AI Interest in Financial Services Hits Major Upswing

July 20, 2023

By: Kate Drew

Banks and AI

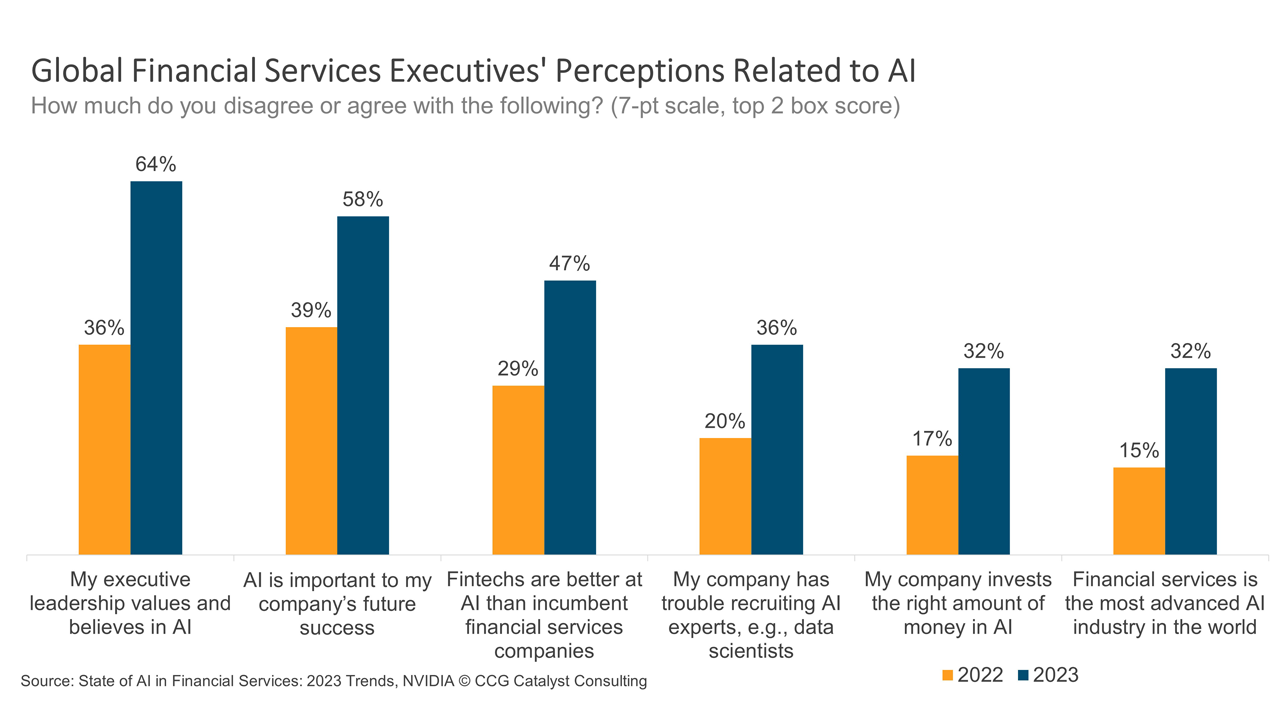

If there’s one innovation pocket today burning hotter than any other, it’s probably artificial intelligence (AI). In particular, the use of generative AI (as employed by OpenAI’s ChatGPT) is gaining wide attention for its ability to create content, including new text, images, video, audio, code, or even synthetic data, on its own. This technology promises to transform many different industries, including banking, in many different areas, from customer service to backend operations. But the question is, how much of this hype is hype? Well, as it turns out, the answer might be not so much if you ask financial services executives. In fact, according to NVIDIA’s recent State of AI in Financial Services report, 64% of respondents feel their executive leadership values and believes in AI, while 58% believe AI is important to their company’s future success.

Perhaps even more interesting in this dataset, though, is the change in perception from last year to this year — specifically, those figures for 2022 were just 36% and 39%, respectively. That indicates a huge boost in the belief in AI at both the executive leadership level and broadly across global financial services executives. Of course, this boost is generally understandable given the incredible deluge of activity in the space over the last several months. But the fact that respondents seem to be taking such activity seriously, rather than as part of a hype cycle, is notable. It would be very easy to dismiss AI as another cutting-edge area in which the value is largely theoretical. And that doesn’t seem to be happening here. This could be for a number of reasons, but it’s probably at least in part because the use cases for AI are more tangible than in a lot of other buzzy spheres (like blockchain, for example). At the end of the day, it’s not hard to wrap your head around impeccably automated customer service or intelligent recommendations, nor is it hard to see the utility.

This is obviously still very much the beginning of the beginning, and there is a lot of maturing to be done before this technology is ready for advanced use cases, especially when it comes to things like financial advice. However, critically, AI is a frontier that is very much not all or nothing. As we discussed in our January 2022 report on AI in banking, this technology can be leveraged for very simple, well-defined use cases at first, and institutions can build their strategies from there. Because of this, the value is relatively accessible at a foundational level. So, for any institution that is interested in AI but unsure where to start, it’s worth taking a step back and thinking about how it might augment your business. There’s no need to jump in with both feet; a measured approach makes complete sense. Given AI’s promise, though, it is probably wise to at least wade into the water, as it’s likely those who start early and learn quickly that will be best positioned to capitalize as this technology evolves and use cases expand.