How Banks Evaluate Fintech Partnerships

October 19, 2023

By: Kate Drew

Banks and Fintech Partnerships

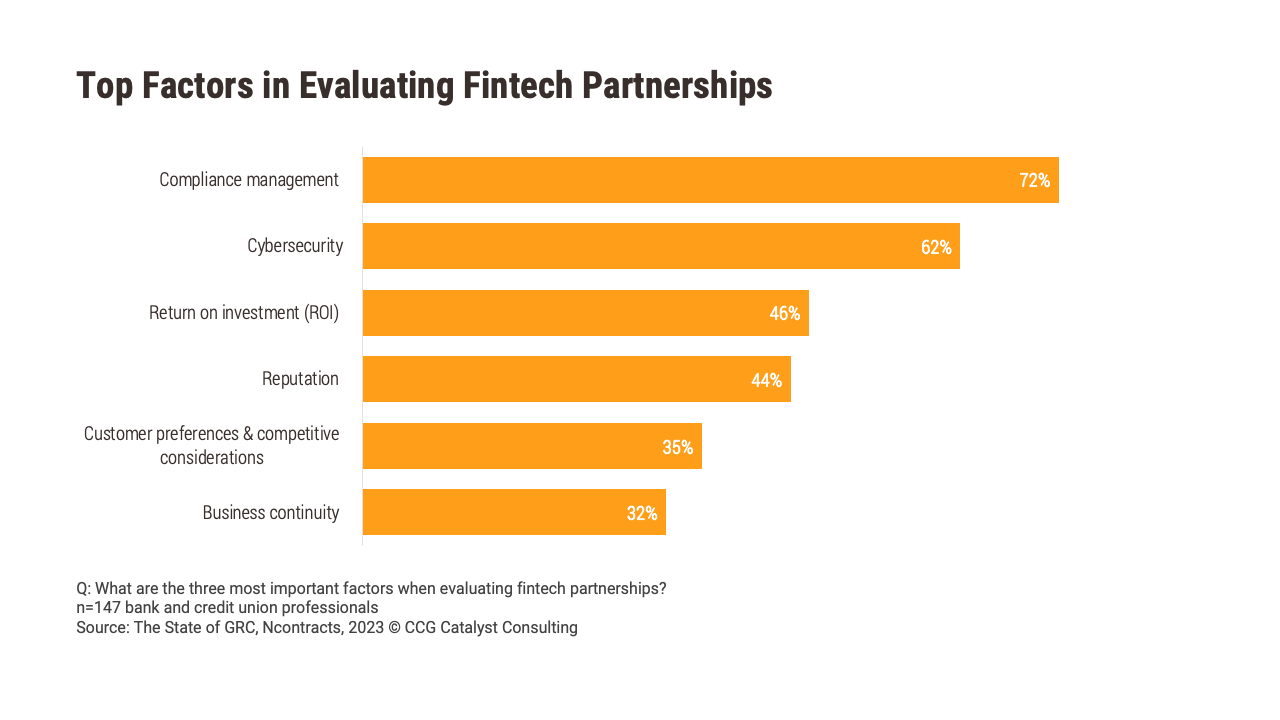

When it comes to evaluating fintech partnerships, compliance management is the number one factor banks are looking at, according to new research from Ncontracts. Specifically, 72% of bank and credit union professionals surveyed said this is one of their three most important factors in assessing these relationships, followed by cybersecurity at 62%, and return on investment (ROI) at just 46%.

Managing risk is clearly top of mind here. That’s (hopefully) always been a priority, but it’s likely even more true now than it was a few years ago given the slew of recent difficulties that traditional financial institutions (FIs) operating at the cross-section of traditional banking and fintech have faced lately. Just recently, Fintech Business Weekly reported that Evolve Bank & Trust and Banking-as-a-Service (BaaS) platform provider Synapse are currently in a dispute over who is responsible for a “deficit” of over $13 million in for the benefit of (FBO) accounts holding customer funds at Evolve. It’s a wild story, and it isn’t the only one like it to surface of late. As a result, regulatory scrutiny on such partnerships is amped up, and FIs are taking a more cautious approach.

Executives are in a tight spot. They need to ensure those they’re working with have their houses in order from a compliance standpoint — an area that many fintech companies admittedly find challenging — without being so stringent that they miss out on key innovations. It’s a balancing act, and not an easy one. As we’ve discussed before, those that do this well are FIs who have a clear ability to distinguish between perceived risk and actual risk. Of course, part of being able to do that comes down to vision and experience. But another part of it is about operationalizing your assessment framework. That means ensuring that you are evaluating potential partners in a uniform way, using a repeatable set of criteria. This kind of standardization helps to avoid patchwork decisions that could lead to either missed opportunities or botched forays as well as provides a level of confidence that allows decisions to be made with greater conviction.

Now, with that all said, it is worth spending a minute on ROI. That fewer than half of respondents put this in their top three factors for evaluating fintech partnerships is both shocking and disappointing. If we aren’t looking for ROI, then what exactly are we doing? And beyond that, modeling for ROI is a key element in assessing the risk of any potential relationship — the financial risk. Ensuring you’ve got the ability to conduct proper due diligence makes sense as a priority, but it’s not going to matter much if you aren’t focused on driving value. Those things need to go hand in hand. The goal should be to take a holistic approach that looks to strike a balance between opportunity and risk and is careful not to place one above the other. By thinking about things in this way, FIs can be more confident in their ability to ink the right partnerships, ones that are objectively rewarding without getting anyone into trouble.