Is Google Biggest Tech Threat to Banks?

July 7, 2021

By: Kate Drew

We’ve been talking about the “big tech threat” for a while in financial services. The idea that technology giants like Amazon, Google, Apple, and Facebook are going to come in and rip the rug out from under the banks is flounced around constantly. But, with the exception of some special energy devoted to Amazon, very rarely do we break down what this threat means by company. All of these companies are very different, they do different things, and their approaches to financial services are very different. That’s important because, depending on their focus, their impact will be concentrated in different areas of the industry — and relevant to different players.

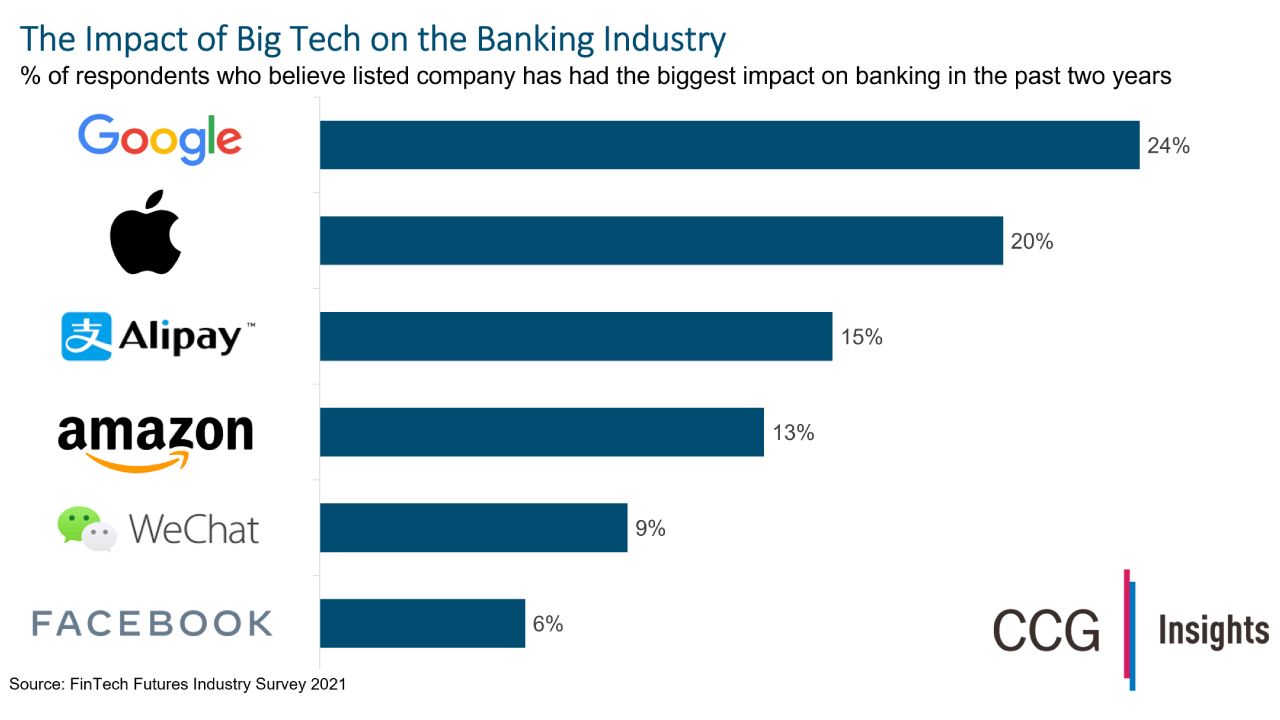

A recent survey by FinTech Futures asked industry participants which tech company they believed would have the biggest impact on banking. Specifically, banking. And the winner? Google, with 24% of the vote. That’s likely because Google is the closest to offering a traditional bank account for US consumers, through its Plex offering. Google Plex is partnered with financial institutions to provide the accounts, while it will handle the UX. Other big tech players are moving into financial services, but in different ways and with different implications. The Apple Card, for example, is a credit card play. What the threat is (or the opportunity, for that matter) depends on which area of the market you are looking at and how exactly your business relates to it.

It’s fundamentally inaccurate to refer to “big tech” as a threat, because it’s not one thing. It’s many things, in different forms. Some might apply to your bank, some may not. It’s also important to remember that none of these companies want to be banks in the traditional sense — they are all looking for less regulation, not more. Instead, what they want is to be able to deliver financial services at the point of need to customers in a way that makes their core propositions more attractive. The Apple Card, for example, is designed to encourage the purchase of Apple products through its rewards program. Google Plex is designed to power Google Pay, which, in turn, is a key pillar of the Android ecosystem. So, in a sense, threat may be the wrong word entirely. Moreover, given these titans aren’t exactly looking for financial services domination, they are probably going to continue to need partners. Google is partnered with 11 banks and credit unions in the US on Plex, for instance. Perhaps it’s time we let go of the “big tech threat” and started looking at these initiatives as new potential channels.

By taking such an approach, banking institutions can begin to think through where each of these companies is playing and which might make sense as partners. Not every bank will be able to partner with the likes of Google and Amazon, to be sure. It’s going to be competitive. But, why not at least explore it? Many of the traditional institutions partnered on Plex are smaller players, so the opportunity is there. And, for those who win, the prize is the biggest distribution play there is.