Is the US Ready for Open Banking?

September 15, 2021

By: Kate Drew

Open Banking and Strategy

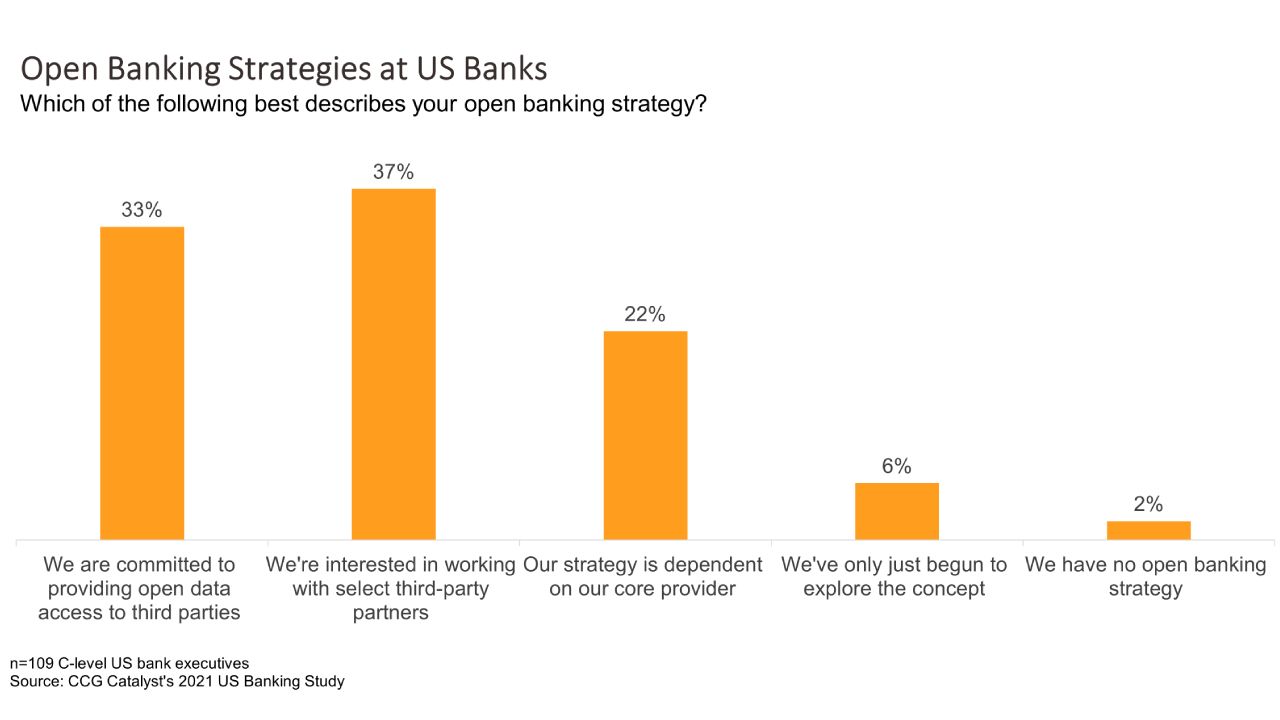

Open banking continues to buzz around the banking industry, especially as the Biden Administration recently asked the Consumer Financial Protection Bureau (CFPB) to issue rules around consumer data-sharing. That move prompted renewed speculation that open banking regulation may finally be coming to the US, where the movement thus far has been largely undefined, and institution led. However, despite widespread claims among financial institutions that open banking is a priority, only a third are embracing the concept in its traditional form, according to CCG Catalyst’s 2021 US Banking Study. Specifically, when asked to describe their open banking strategy, just 33% of respondents said they were committed to providing open data access to third parties, aligning with the definition laid out in other jurisdictions by regulation like the Second Payment Services Directive (PSD2) in Europe.

The data suggests that not only will US institutions have to grapple with technology hurdles should open banking become a reality, but they will also need to undergo a massive shift in mindset:

Thirty-seven percent of respondents to our survey said they were interested in working with select third-party partners, reinforcing the idea we explored a few weeks ago that security is a top concern for banks when it comes to opening up their systems and data. But open banking, in its true form, puts control of data in the hands of consumers, mandating that financial institutions share that data with third parties at a customer’s request. That means, under traditional open banking regulation, banks do not get to choose those third parties. Today, that represents a huge mental barrier for most banking providers in the US.

Getting comfortable with the concept of open banking requires education and understanding. In Europe, for example, third-party providers that want to participate in open banking are required to get licensed. It’s likely that a similar scheme would emerge here should expressed rules come into effect. In essence, this means the government would be laying out the protocols by which risk is managed. That should alleviate some of the concern banks might have. The bottom line is, though, we appear to be moving closer to a reality where the US embraces open banking in a formal way, forcing institutions to comply whether they like it or not. Preparing for that future early can help banks avoid considerable headaches down the line. That means considering your technology infrastructure and its ability to integrate widely with third parties, as well as, and perhaps even more critically, creating a culture within the bank that embraces collaboration and can support full and complete openness without fear.