Ecosystem Banking Hurdles

September 01, 2022

By: Kate Drew

Ecosystem banking models are growing in popularity, fueled by adjacent trends like open banking and Banking-as-a-Service (BaaS). There are many different flavors of such models, from deploying bank products through fintechs in a BaaS arrangement to incorporating a range of services from outside parties into a bank’s own customer channels. But the key to this concept is working with third-party providers to enrich your value and tap into new revenue streams. And, as such, it offers a major lifeline to traditional institutions looking for ways to diversify and compete.

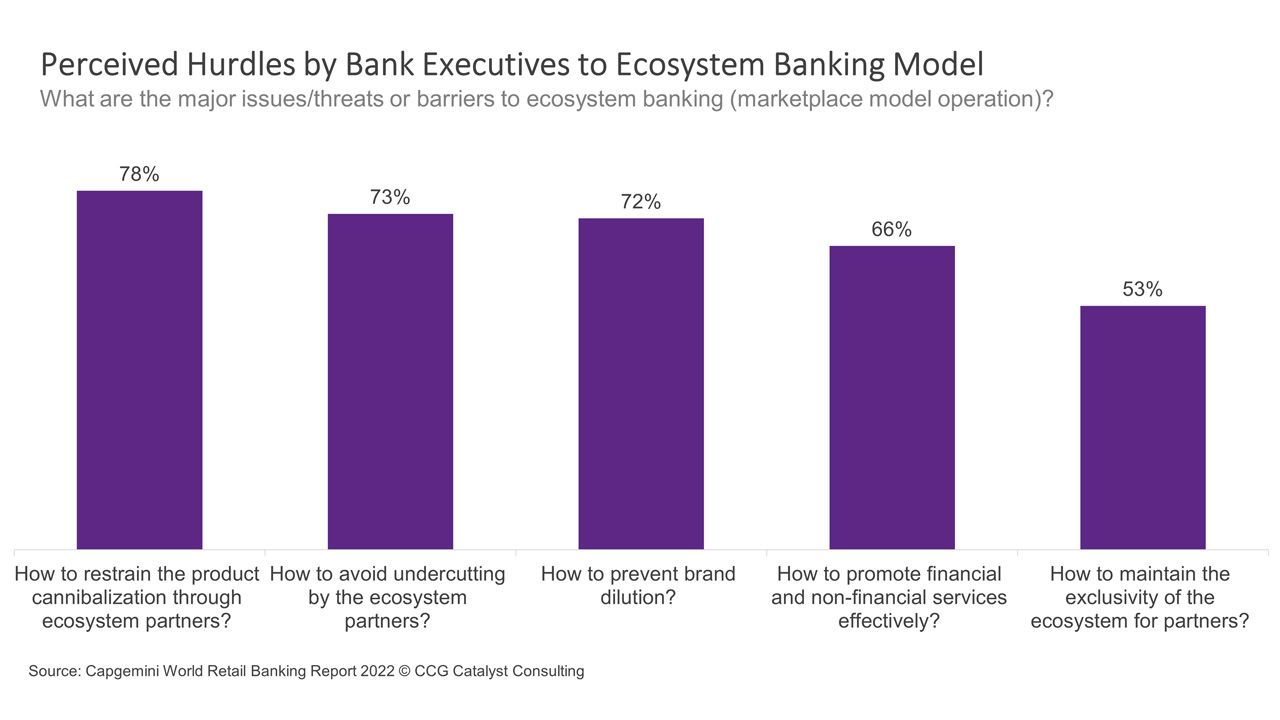

Despite banks’ interest in such opportunities, however, hurdles remain to adoption across the industry. And it seems as though those hurdles are largely tied to one specific idea — the possibility of becoming “dumb pipes,” by which they lose the ability to compete with those who leverage their infrastructure and thus see their core businesses erode. In fact, according to Capgemini’s World Retail Banking Report 2022, the top three major threats that executives see related to ecosystem banking — restraining product cannibalization, avoiding undercutting by partners, and preventing brand dilution — all speak to this fear. Such concerns are not totally unreasonable, but they are a bit misplaced. That’s because, in reality, the dumb pipes scenario speaks to a misunderstanding of what an ecosystem or platform approach really means.

The problem, generally, stems from the word “partner.” Take a BaaS arrangement, for example, by which a bank is providing account services to a number of fintech providers. The bank is tapping into that ecosystem and generating revenue through it. The fear, if you’re thinking of those fintechs simply as partners, is that they will cannibalize your existing business. And that’s fair — when you think of a partner, the possibility of usurpation doesn’t seem all that unrealistic. But what if you thought of them as customers? Because that’s really closer to what they are: You, as the bank, are providing services that power an ecosystem, and the participants in that ecosystem are paying you in any number of fees for those services. That is a provider-client relationship. And, on the flip side, if you are providing an ecosystem where others sell their services, the same holds true, you’re selling access. Through this lens, it’s all a lot less scary, because it becomes less about preserving your existing business and more about how you can make new business lines grow and flourish.

This is really about flipping your mindset. When you think of a customer, their success is your success. That is how we should be thinking about these things. If we can stop thinking about those we work with in these ecosystems as potential threats and focus more on building sustainable revenue streams through their businesses, we will get to a point where interests are aligned, and the fear of turning into dumb pipes becomes irrelevant. The focus needs to be on building a business around these third parties, rather than how the business of those third parties could potentially impact the bank’s existing operations. In doing so, you’ll generate new offerings and brand recognition that maybe don’t look like you’re used to but can take you into the future.