Fintech, Meet Regulation

May 19, 2021

By: Kate Drew

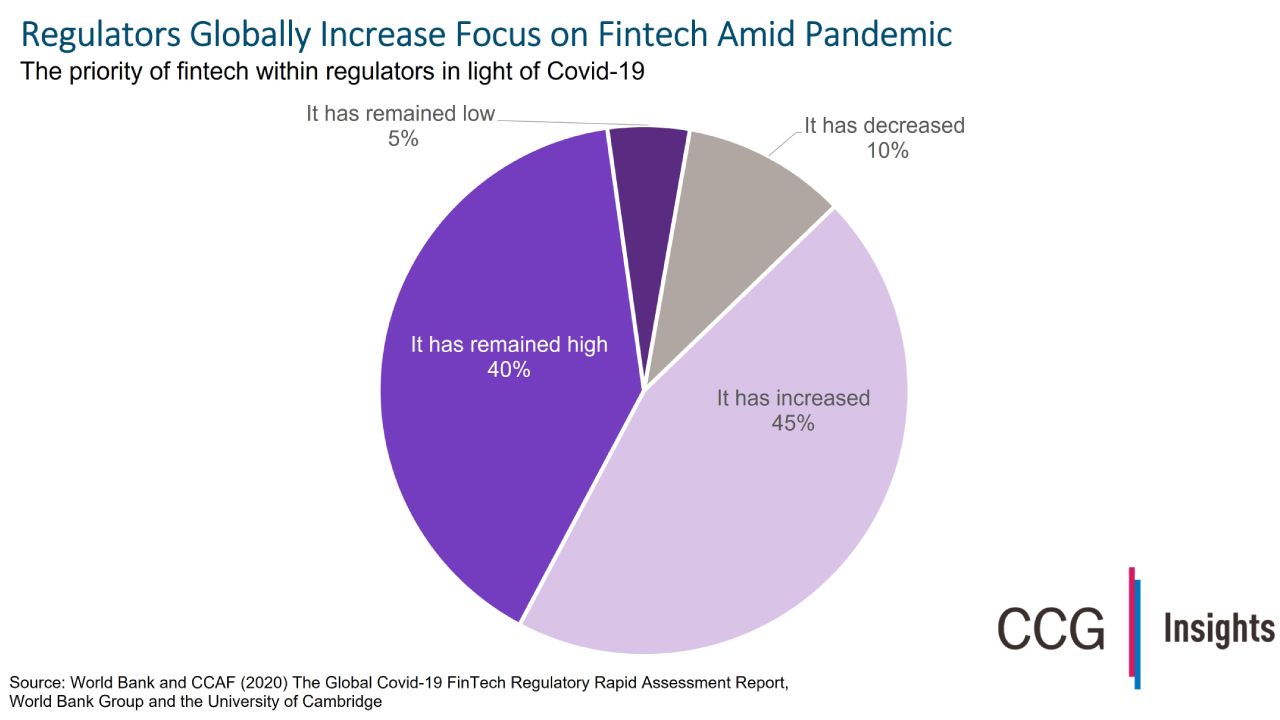

As the Covid-19 pandemic prompted customers to flock to digital in the last year or so, fintech startups got a major boost. Adoption of these services soared globally, in many cases, outpacing traditional banking apps, which also saw acceleration in downloads and usage. The increase in activity arrived with great fanfare, spurring big funding rounds, splashy headlines, massive IPOs — and, accordingly, more interest from regulators. In fact, 45% of regulators around the world surveyed by the World Bank and Cambridge Centre for Alternative Finance (CCAF) say that fintech has increased as a priority in light of the Covid-19 pandemic. Another 40% said it remained a high priority, while just 15% reported low or declining prioritization.

The data seems to be bearing out in reality, too. Just a few weeks ago, the Federal Reserve invited comment on proposed guidelines for handling requests for access to Fed services by institutions with “novel types of banking charters.” The central bank said the guidelines reflect a large influx of such applications as well as technological advancement and are designed to create a “transparent and consistent” process for firms looking to access Fed accounts and services. This could be both a positive and a hinderance for the fintech space — on one hand, it will bring standardization to the process to ensure all applications are treated equally, while on the other, it could make it more difficult to access important functions of the Fed, especially its payment services. Meanwhile, digital challenger Chime recently settled a dispute with California regulators over the use of the word “bank” in its marketing materials. Chime provides bank accounts to its customers through its partner banks, The Bancorp Bank and Stride Bank. Like most other challengers in the US, it is not a bank itself. This decision is likely to have its own implications for the industry, as similar fintechs will be encouraged to more clearly define their services before running afoul of regulators.

These are just two recent examples that demonstrate regulators aren’t only exploring the fintech industry anymore; they are starting to get more involved. For traditional banking institutions, it may be tempting to believe increased regulatory oversight on this sector will mollify the fintech threat. That’s a gamble unlikely to payoff. While there may be some initial bumps and bruises, bringing fintech into the regulatory umbrella will probably have the opposite effect long term, making their services more secure and creating greater legitimacy around their brands. The most forward-thinking institutions will be trying to understand what a regulatory environment that includes the fintech industry looks like, and preparing for that future. That could mean collaborating with these players as they build new products and services, or even helping to build with them. It’s important to remember, in jurisdictions where the regulators are active on fintech — think the UK, Singapore etc. — the industry tends to flourish.

–Kate Drew is the Director of Research at CCG Catalyst. Contact her at KateDrew@ccg-catalyst.com or 1-480-744-2240. Follow CCG Catalyst on LinkedIn and Twitter.