Banks Show Interest, Not Action in Sustainability

April 14, 2022

Banks and Sustainability Efforts

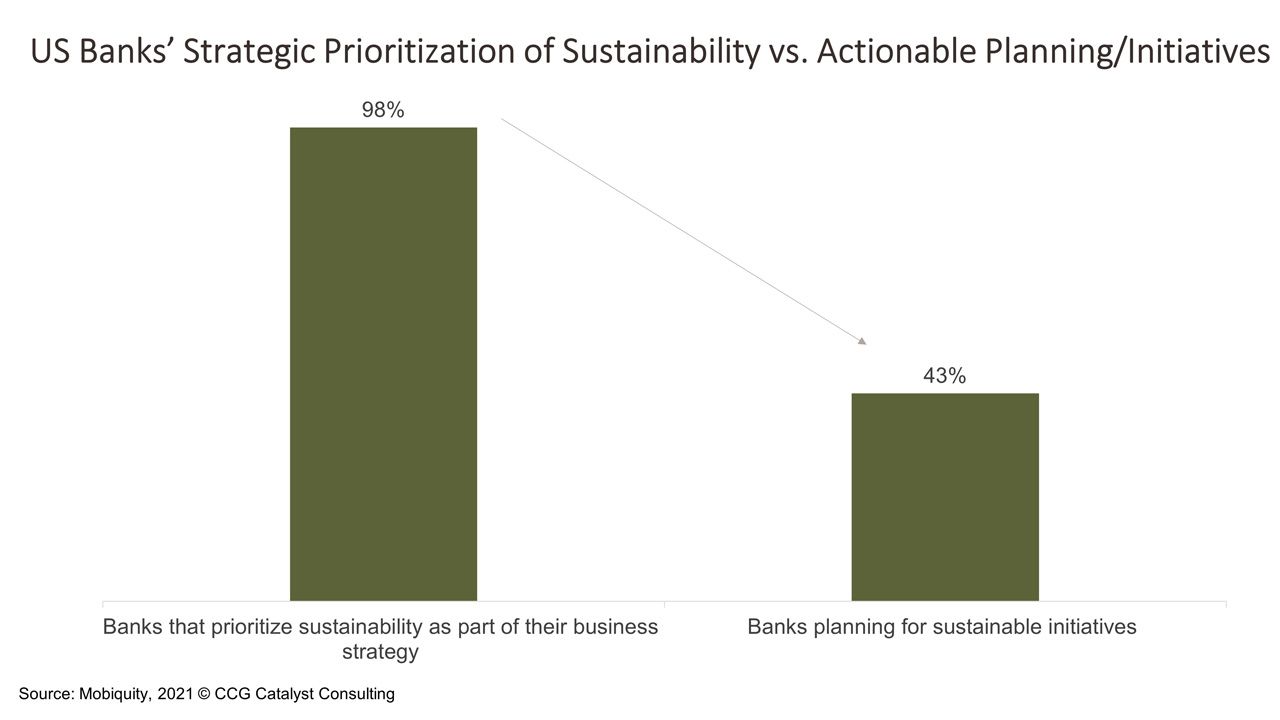

US banks are showing greater interest in sustainability practices, but few are actually making tangible moves. In fact, according to a report by Mobiquity, 98% of banks surveyed say they are prioritizing sustainability as part of their business strategy, yet just 43% are planning for sustainable initiatives. This data is both stark and extremely contradictory, without being all that surprising. There is a lot of activity happening on the environmental front in the US — consumers are becoming much more interested in where their money is going and how it’s being used, and the government is upping its scrutiny on companies’ monitoring and reduction of emissions. However, sustainability is also an area that’s easy to talk about and harder to tackle. That’s likely because there is still a lack of guidance around how to properly track and offset your carbon footprint. It’s also not necessarily tied directly to revenue, and its business impacts aren’t always clear, which means it’s probably being “prioritized” without being prioritized.

For banks that don’t want to be at the crossroads of this data, there are a few things to consider. First, this is not simply about lending (or not lending) to certain kinds of customers — like those in oil and gas, for example. It’s much more than that; it’s about assessing your carbon footprint holistically and finding ways to offset it. To truly prioritize sustainability, a company (any company, including a bank) needs to consider its emissions across three classified scopes, which include direct and indirect emissions as well as emissions related to your entire value chain. While direct emissions, those related to your own operations, are generally straightforward to track, the picture becomes a bit more difficult when trying to assess your carbon impact outside of your own walls. And, given there isn’t a single, established framework for how to do all of this well, banking providers are largely left to develop their own approaches for sustainability internally. While not impossible — there are a few like Climate First Bank paving the way here — this can be quite a feat. The trick is to put sustainability at the heart of what you do, dedicate resources to it, and build a well-defined strategy around it. Only with that kind of commitment will you be able to achieve results and make a real impact.

Ultimately, it’s very likely that the lack of actual work being done on the sustainability front has to do with a perceived risk-reward balance that just doesn’t add up for a lot of executives. Sure, there is pressure to be responsible coming from various different arenas, but there is also a lot of pressure to make money. And those pressures may often appear to be competing with each other. Getting to “net zero” on carbon emissions takes time, money, and effort. That’s time, money, and effort that could be spent elsewhere. The problem is, this isn’t going away, and it’s not likely to be a “later on” problem for much longer. Companies across industries are starting to pay more attention to their environmental impact, in response to increased governmental and consumer demands. Banking will be no exception. So, it’s probably worth getting ready now. As is true in most circumstances, a good strategy should never be underestimated, and it almost always pays off.