Moving Forward in a Post-SVB World: Part II

June 22, 2023

By: Kate Drew

Bank Failures and Stability

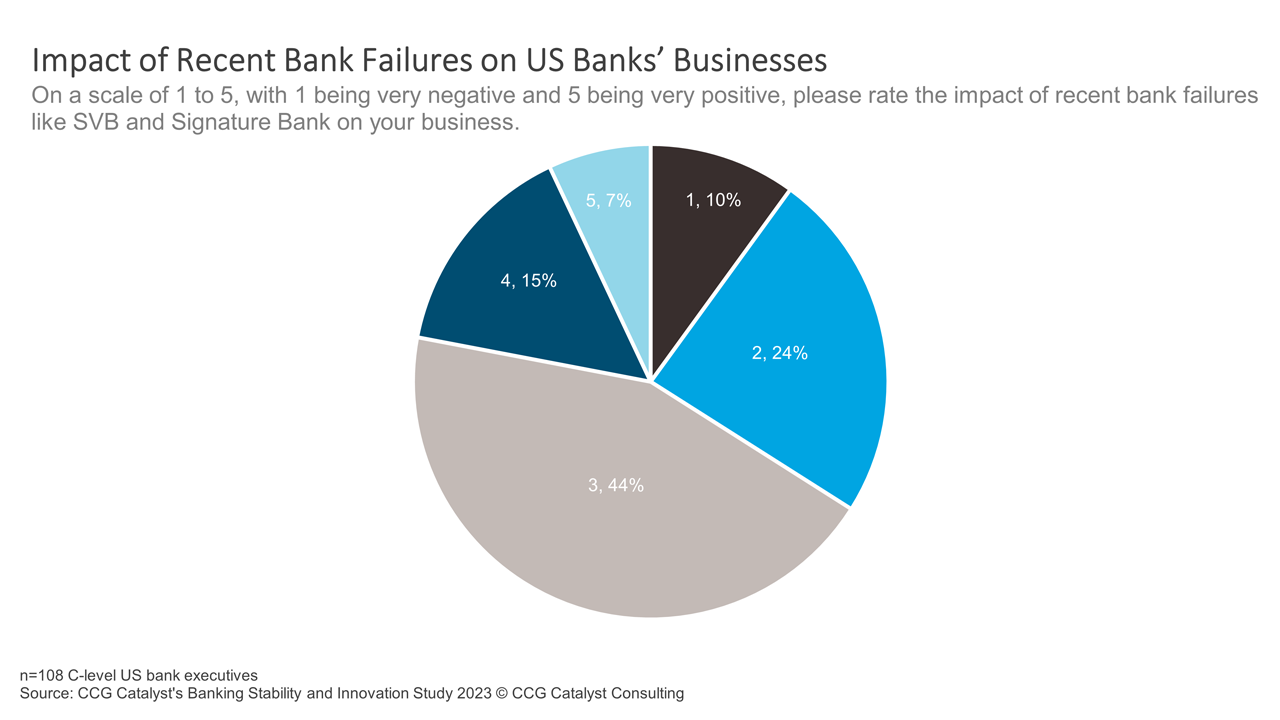

In Part I of our Moving Forward in a Post-SVB World Series last week, we talked about how bank executives are feeling about the state of the industry, based on our Banking Stability and Innovation Study 2023, which surveyed 108 C-level bank executives in the US between May and June. In this second installment, we’re taking a look at how bank executives feel their own institutions were impacted by the string of recent bank failures. Notably, the largest bulk of respondents (44%) said the impact has been neutral, while about a third reported a negative impact, and a smaller number (22%) saw positive effects. Of course, which bucket you fall into here depends very much on what type of bank you are — for example, unsurprisingly, larger institutions were more likely to see favorable activity in the wake of these events.

