What Is a Greenfield Bank?

May 10, 2021

By: Kate Drew

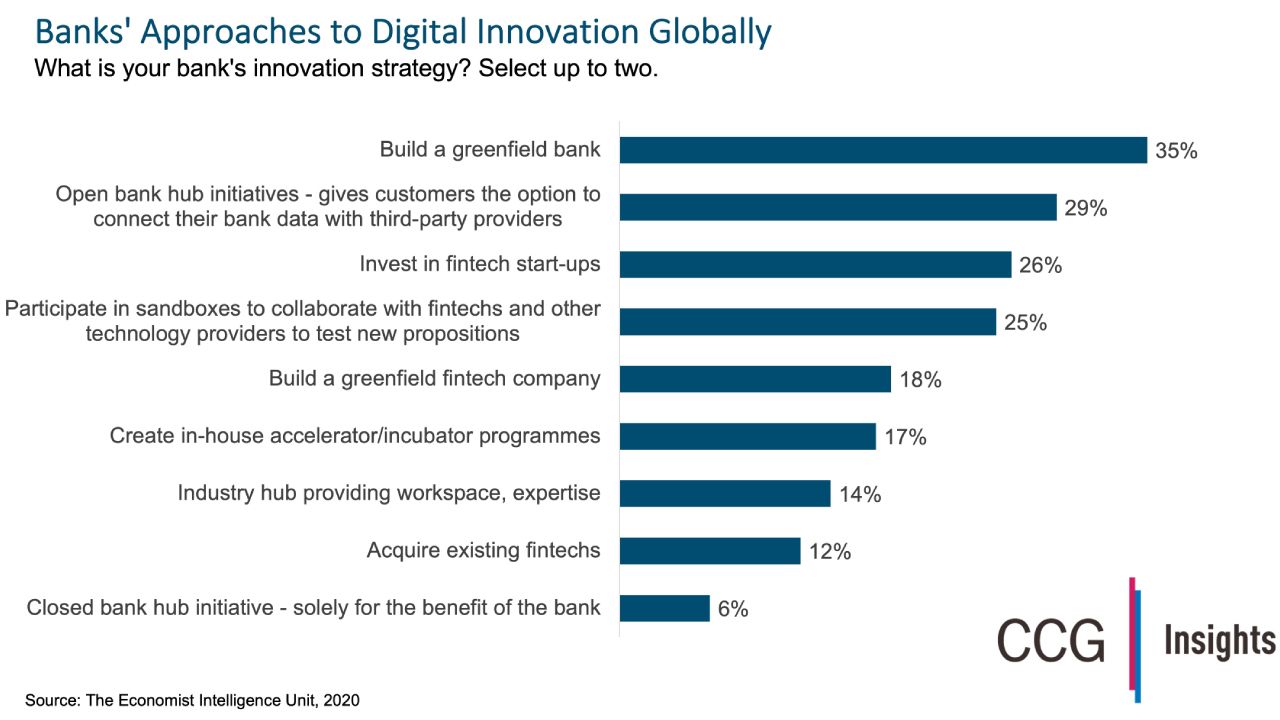

As banks look to modernize their infrastructure and reposition for the future, a popular path has become the greenfield approach. A greenfield bank is a standalone unit that leverages its own tech stack, and usually its own brand, serving as a proving ground for more modern infrastructure that the bank may or may not migrate fully to in time. Perhaps the most notable example of a greenfield operation is Marcus by Goldman Sachs — built from the ground up on modern technology and positioned as a savvy, digital-first brand underneath the behemoth’s umbrella, the bank’s retail unit ended 2020 with $97 billion in deposits. The potential for this kind of success has made the greenfield strategy of interest to banks all around the world. In fact, according to a survey by The Economist Intelligence Unit, 35% of banking execs say building a greenfield bank is part of their innovation strategy, making it the most selected option.

The pressure to move away from legacy systems is strong: As we recently noted, by this point, a majority of banks are at least exploring how they can modernize their core technology, with 68% of respondents to an Everest Group report saying they were either on their way to upgrading their core systems or employing a mix of modern and legacy technology. But going about upgrading old tech that’s deeply embedded in the bank is no easy task, and it can be extremely expensive; according to McKinsey, a full core conversion may cost upward of $100 million. A greenfield strategy, meanwhile, can cost half that and doesn’t come with the risk of disruption to normal operations. That’s because a greenfield bank operates independently from the organization’s core business. If successful, the bank can begin to slowly move operations over.

This strategy is not without its own risk, however. The purpose of a greenfield approach is to test new tech and customer propositions, which means there is the possibility that it will fail entirely. Finn by Chase is a good example of a digital-only, standalone unit that was shuttered when it failed to provide value. For a bank as big as Chase, taking such a bet is a drop in the bucket, but for others, it may feel like a big gamble. A greenfield bank is likely to be most attractive to those looking to experiment with cutting-edge technology that’s not yet proven, while keeping costs down. The bigger takeaway, though, is that banks today have options when it comes to modernization. Gone are the days of choosing only between standing still and migrating to another legacy core. As the greenfield model illustrates, there are multiple paths forward here. Banks would do well to consider all of their options and fully understand what’s available to them, before making a plan that will no doubt have long and lasting implications.

–Kate Drew is the Director of Research at CCG Catalyst. Contact her at KateDrew@ccg-catalyst.com or 1-480-744-2240. Follow CCG Catalyst on LinkedIn and Twitter.