What Could Consumers Want From Real-Time Payments?

November 23, 2023

By: Tyler Brown

Consumers and Real-Time Payments

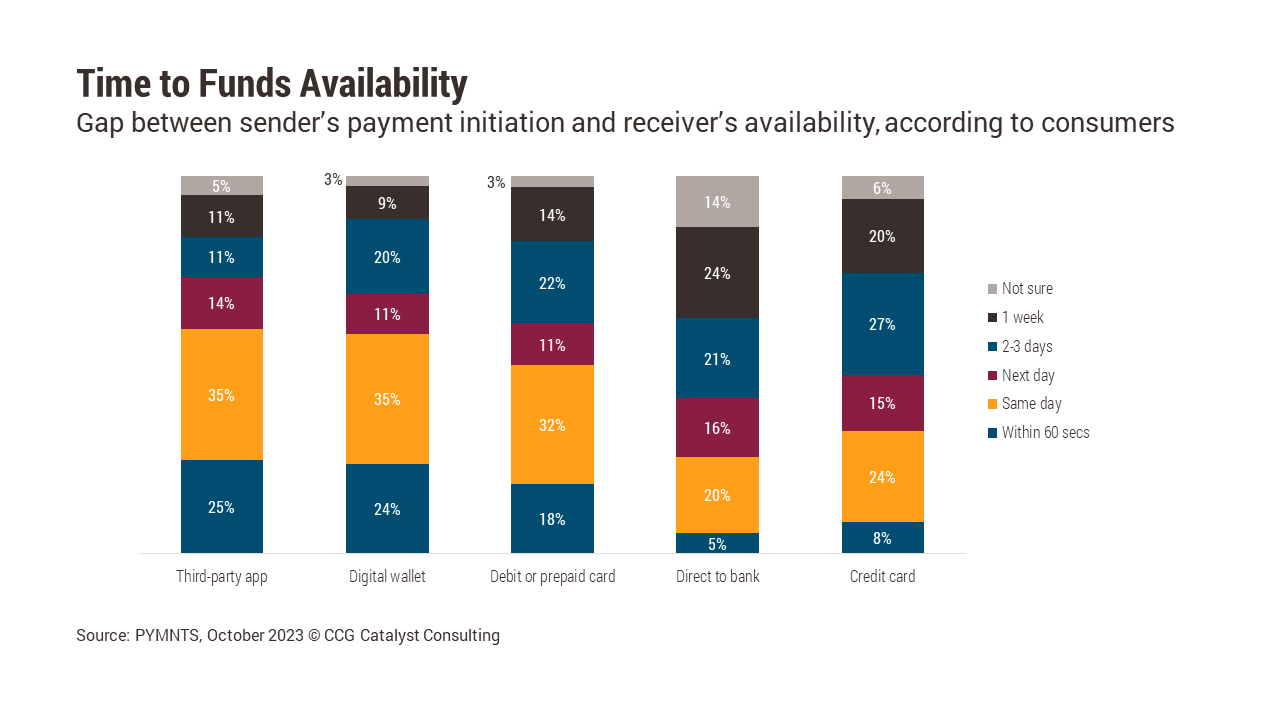

Direct-to-bank payments are, most of the time, still slow. Nearly a quarter of consumers can wait a week for money to arrive directly to their bank account, and 45% can wait 2-3 days up to a week, according to PYMNTS data. In other words, receiving a direct-to-bank payment is on balance the slowest way consumers are electronically receiving cash, substantially behind a debit or prepaid card, digital wallet, or third-party app. A very small proportion of consumers (5%) said they received at least one direct-to-bank payment in real time or near-real time, and a relatively low proportion (20%) received funds the same day. Something is slowing down payments between when the sender hits “send” and the funds are available to the recipient, and the payment rails used (generally still ACH) are a likely culprit.

Expectations for money movement have fundamentally changed with the proliferation of closed-loop peer-to-peer (P2P) systems like PayPal and Venmo, or nearly real-time bank-to-bank payments over debit rails, like with Zelle. And features like disbursements to prepaid cards, such as in gig economy apps, (rather than waiting for an ACH transaction to a bank account) have made it more difficult for consumers to accept payments that take multiple days. But the status quo of slower payments and real-time workarounds is not necessarily a bad thing for consumers or for banks.

There are reasons not to make the jump to offer FedNow and RTP payments capabilities, and as we wrote in August, banks haven’t been jumping on the bandwagon. Two months after FedNow went live, adoption by financial institutions (FIs) was lackluster, and half of FIs surveyed were noncommittal about FedNow adoption. One likely reason is that it’s not clear what consumers think is “fast enough” for bank-based payments. Receiving money more quickly is a real-time payments use case that’s easy to love. But it’s not immediately apparent that regular real-time inbound payments would provide more benefits than early payday-type products or prepaid cards already do. Speed for outbound payments affects consumers mostly when they need to meet an obligation quickly, which may have some applications to bill payments —but a lot of that will depend on billers.

The biggest change coming for consumer payments may not be the switch to real time. Certain features enabled by open banking, or consumer-permissioned sharing of financial data via application programming interface (API), promise to remove friction when paying by bank. By making account verification instantaneous, bank-to-bank payments will become a viable way to pay merchants, whether they are billers or retailers. If merchants can incentivize consumers (through rewards, for instance) to use such payments without running afoul of card network rules, they may have legs as a regular payment option at checkout that is cheaper for the merchant. At that point, real-time capabilities may be more of an imperative for retail banks.

In the near term, real-time account-to-account payments are probably a business-to-business (B2B) use case. For banks, they are a competitive differentiator for large commercial customers because they reduce counterparty risk. For smaller businesses and merchants, the low cost per transaction from account-to-account payments makes real-time a more cost-efficient payment method. But first they need to convince customers to use it. Perhaps those reasons are why many banks aren’t in a rush to get on board with FedNow: If you don’t have large commercial clients, maybe too few of your customers care about real-time payments. And if your retail customers don’t have a good reason to demand real-time payments, the bank doesn’t have a strong incentive to cannibalize interchange on card products.