Bankers Expect Deposit Competition To Worsen

June 8, 2023

By: Kate Drew

Banks and Deposit Competition

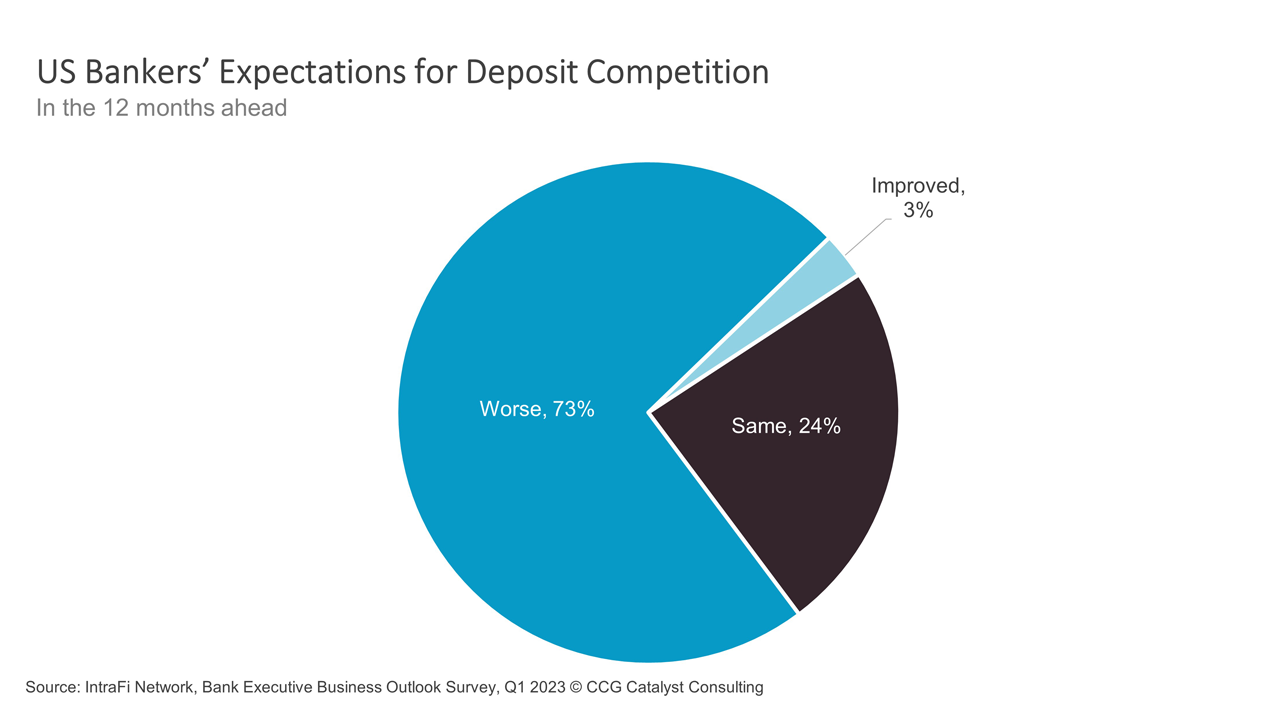

Overwhelmingly, bankers expect the war for deposits to worsen. Specifically, a whopping 73% of banking executives surveyed recently say they believe deposit competition will intensify over the next 12 months, according to data from IntraFi. As such, this side of the business is likely to remain top of mind for industry participants for the foreseeable future as they look to retain and win customers.

The question is, how exactly should a bank go about fighting this battle? We’ve explored potential answers a lot lately, honing in on strategies from doubling down on existing brand recognition to diversifying through new channels. And all are options on the table to consider. However, at the heart of this is really deepening customer engagement. Inside and outside of banking, engagement is a major driver of loyalty. And that’s the first imperative for every bank here — preserving the deposits you have. Second, is pulling in deposits from your competitors.

Keeping your customers engaged is really about two things, communication and delivery. On the communication side, we’ve been beating the same drum for a while — banks need to be helping their customers to understand the current environment, the stability of their bank and how it is reacting to today’s pressures, and their options for securing their money, for example, through extended Federal Deposit Insurance Corporation (FDIC) coverage. Critically, waiting for inquiries to come in is not a communication strategy. Banks should be proactively communicating with their customers on these topics, getting ahead of any anxiety. Delivery, meanwhile, is a little bit trickier because it speaks to technology and investment, two areas that (as we discussed last week) may be tempting to pull back on right now. Those with a long-term view, however, will continue pushing forward in ways that allow them to get to market faster with products and features that please their customers, and create stickiness.

Figuring out how to use these engagement levers strategically is where the value lies. As mentioned above, that can come in many forms. At the end of the day, though, customers are people, and they will respond to strong offerings with clear messaging. It’s really that simple at a high level. While it gets more complicated once you get into execution, understanding the power in the combination of these two things is foundational to charting a path that will deliver results. So, if you are feeling lost, bring your focus back to the basics, back to what every company in the world looks to do to drive success, ultimately, back to how you serve and talk to your customers.