Consumers Still Flock to Basic Mobile Features

August 25, 2022

By: Kate Drew

Mobile App Features

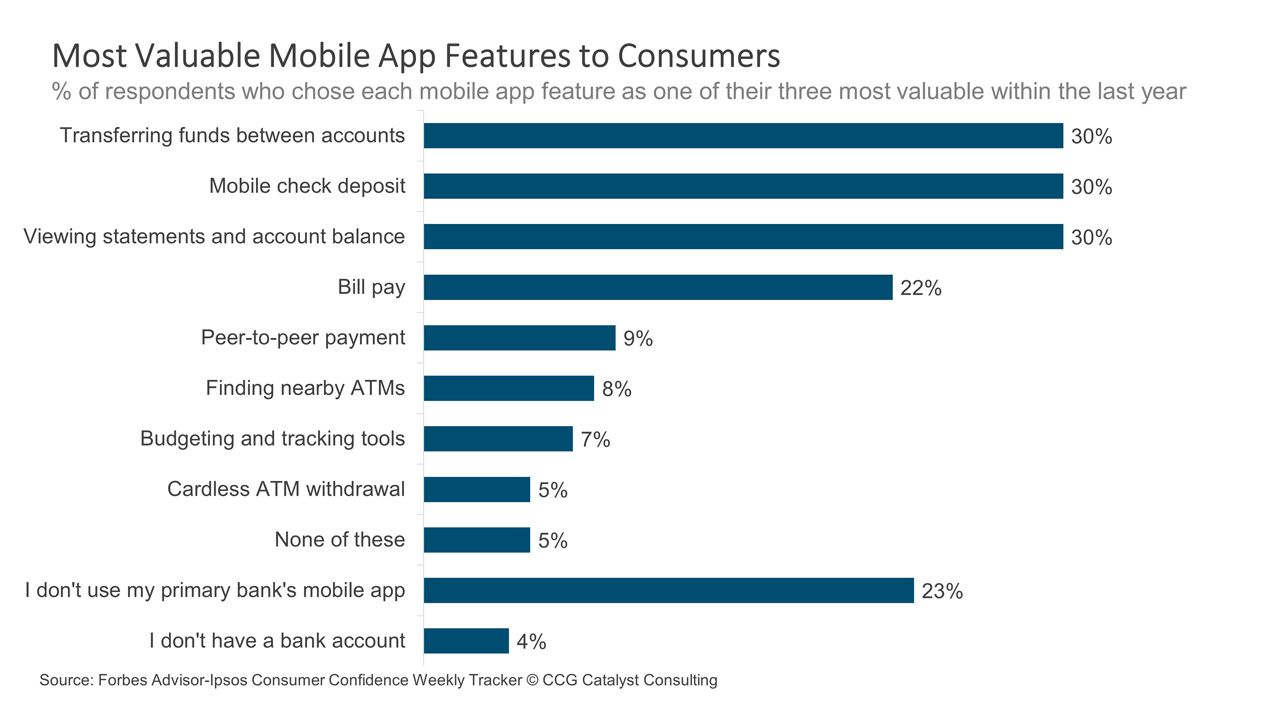

When it comes to mobile banking, consumers still value basic features most, according to data from the Ipsos-Forbes Advisor U.S. Weekly Consumer Confidence Survey. Specifically, respondents to a February 2022 fielding of the survey put transferring funds between accounts, mobile check deposit, and viewing statements and account balance in the top three spots when asked to pick their three most valuable mobile app features within the last year. It makes sense that these capabilities would be especially prominent for customers as they refer to everyday tasks. They also represent the baseline capabilities banks should be offering today if they want to stay on par with consumer expectations. The emphasis there is on baseline, though.

The truth is the industry should by now be thinking beyond these capabilities and pushing consumers to do the same. Technology companies do this all the time — they are in the driver’s seat telling us what we want and need before we even realize it. Remember when Apple released the first iPhone with no keyboard? How uncomfortable was that? Smartphone users everywhere clung to those little keys desperately, fighting the changing tide with gusto. But now? Can you even imagine a keyboard existing anywhere on your mobile device? True innovators are able to think ahead of consumer expectations, which allows them to create services and products that are truly differentiated and thus pull in large swaths of the population.

The goal is to shift before consumers do, to spot trends before they are really trends. The data from the Ipsos-Forbes Advisor survey also showed that, while these basic features remain top of mind for consumers, their positions aren’t as strong as they once were. In fact, all three commandeered higher percentages in the same survey a year earlier, while budgeting and tracking, an arguably more advanced and rarer capability, rose in prominence this year by a couple of points, despite its overall lower position. This reinforces the idea that banks should not only have table-stakes capabilities in place, but they should also be thinking about some of these future frontiers. And, ideally, identifying entirely new ones. Those that are able to accurately identify customers’ needs ahead of their own awareness will be well positioned capitalize on — and actually create — demand.