Consumers Will Share Data for Personalization — Within Reason

September 7, 2023

By: Tyler Brown

Consumer Willingness To Share Financial Data

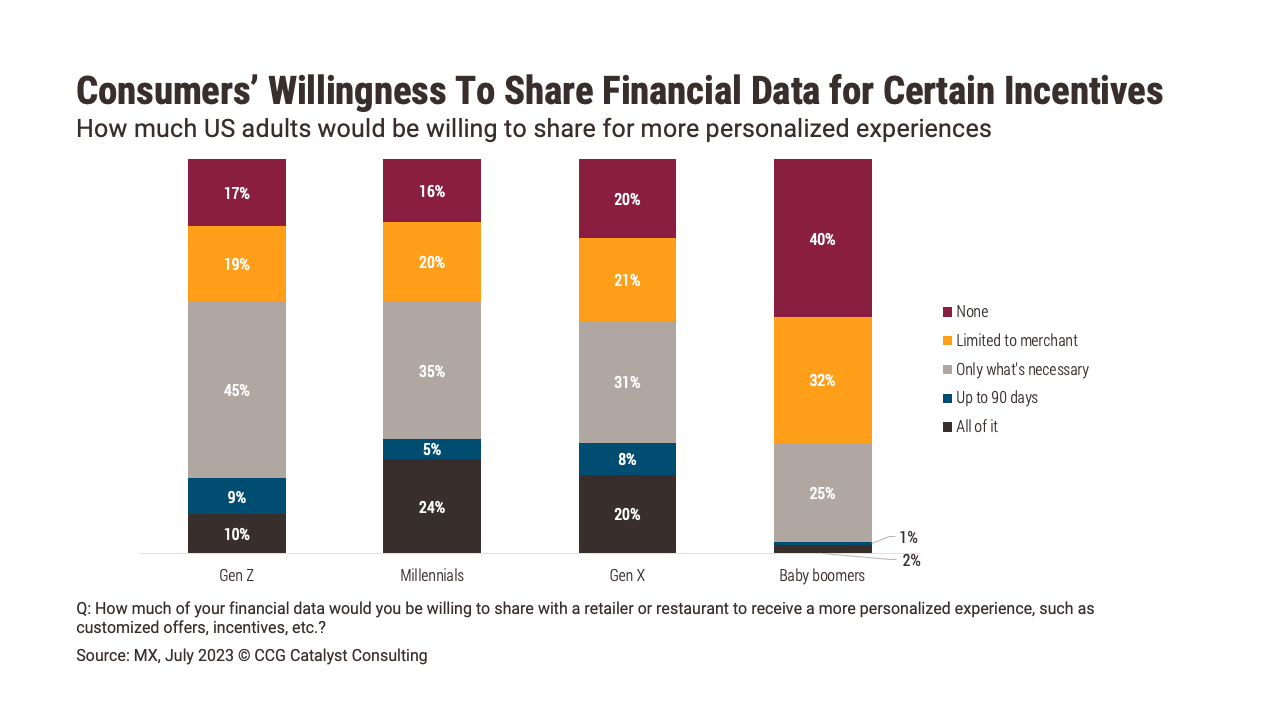

There’s a strong chance that consumers would provide financial data to help merchants enable a more personalized experience, according to data from MX. Up to 64% of millennials, the most willing demographic, would share at least some of their data in return for benefits like customized offers or incentives. But boundaries are critical. Only 29% of millennials said they would share their comprehensive financial data (all of it or up to 90 days’ worth of transactions) with a retailer or restaurant. The other 35% said they would share only what’s necessary.

This limitation emphasizes the importance of application programming interface (API)-based connections to deposit and credit card accounts. Consumers need to feel the security that comes from the ability to restrict a third party’s access to their financial information, while at the same time using that data to their benefit. They need to be able to choose “what’s necessary.” To have that ability, their bank needs to be able to easily communicate with third-party systems and create mechanisms that allow a consumer to “switch” sharing on and off, including for particular accounts or types of data. As the enabler in this scenario (and custodian of the data), it is ultimately on the bank to facilitate access in a way that makes customers comfortable. (Other popular methods of data sharing like screen-scraping do not allow for this level of control.)

A merchant, on the other hand, is challenged to convince consumers that what it needs is truly crucial to create a personalized experience. And, because many merchants already have an immense amount of direct knowledge based solely on their own data, they face an uphill battle in getting details that are actually useful. (In the context of retail, they likely already have data on customers’ purchases, browsing history, and in-store interactions, for example.) To drive additional value, they need access to things like account names, product types, and details like balances, transactions, and rewards, that offer clues to the customer’s habits at other merchants, their wealth, rewards use, ownership of cobranded financial products, and channel preferences for making purchases. It’s access to this kind of information that they will need to get consumers on board with sharing in order to drive the potential benefits.

You could imagine, for example, targeting a customer with offers based on travel, dining, and retail spending; available rewards points tied to a high-end credit card; and median transaction size at certain merchants to put together an individualized vacation plan that includes accommodations, shopping, and dining of the right class with relevant offers. But in order to do that effectively, the merchant would need access to a slew of data points housed within that user’s financial institution.

The opportunity for financial institutions is that they can position themselves at the center of this dynamic as an access manager of sorts. If they enable their customers to connect their financial information to consumer brands like retailers and restaurants, in a way that gives them control and makes them feel safe, the financial institution becomes a hub for commerce — not just a place that offers banking products. As a result, it forms tighter relationships with its customers who show a willingness to share at least some amount of their financial information outside the bank. But due to the constraints of legacy infrastructure or lack of will, many banks and credit unions will struggle to answer the call. That’s where it becomes imperative that you have a transformation strategy in place that includes API enablement.