Payment Hub Strategies Still Have Room To Run

June 23, 2022

Banks and Payment Hubs

Payments modernization is an important focus for many banks today, especially in light of new pressures like the upcoming introduction of ISO 20022 and shifts toward real-time payments. As a result, a quarter of US mid-tier financial institutions surveyed by Volante Technologies say they are actively modernizing their payment infrastructure. Meanwhile, of those without active modernization plans, 16% are dissatisfied, 38% are satisfied but missing capabilities, and 5% are facing some challenges. Only 16% of respondents in Volante’s sample said they were fully content. This suggests that the drive to upgrade payment infrastructure is a powerful one, both among those who are already working on it and those who haven’t started yet.

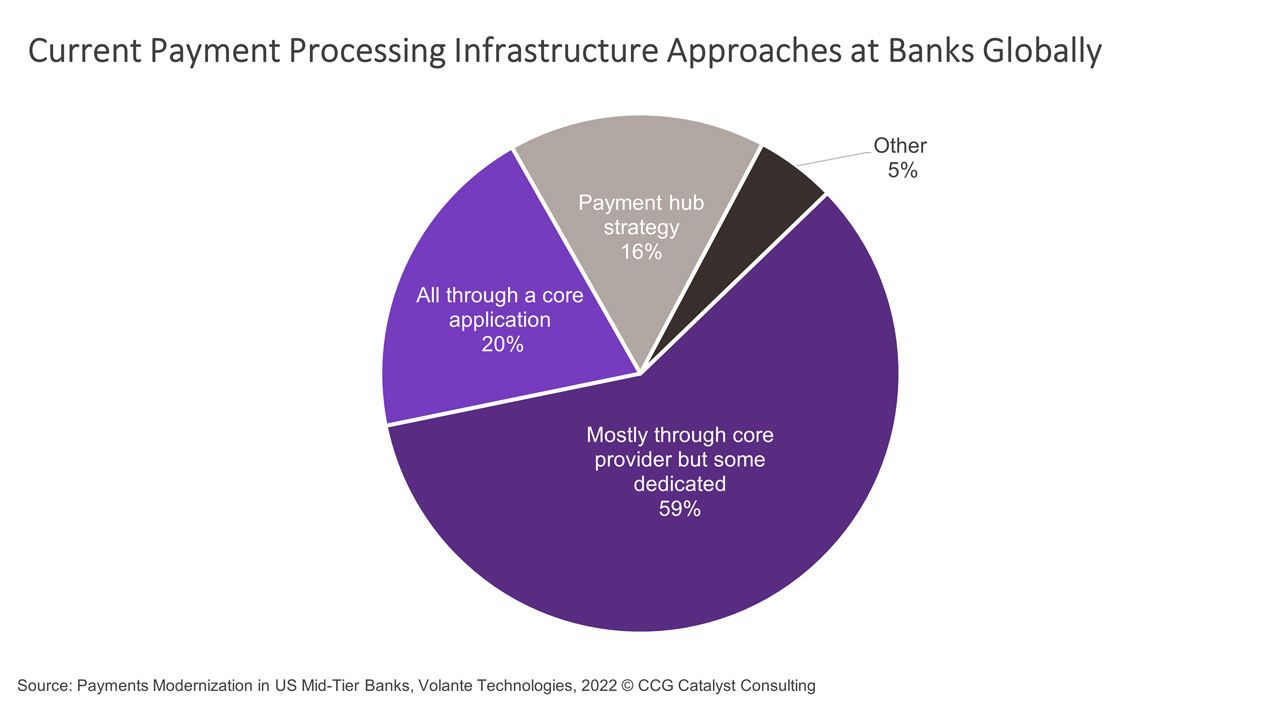

As banks begin to grapple with the future of payments, there are many questions they need to answer. What kind of capabilities do they need today? What will they need tomorrow? Areas like faster or real-time payments may be in focus right now, but how will those capabilities evolve and grow over time to include new features and functionality? Think about things like requests to pay or confirmation of payee, which are typically served up alongside instant payment schemes and offer tremendous potential to improve the customer experience. The goal should be to build modernization roadmaps that bake in flexibility for the answers to these questions. And it seems as though banks realize this — according to Volante’s survey, only 20% of respondents are currently handling payments processing through only a core application, which is down from last year, signaling institutions are embracing the idea that they will need to think outside the box in a best-of-breed approach if they are to be successful long term.

Notably, however, only 16% are pursuing payment hub strategies, by which all of their payments are handled through a single unified system that is able to route transactions across channels in an intelligent way while providing a data-rich, holistic view of customer activity. The lack of uptake here, despite seemingly obvious benefits, is likely in part because the idea of unifying many disparate systems while still trying to do business feels like a rip-and-replace exercise that’s expensive and not worth the risk, at least for those outside of the big bank club. It’s much easier (and less scary) to upgrade systems slowly over time. However, as it often does, technology seems poised to make all of this much more accessible — modern hub solutions are emerging today that can allow a bank to unify its payment systems without completely ripping everything out and starting over. Moreover, they offer the flexibility that banks will need to support an uncertain future, especially when it comes to participating in new rails or networks.

Modern payment hub solutions, which tend to be cloud-first and built for interoperability with a heavy focus on application programming interfaces (APIs), clearly still have a lot of room to run, but they may very well be heading for the mainstream, especially as the technology further evolves and advances. As such, this is likely an area to watch for banks looking to pursue payment modernization. Regardless of which path you choose, though, it’s important to keep evolution in mind. Of utmost importance is that your infrastructure is agile enough to support changes and pivots as the broader environment around the bank shifts and transforms.