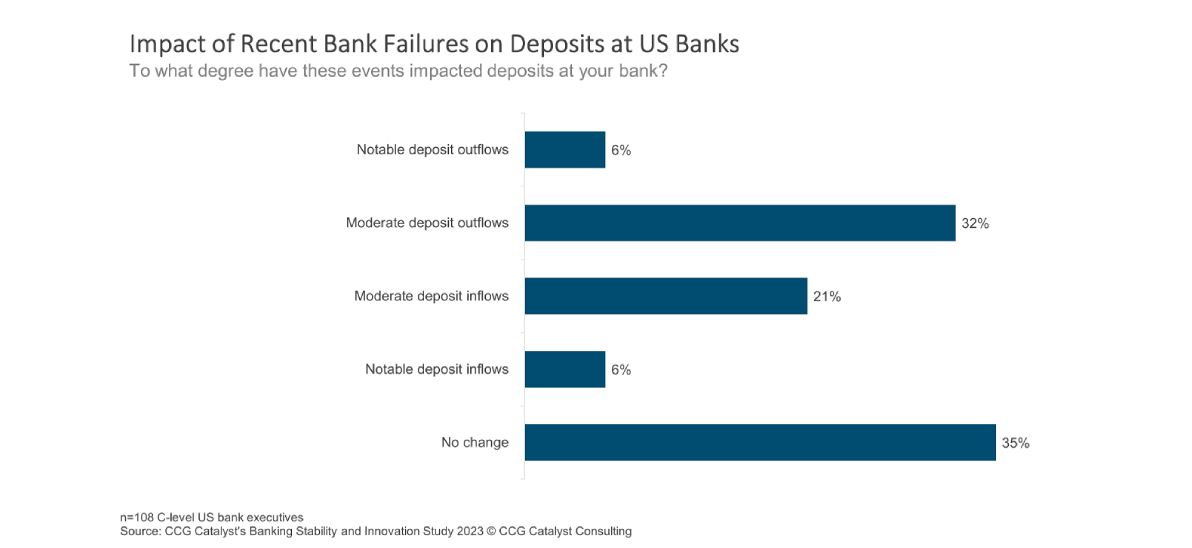

In exploring what exactly the impacts looked like, we asked respondents specifically about deposit flows at their bank. A little over a third reported no change, 38% said they’d experienced deposit outflows, and 27% said they’d experienced deposit inflows. Again, those experiencing deposit inflows tended to be larger institutions. While none of this data is particularly surprising, it does serve to further validate a lot of the discourse in the market over the last few months. Additionally, it is worth pointing out that very few reported deposit fluctuations beyond moderate level, which coincides with the data above as well as our analysis in Part I. Overall, things seem to be shaken but contained, and executives broadly aren’t sounding major alarm bells yet. For instance, when asked to elaborate on the impact to their bank, one chief information officer at a $1 billion-$5 billion institution said, “We are cautiously optimistic this is not systemic for all banks.”

Beyond the impact of these events, our study also provided some insight into how banks responded and the steps they took to shore up defenses. Specifically, a number of respondents brought up their communication strategies and how they interacted with customers to calm fears. For example, one executive noted that this created an opportunity to “provide customer education,” while another said they were able to rely on their staff “to quell concerns and avoid any significant implications (i.e. runs) as a result of the news cycle.” This is key because it reinforces an idea we’ve been hammering for a while, that banks need to be proactively communicating with their customers in this environment. That is the number one tool institutions should be leveraging as they look to hold on to deposits. Banks should be helping their customers to understand the current situation, the stability of their bank, and their options for securing their money, such as through extended Federal Deposit Insurance Corporation (FDIC) coverage.

If we were to sum all of this up, the central takeaway is that, while the banking industry undoubtedly took a hit this year, it appears to be staying on its feet, and communication was and is an important role. This is overwhelmingly good news, but it should not be taken as a pass. The reason why the country’s banks largely appear to be weathering the storm is because they did not rest on their laurels this spring. Rather, they are putting in the effort, and they will need to continue to do so. That is true both when it comes to the war for deposits as well as getting back to planning for the future longer term. Along those lines, next week, we will examine what comes next for bank executives when it comes to their strategic direction and plans for innovation as we all work to move forward.