Defining Open Banking in the US

July 21, 2021

By: Kate Drew

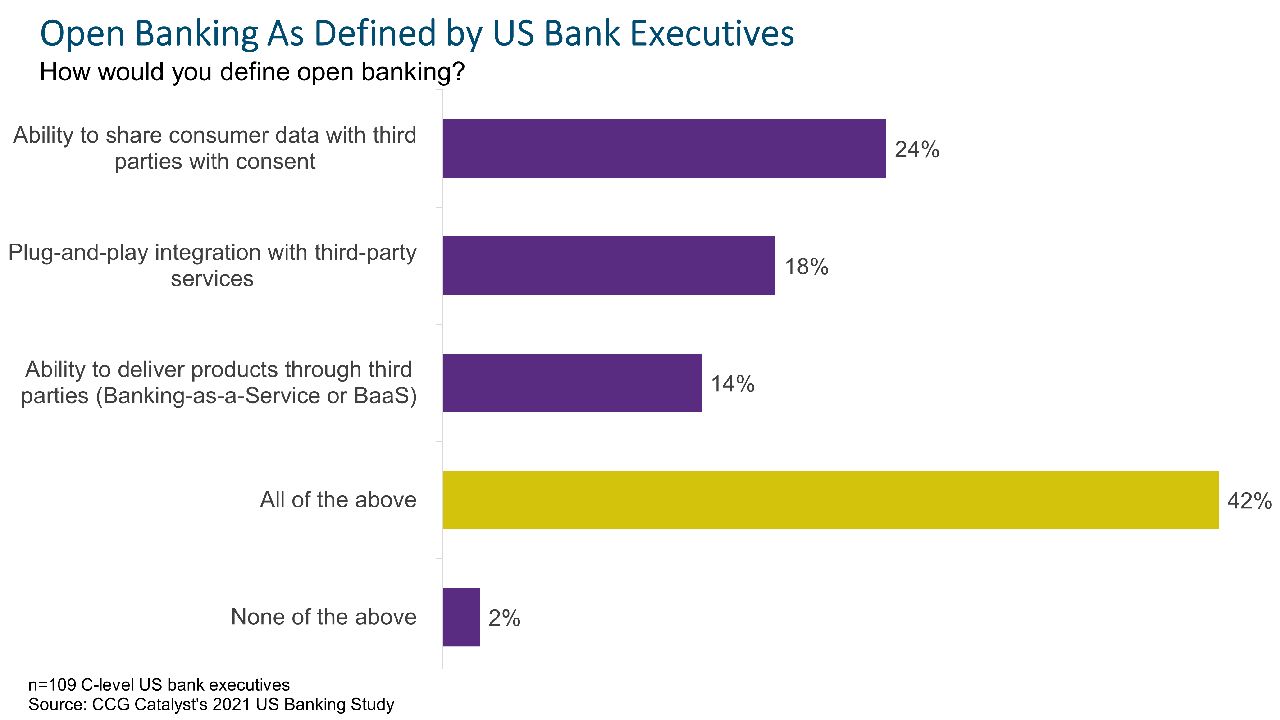

There’s no prevailing definition of open banking in the US. In other jurisdictions, like in Europe, there is a very specific characterization of open banking laid out by regulation that refers to the ability to share bank customers’ data, at their request, with third parties. Because we don’t have this kind of regulation in the US (yet), institutions have largely been left to decide for themselves what the concept means and how to implement it. That’s led to an expansion of the idea of open banking beyond its original premise to encompass a range of data-sharing and integration capabilities, including sharing back-end data and functionality. As a result, open banking now means many things. In fact, when asked how they would define open banking across a range of options — including the ability to share consumer data, plug-and-play integration, and Banking-as-a-Service (BaaS) — more respondents to CCG Catalyst’s 2021 US Banking Study (42%) selected all of the above than any other choice listed.

This is both a blessing and a curse — you can do many more things under this expanded concept, like working with third parties to offer new products, or pursuing new distribution models through BaaS. However, the resulting free-for-all can also be very confusing. Many banks are left wondering where they should start, or which capabilities apply to them. As we’ve discussed before, the real trend here is toward infrastructure flexibility. It’s about getting your systems to a point where they can support any kind of integration you may want today, or tomorrow, all aligned to the bank’s overall long-term strategy. That can be done either by working with your core provider, though many of these firms tend to be at the beginning of their own open banking journeys, or by creating a dedicated API layer that can easily deliver data and functionality to the outside world. Either way, it means taking closer look at your infrastructure and making sure you’re positioned to succeed in a future that doesn’t yet exist.

Open banking is a buzzy term. It gets thrown around a lot without much discussion around execution. Even when we do talk about execution, it’s often in broad strokes that lead to the use of other buzz words like “ecosystem” and “speed to market.” Very rarely do we acknowledge that this concept is still evolving, that we don’t know exactly how it will take shape in this country, and as a result, we need to be agile. It’s possible that clarity is coming — the Biden Administration recently asked the Consumer Financial Protection Bureau (CFPB) to issue rules giving consumers full control of their financial data by Executive Order, signaling the US may soon have some formal guidelines around open banking. Even so, though, such regulation will take time, and meanwhile, institutions will continue to push forward with their own initiatives. Focusing instead on flexibility seems to be a much more worthwhile effort. That way, the actual definition of open banking ceases to matter. It can change and evolve, and so can you.