Fintech Funding Rebounds in Q1

May 25, 2023

By: Kate Drew

Fintech Funding

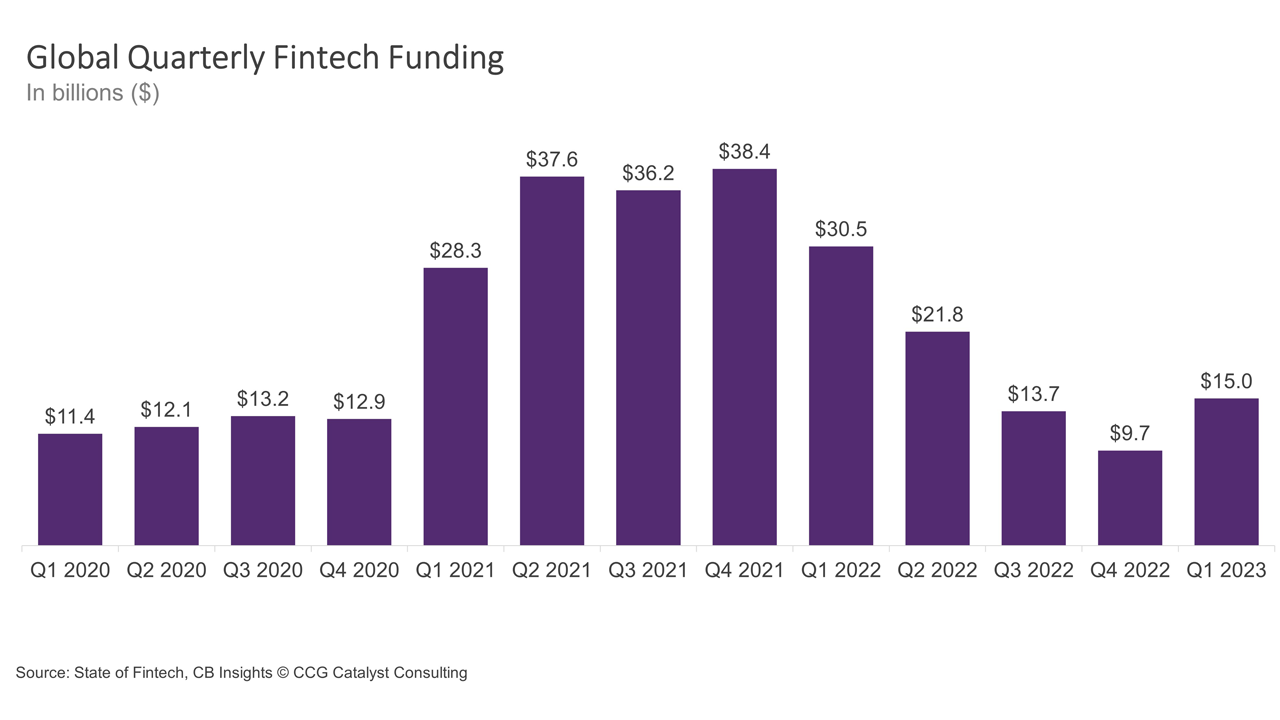

Global fintech funding rebounded in the first quarter of this year — technically. The truth is funding hit $15.0 billion in Q1, up from $9.7 billion in Q4 2022, according to CB Insights, but $6.5 billion of that came from Stripe’s Series I round. Without it, funding actually fell for the fifth quarter in a row, by 12%. This tells an important story about where the fintech market is today, and reiterates our prior analysis that the industry is in the midst of a recalibration that is largely focused around business-to-business (B2B) propositions. Stripe, for example, runs a payment processing platform for online businesses. Meanwhile, other fintech funding rounds this past quarter include Treasury Prime’s $40 million Series C and payments company Moov’s $45 million Series B — both of these companies also operate in the B2B space.

The important thing to take away from this funding data is the nuance. Yes, the fintech market is showing signs of a rebound, but where that rebound is happening is important. As we’ve said before, it’s quite likely that we are going to see a lot more focus on B2B companies in the next few years, as these players are solving underlying problems for other businesses, which is a much more lucrative place to be than in business-to-consumer (B2C), where people are not used to paying for a lot of the services fintechs are serving up. And while B2B companies are also having to readjust — Stripe’s latest funding round put its valuation at $50 billion, a far cry from its record $95 billion valuation in 2021 — that they are still managing to raise funds in such a tight capital environment suggests an ability to demonstrate sustainable value.

So, what does this mean for banks? Today, we are seeing a lot of institutions pull back on their interest in working with fintechs. (We covered this recently in our third annual US banking study — The Banking Battleground 2023: Pulling Back and Pushing Ahead — which surveyed 122 C-level US bank executives about their attitudes and priorities as we look toward the future.) That tendency, though, fails to look at the details. It fails to consider why certain things are failing, where there are signs of survival, and what those signs mean. On the other hand, some institutions may look at this recent funding data and think, “Fintech is back!” That would also be a mistake. Fintech still presents a ton of opportunity for traditional banks, but the goal should be to look at the market with a critical eye, and to identify where the actual possibilities are.

Going forward, it is perfectly fine to be slightly more hesitant, as long as that hesitancy doesn’t turn into paralysis. Rather, executives should use this time to make their approaches to fintech more targeted, well defined, and methodical. Develop ways of assessing new propositions that you can rely on. And then apply that framework uniformly. This growing emphasis on B2B as the fintech space evolves presents real openings for banks, with many of these companies building propositions that they will eventually sell into such institutions. As a result, those who are set up to capitalize on these solutions not only stand to reap serious benefits, but they may actually be able to deliver the kind of innovation that we’ve all been talking about for years.