Fintech Engagement Grows Tougher

August 03, 2023

By: Kate Drew

Banks and Fintech Engagement

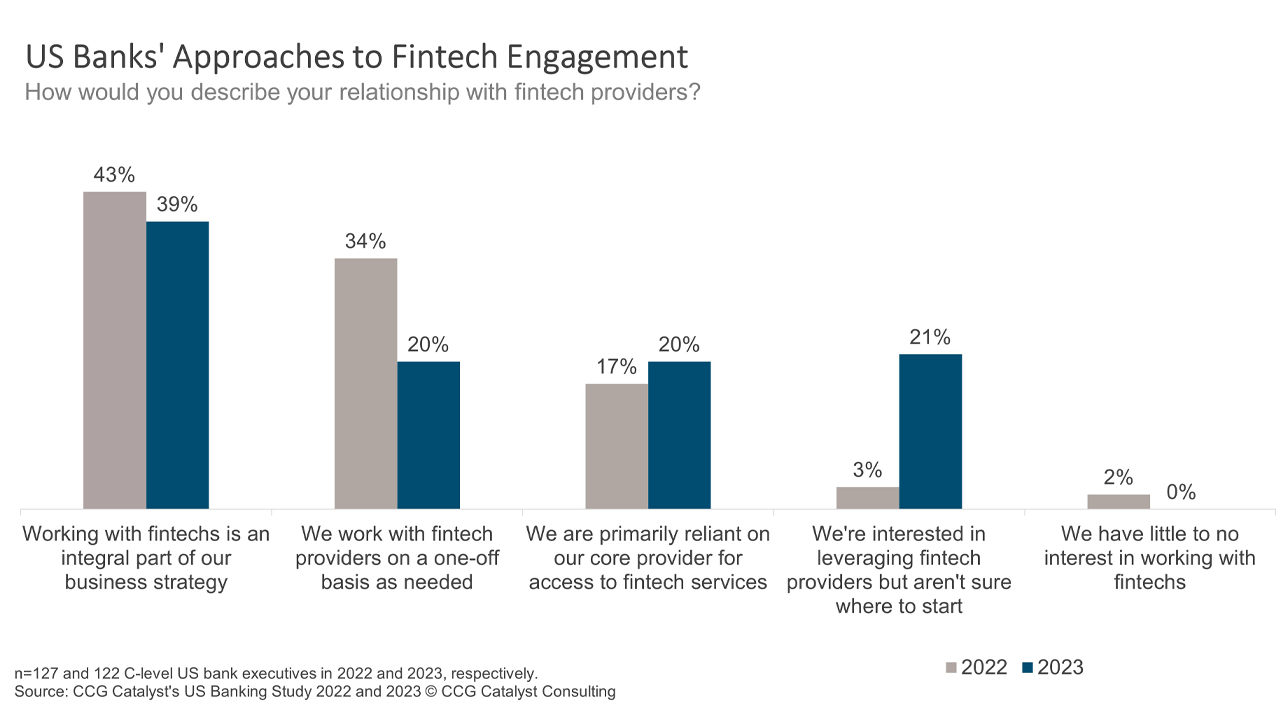

Banks’ commitment to fintech engagement is under pressure, according to CCG Catalyst’s 2023 US Banking Study (which forms the basis of our latest report, The Banking Battleground 2023: Pulling Back and Pushing Ahead). Specifically, C-level bank executives who said working with fintechs is an integral part of their business strategy slipped from 43% to 39% from our prior year’s survey, while those who said they work with fintech providers on a one-off basis fell a weighty 14 percentage points. Meanwhile, those who said they are interested in leveraging fintech but aren’t sure where to start increased from 3% to 21%, seemingly taking the bulk of that drop.

It’s completely understandable that bank executives would be more reluctant to engage with fintechs in the current environment — the macroeconomic outlook is uncertain, heightened regulatory scrutiny is all over the space, and there is less private capital for these companies to subsist on. However, what’s notable is that it seems those with less experience are the ones most struggling to continue to engage. Indeed, those who have made fintech central to their strategy appear to be holding relatively strong; it’s those who were working with fintechs more sporadically who have really pulled back. This, coupled with the dramatic increase in those who are interested in leveraging fintech providers but don’t know where to begin, indicates that growing reluctance is likely down to shaken confidence more than lack of appeal or opportunity.

Believe it or not, this is good news. It suggests that bankers still see the value in engaging with the fintech community at a time when sentiment could be souring. It also indicates that the big hurdle to be overcome is a strategic one — not easy but doable. So, if you are a bank that’s fallen behind on fintech engagement due to uncertainty, allow this data to remind you that you’re in sound company — but only for a moment. Don’t stop there; take the steps necessary to better understand the opportunities in the market, the real ones, and how to capitalize on them. That means working hard to educate yourself and your peers on the utility of new technologies, the business models of these companies, and how they might augment your business. In the end, those who make the most of fintech will likely be those who fully embrace its possibilities and thus benefit from the knowledge that this brings. If you’ve got the knowhow, selection and diligence becomes a whole lot easier.