Consumers Link Accounts for Convenience

April 28, 2022

Open Banking and Convenience

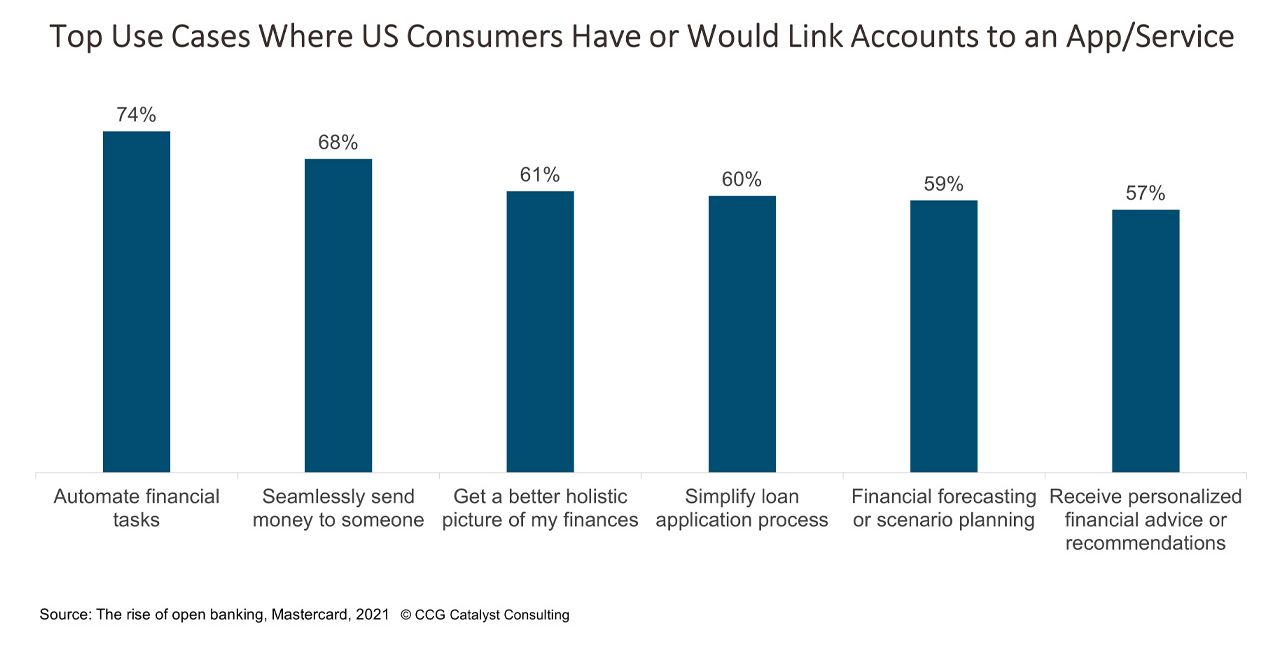

Open banking may not be a formal concept in the US, but the core tenets behind the idea have taken hold with consumers. As a refresher, in jurisdictions like Europe where open banking regulation exists, banks are required to enable customers to share their financial data with third parties at their discretion, usually via application programming interfaces (APIs). Here in the US, that’s not the case. The movement toward data-sharing has thus far been mostly institution-led, despite some recent regulatory attention. As a result, we are a bit further behind other countries when it comes to enabling open and secure data-sharing for customers on a wide scale. However, that hasn’t stopped consumers from linking their bank accounts to third-party services when they want to use them — and that’s usually for convenience. According to a recent Mastercard study, 81% of US respondents reported connecting their primary financial accounts to another service by using their online banking credentials, with the top use cases being to automate financial tasks and to send money to someone.

This data is telling because it suggests two things: First, that consumers are looking to save time and effort, and fintechs and other nonbanking services are offering solutions they want to use, and second, that they are willing to share their bank data with those services to reap the benefits. What is critical, however, is the way these consumers are connecting their accounts, by sharing their login online banking credentials with the third-party app or service. As we’ve discussed before, this practice of accessing a user’s financial data by using their own login credentials to “screen-scrape” the information they need is employed by many fintechs and other services. It’s also not very secure because it means sharing passwords, often with multiple parties. Banks have an opportunity here to provide direct access to this data, securely via API by getting on board with the open banking movement. That means ensuring that your infrastructure is flexible enough to support such access, whether that’s through working with your core provider or building an API layer to make data-sharing and integration easier. Either way, it’s important to get a strategy in place now, as it’s clear consumers and third-party providers are moving ahead on this with or without bank participation.

We live in a world of convenience. This is an idea we’ve been coming back to again and again. Consumers are increasingly used to having everything at their fingertips. The use cases that came out on top in Mastercard’s study speak to things that are relatively ubiquitous like automated bill pay and Venmo. And we’re only going to keep getting more demanding when it comes to features and services that give us back precious time. Fintech has done a tremendous job in answering that call, and it will likely continue to do so. But where does that leave the banks? Today, it means that fintech companies and other third-party providers are pulling down data from their online banking systems, perhaps without these banks even realizing it. Isn’t it time to play a more active role? There is work to do, given all of the legacy technology that banks are still running on. That’s true. But there are solutions out there, too. Right now, the goal should be to get started. That’s it. Just get started. And we’ll go from there.