April 14, 2021

Banks Miss the Mark on Customer Expectations

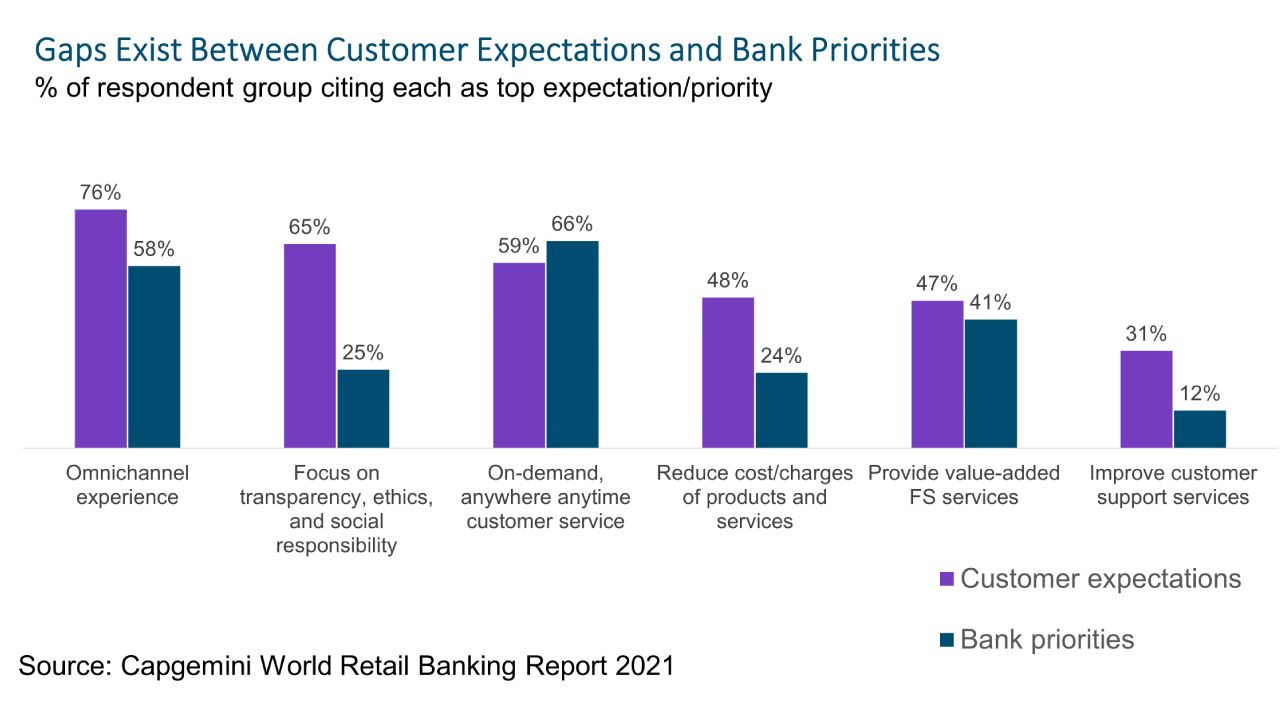

There’s a disconnect between customer expectations and bank priorities, according to new data from Capgemini. In particular, while banks are rising to customers’ desire for on-demand, omnichannel experiences, they are falling short on things like social responsibility and transparency as well as cost and support services. Banks globally made major strides in the last year on their digital transformation efforts as they attempted to meet customers at home and provide seamless service during the pandemic. But perhaps this focus on digital led banking execs to move away from other priorities that customers also consider to be important.

The biggest gap, for example, was on social responsibility and transparency, with 65% of customers citing this as a top expectation for their primary banking provider, while just 25% of bank respondents listed it as a top priority. It makes sense that, in an environment where many banks are just trying to survive, they would de-prioritize areas that do not directly tie to revenue. And initiatives focused on promoting the bank’s ethics and transparency could easily seem less urgent against the backdrop of a pandemic. The problem is that customer expectations do tie directly to revenue. While digital is certainly key today, keeping up with what customers want outside of the obvious features and elements can be what makes the difference when it comes to customer acquisition, and ultimately, retention.

You may be thinking the point of this is to say bank execs should pay more attention to transparency — it’s not. While that is certainly a worthy cause, the point is that banks should be taking steps to deeply understand their customers and deliver on their needs. It starts with who your current customers are and who you want your future customers to be. Once you have that nailed, you can begin to segment and analyze the market and tailor your services to drive acquisition and satisfaction. Survey your customers, get to know them. And then tie your product roadmap tightly to their specific needs. So often banking institutions rely on their core provider to upgrade their services, or simply follow what others are doing. We’re moving rapidly to an age where differentiation is everything and following the leader simply won’t cut it. Instead, follow the customer.