A Recalibrating Fintech Space

March 16, 2023

By: Kate Drew

Fintech Funding

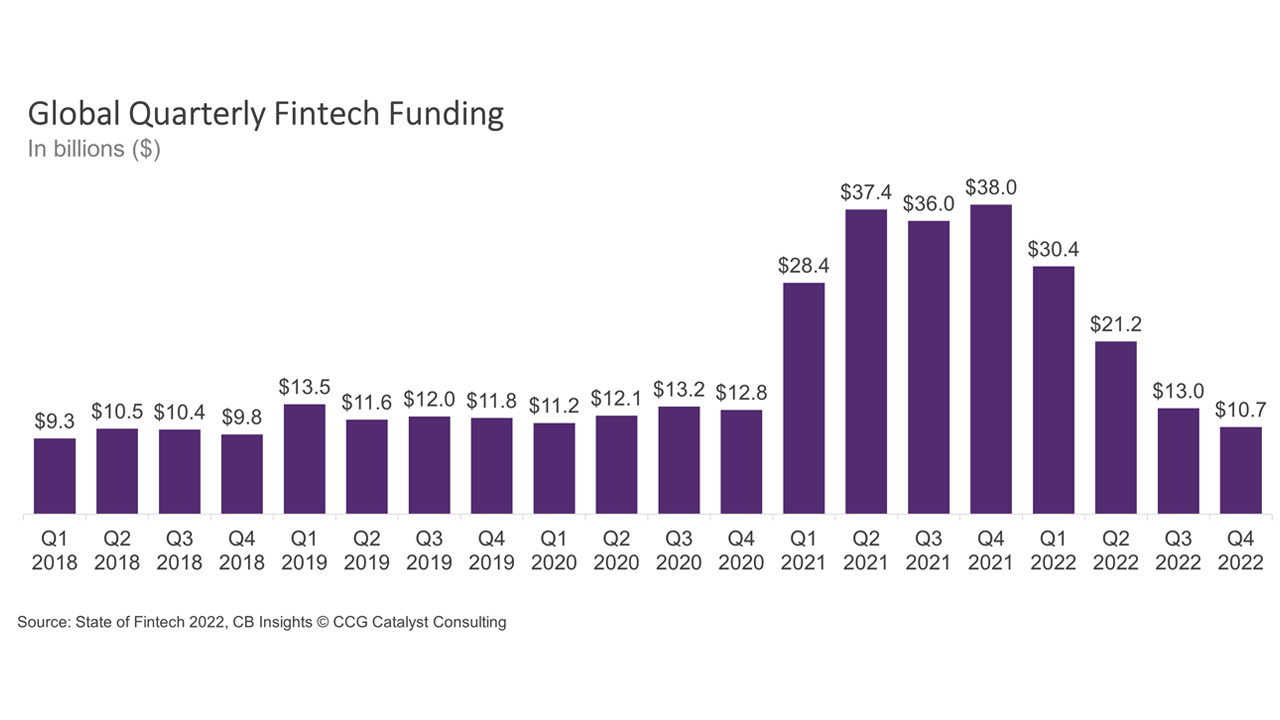

Fintech is going through a difficult time. After several years of flying high, especially in 2021, an uncertain economic backdrop is testing the business models of these startups. At the same time, a tighter private capital market is making it harder to raise funding, which means many of these companies need to either figure out how to make a profit or they are going to run out of cash to operate. In fact, fintech funding has declined for the last four straight quarters, hitting $10.7 billion in Q4 2022 — a level not seen since 2018, according to data from CB Insights.

It might be tempting to look at such data, coupled with headlines detailing layoffs and valuation cuts at some of the most reputable fintech companies, and think it’s all bad news. And, for a bank, this environment may conjure discussion about retreating from ambitions that include working with such players. But these reactions are probably misguided. Essentially, what we are seeing is a separating of the wheat from the chaff, and it’s likely going to be a good thing in the end because it will lead to a stronger, more capital efficient fintech market on the other side. In the context of banking, that means more attractive partners and value propositions to take advantage of.

We’re already starting to see the beginning of this in who is still able to raise funding today. Banking-as-a-Service (BaaS) provider Treasury Prime, for example, is fresh off a $40 million Series C funding round, while payments company Moov recently raised $45 million in Series B funding. One notable thing these companies have in common is that they are in the business-to-business (B2B) space rather than business-to-consumer (B2C). It’s quite likely that we are going to see a lot more focus on such companies in the next few years, as these players are solving underlying problems for other businesses. And that’s a much more lucrative area to be than in B2C, where people are not used to paying for a lot of the services fintechs are serving up.

This shift is set to lead to tremendous opportunities for traditional financial institutions (FIs), as the companies building these propositions are largely going to be selling into such organizations. As a result, we will probably see major leaps forward in what those FIs can deliver. Capitalizing on this new climate, though, will require having a strategy in place to spot, assess, and onboard these new solutions as they emerge. Banks are going to have to recalibrate their approach to fintech the same way the fintech market is recalibrating internally. Ultimately, those who make the most of this new era will likely be those who can move with agility and identify the winners early.