What Drives Consumer Trust in Banking?

April 20, 2023

By: Kate Drew

Banks and Trust

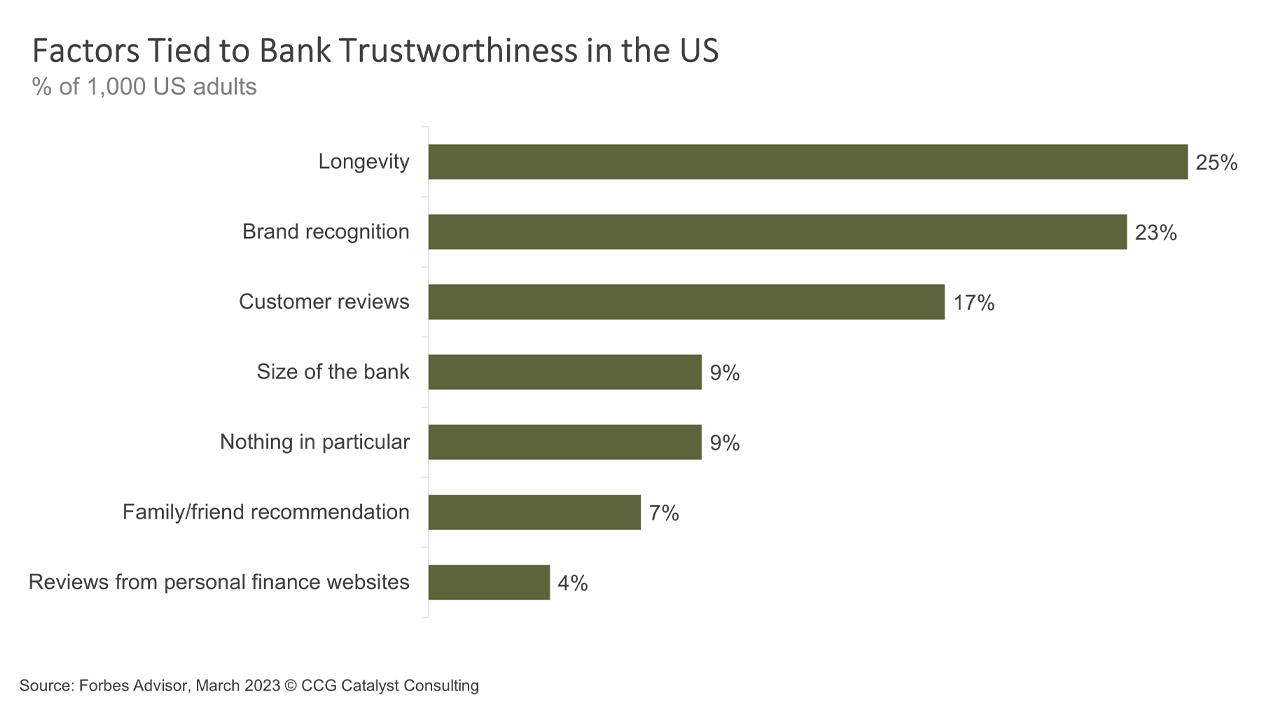

The data illustrating deposit flows into big banks and fintech providers following the fallout from SVB and Signature Bank is pretty staggering. But, of course, it’s not all that surprising — trust is shaken, with 77% of US respondents to a recent Forbes Advisor survey saying they are worried about the stability of their bank. None of this is really up for debate. The question is, rather, “What are we going to do about it?” And that comes back to trust, or more specifically, what creates trust. Forbes Advisor asked about this, as well, and found that, across a range of options, longevity and brand recognition are the top two factors driving consumer trust in a bank, followed by customer reviews.

This is good news for the country’s community banks, some of which have been around much longer than you or me, and have already built their businesses around reputation. It means that doubling down on a bank’s history may be a relatively straightforward and effective way of reassuring customers in turbulent times. But it also means you’ve got to take the reins and actively double down — this is not the time to let your reputation speak for itself. Some banks are already beating this drum to positive effect, which demonstrates the value in having a strong communication strategy that helps elevate a bank’s experience and approach to serving the market. While there is opportunity here, it’s not enough to be a bank with a long track record, you’ve got to make it known.

Truthfully, deposits were flowing out of even the largest banks before recent events as customers searched for higher yields, so pressures are unlikely to abate anytime soon. Right now, those in the most difficult position are probably the ones who were already feeling the heat and are currently on the defensive. It’s quite likely, though, that many of those institutions also have a very long track record. The goal should be to find ways to use that track record to calm fears, while also growing really tight on your overall strategy. Remember that second factor, brand recognition? If experience is the first part of this, the second part is what you’re known for. Combining longevity with expertise represents a powerful one-two punch, and using these levers strategically could very well help many organizations navigate their way out of the chaos.