Effective Fraud Management Starts With Customer Identity

February 22, 2024

By: Tyler Brown

Identity Risk Solutions

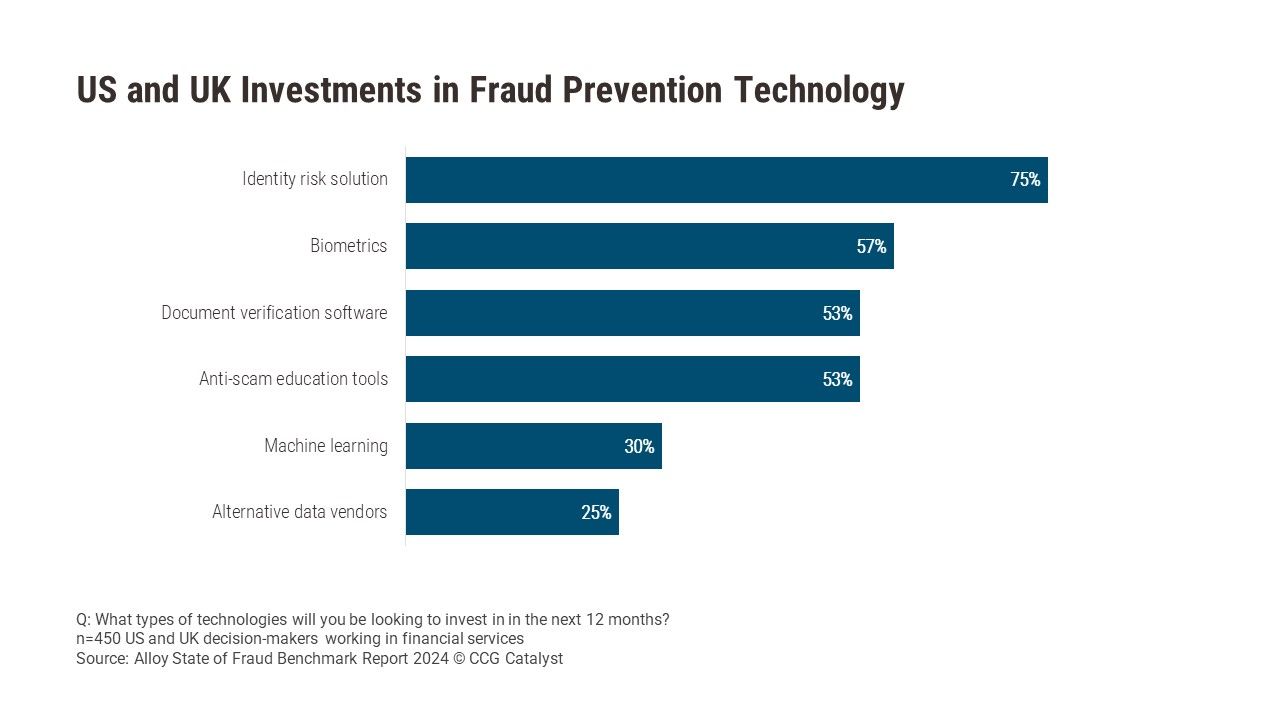

The vast majority of US and UK financial services decision-makers are looking to invest in an identity risk solution in the next 12 months, according to a benchmark study conducted by Alloy. The idea is particularly popular among 1) credit unions and community banks and 2) online and pureplay lenders. Three quarters of respondents overall cited planned investment in an ID risk solution, compared with nearly 90% of credit unions and community banks and online and pureplay lenders.

An identity risk solution augments financial institutions’ (FIs’) historical focus on suspicious transactions, Sara Seguin, principal advisor, fraud and identity risk at Alloy, told CCG Catalyst. It works in tandem with the existing tech stack to broaden data used to anticipate and arrest fraud to include things like data on a person’s financial history, device usage, and ongoing behavior. “An FI should expand their strategy [beyond a focus on transactions] because people are the ones [who] steal money,” added Seguin. Currently, the most common flag of attempted fraud for a plurality of respondents to the survey (39%) is dramatic growth in transaction volume in a short time window.

The key to a fraud management approach with a greater focus on the “people” part is an effective customer identification program. That, according to the Alloy report, combines automation with connected data sources to accurately verify and assign risk to a high volume of customers. “The more data you arm yourself with as a financial institution, the more likely you are to catch a fraudster and protect yourself from losses,” said Seguin. “Evaluating identity holistically is the key.”

An identity-driven approach may require an FI to change its mindset about fraud protection and identity verification. “Identity is more than just a KYC [know-your-customer] or KYB [know-your-business] checkbox,” said Seguin. “If you can figure out who those people are, you will address your fraud problem at its source.” For community FIs and credit unions with outdated fraud and risk management solutions, this may be particularly relevant. With smaller budgets and less ability than bigger peers to update and scale technology or build their own solutions, they’re more likely to depend on vendors to orchestrate fraud and risk solutions — even basic KYC and KYB processes.

It’s no surprise, therefore, that so many smaller FIs have an ID risk solution at the top of their minds. But implementation follows dedication — FIs can be overwhelmed by the size of an identity risk solution project, noted Seguin. Small steps are crucial. “It is important to remember you can start with one segment of the business and continue to expand across the organization,” she said. “Managing identity risk is an ongoing project that develops and changes as you progress, the same way fraudsters change their tactics.” An identity-focused mentality toward fraud management is a place to start.