Will US Banks Adopt FedNow?

August 17, 2023

By: Kate Drew

Banks and FedNow

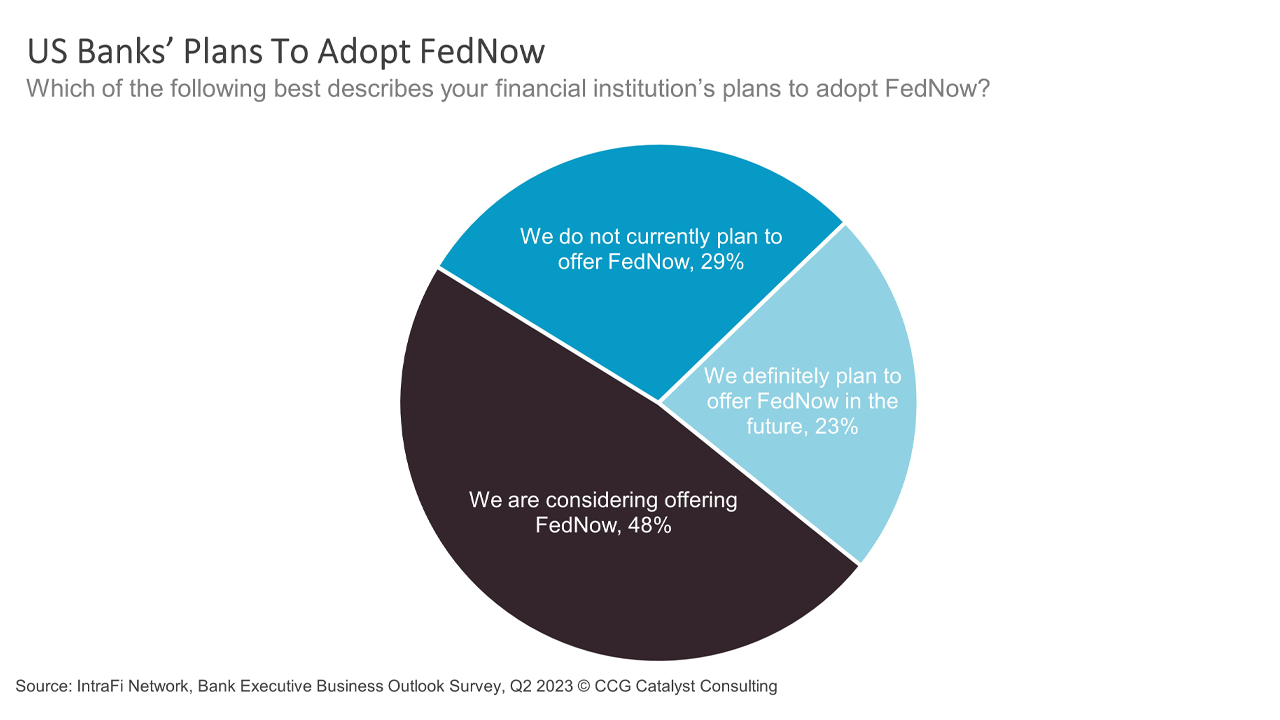

The Federal Reserve’s instant payments system, FedNow, officially went live in late July with about 35 financial institutions signed up and 16 service providers on board for initial support, per TechCrunch. This puts the US on the road to catching up with many other countries, including Brazil, India, and the United Kingdom, when it comes to real-time, 24/7 payments (though it does follow the launch of an existing network from The Clearing House). The question now is, what will adoption look like? And the answer appears a little lackluster. In fact, according to IntraFi’s Q2 2023 Bank Executive Business Outlook Survey, only about a quarter of bank executives surveyed said their financial institution definitely plans to offer FedNow in the future, while 48% are mulling it over, and nearly 30% don’t expect to do so at all.

These figures are obviously somewhat disappointing. The launch of FedNow represents the first government-led effort to bring instant payments to the US. And the potential benefits, from speeding up payroll and payments to merchants to things like request to pay or confirmation of payee, are considerable. But clearly none of this is leading the country’s banks to rush to sign up. Why? There are likely two major issues at play here. The first is that in order to adopt FedNow, financial institutions are going to have to make infrastructure changes to support a 24/7 payments scheme. That will involve not only working with their core provider in most cases but also thinking about how they will handle support services and manage fraud. And second, because the US has been so slow to adopt such a scheme, offerings that emulate real-time payments like Venmo and Cash App already exist. As a result, US consumers aren’t exactly complaining.

The work required to get ready for FedNow, combined with a lack of active demand from customers, is probably what is leading many institutions to drag their heels. However, this is likely a mistake. On the demand side, allowing alternative apps to satisfy users’ needs for “real-time” payments gives them a wedge with customers that could cannibalize other parts of a bank’s business — Venmo offers a debit card, for example. Meanwhile, the opportunities to drive new revenue through future use cases especially on the business side are important to ponder. Overall, it is understandable that many institutions would not want to be early adopters of such a large-scale change. But that doesn’t mean they shouldn’t be making some moves. A good first step would be to consider your payments strategy and plans for modernization (which you should be doing already), and then begin to think through how FedNow might fit in. There’s nothing wrong with wait-and-see per se, as long as waiting isn’t just waiting. Rather, make this a component of a broader effort; that way, even if you’re on the sidelines, you will be using this time strategically to prepare for the future.