach, taken by Bank of America, is to do both. Its small business services integrate “connected apps” into its digital banking experience. Examples include Square for payments, Instagram for marketing, QuickBooks for accounting, and ADP for payroll. It also has the infrastructure to offer stable, secure API-based connections for apps to retrieve data (as do at least seven of its competitors).

Software features for managing a business’s finances, which are more useful with API-based integrations, come in three increasingly complex tiers, based on CCG’s research:

- Invoicing, electronic collections and payments, and simple historical cash flow. Sometimes these features fit naturally with basic banking services for business.

- Aggregation, transaction tagging, receipt matching, reporting for tax obligations, expense management, and payroll.

- Specialized, sophisticated, and increasingly automated solutions for financial planning and analysis, business intelligence and analytics, customer data, human resources management, billing at scale, compliance, and cash flow management.

From tier to tier, those features become increasingly challenging for a bank to implement, particularly when it builds them on its own. Banks without the scale nor deep pockets to build those features thus may want to consider leveraging a modern digital banking platform that embeds third-party services as well as provides APIs for consumption. Some may fear that, by enabling the infrastructure for data feeds to third-party software, they would invite customers to leave if those third parties offered financial products. But by embracing this kind of openness, they’re more likely to meet customer expectations for an evolving ecosystem of nonbank applications and stand up to direct competitors whose infrastructure already supports APIs.

In the long run, banks should expect the retention of business customers to depend substantially on the quality of their third-party integration capabilities. The most important part of this trend to keep in mind will be that, when banks make the technical changes necessary to retain customers that use third-party services, they are more likely to remain the first choice for complex, profitable products — like loans — that business software is unlikely to offer.