Fintechs Haven’t Solved Retirement Planning

January 11, 2024

By: Tyler Brown

Roboadvisors and Personal Finance

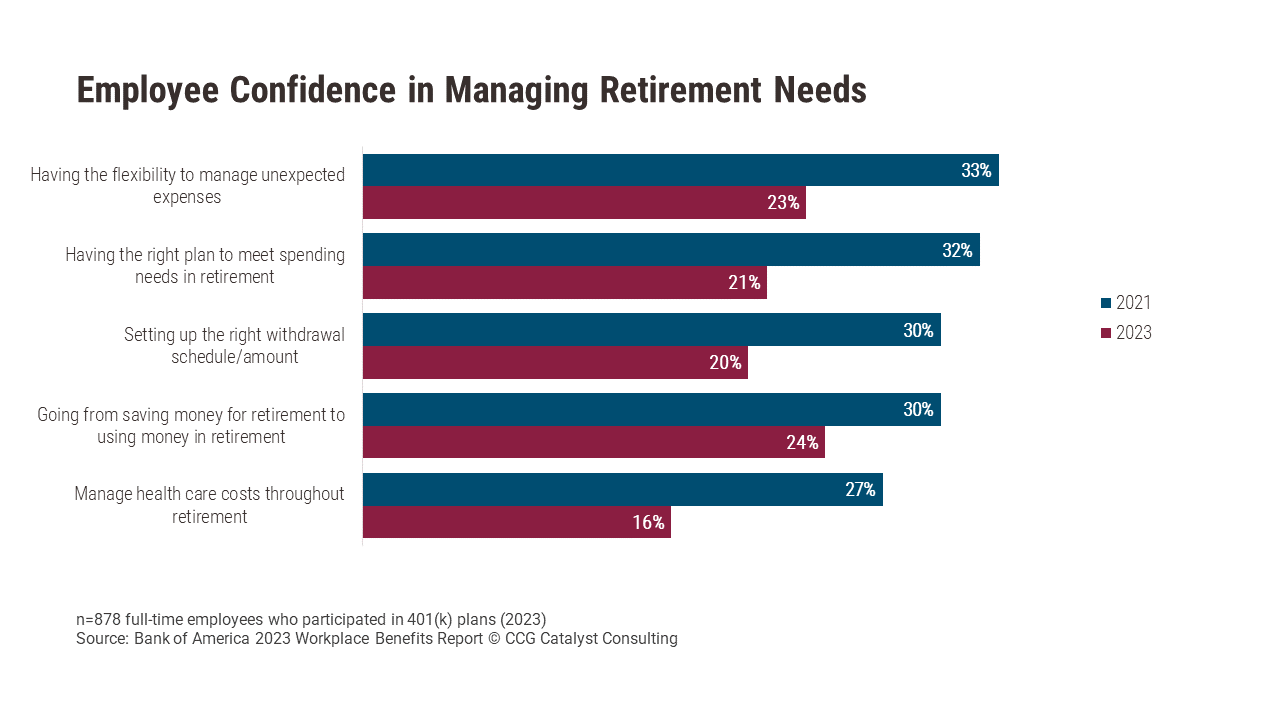

Employee confidence in retirement planning declined between 2021 and 2023, according to a study commissioned by Bank of America. Specifically, fewer than a quarter of consumers surveyed said they were confident in managing their retirement needs across a number of areas. A factor in this decline may be the uncertain macroeconomic climate and interest rate environment that characterized 2023, especially early in the year when the survey ran. Over half (63%) of employees surveyed agreed that economic uncertainty will affect their current and future workplace benefits and 401(k) plans.

Short-term fear, however, distracts from consumers’ need for financial planning with a decades-long time horizon. The ability to manage unexpected expenses and meet spending needs in retirement, for example, are a product of careful planning, saving over the long term, and investment strategies that calibrate risk and return. Closer to or during retirement, financial planning changes as consumers’ needs shift with their life stage and associated expenses.

According to Bank of America’s analysis, those needs fall into four buckets:

- Saving enough money

- Planning how to use it

- Figuring out government requirements

- Changing mindset from saving to spending

Of these classic elements to financial planning, fintech has focused on the first with tools that include automated index investing for IRAs and liquidity and diversification based on investment goals and risk tolerance. It’s easy to find those fintechs, known as robo-advisors — Wealthfront and Betterment are big names. Established brokerage firms have also jumped in with services like Schwab Intelligent Portfolios, Fidelity Go, and E*Trade Core Portfolios. Bank of America’s Merrill has a similar service.

For consumers, though, an investment plan can’t fix fear of the unknown and isn’t designed to programmatically solve nos. 2 through 4. Consumers may ask themselves, “What amount of savings is enough? “Will I ever get there?” or “What bad things could happen?” Budgeting fintechs that could shed some light on specific long-term spending needs (Quicken Simplifi, Honeydue, Monarch, for example) instead focus on spending in the moment and short- to medium-term budgeting.

So there’s the gap in the market: The automation of both investing and holistic long-term financial planning built into a solution that evolves with a customer’s life stage. While some robo-advisors offer access to financial planners, financial planning and automated investment tools don’t automatically adapt to life circumstances and can’t build a plan that accounts for future streams of income, lifestyle, or healthcare costs (the latter is about 15% of living expenses in retirement, according to Fidelity).

Fintechs or traditional players have a real opportunity to solve for this problem, but it will take time. While machine learning promises the technical capability, today, software can only piece together a consumer’s financial situation from demographics, some account data, and manual inputs. In short, we need more data. Open finance may be the catalyst to change that, enabling a more thorough view of a consumer’s circumstances that can help providers build solutions suited for the long haul.