Are US Banks Warming to Crypto?

October 27, 2021

By: Kate Drew

Banks and Crypto

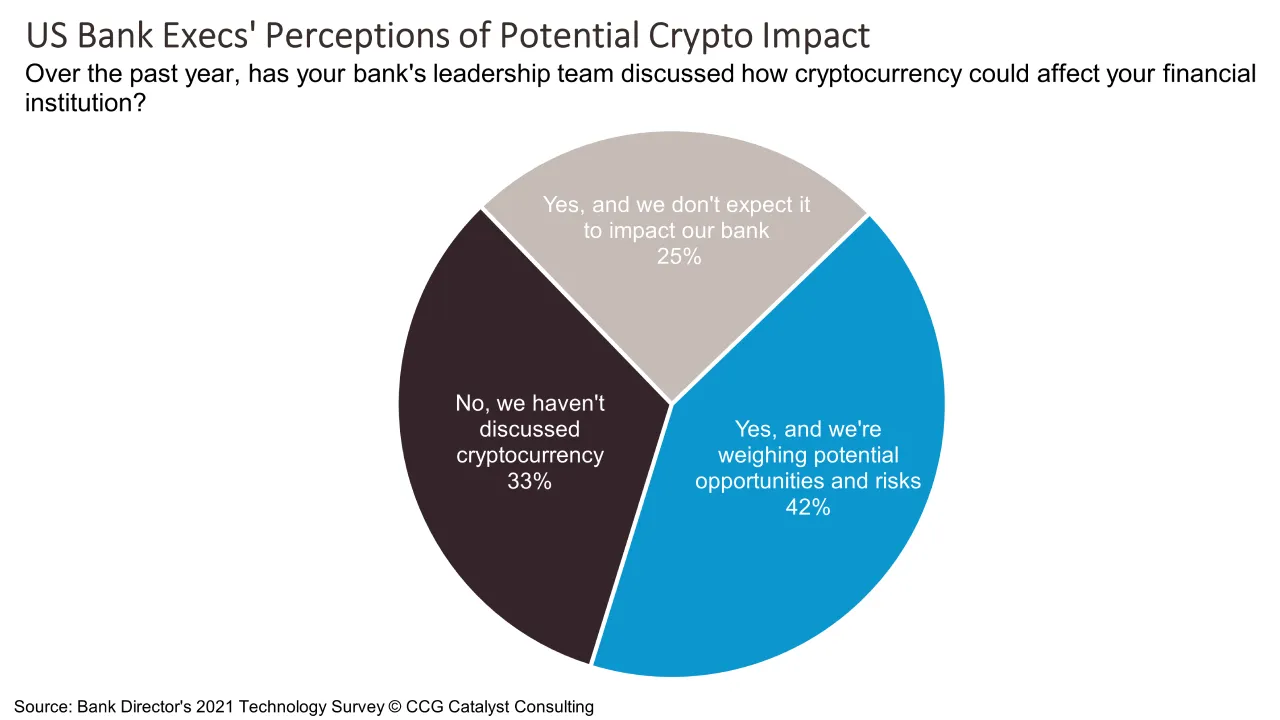

Bank executives are warming to crypto, according to new data from Bank Director. In fact, 42% of respondents to the company’s 2021 Technology Survey said their bank’s leadership team has discussed the possible impact of cryptocurrency in the past year and is weighing potential risks and opportunities. That’s nearly half of respondents reporting they are taking this new frontier seriously. For a space as novel and often dismissed as crypto, this is an impressive number.

The interest perhaps comes from a few developments in the space over the last year — in addition to yet another meteoric rise of Bitcoin, we’ve also seen the emergence of new digital assets like nonfungible tokens (NFTs), a plethora of new crypto services hitting the market, and most recently, the long-awaited launch of the first Bitcoin futures exchange-traded fund (ETF). In short, there is a lot of activity happening in the crypto space today, and these developments, combined with raging consumer interest — nearly half of US respondents to a Baakt study said they had invested in crypto — have made it very difficult for banks to ignore this market and how they might play a role.

In particular, we’ve seen a number of banking institutions launching crypto custody services, including U.S. Bank just a few weeks ago. This trend is aligned with our prediction earlier this year that more banks would begin to jump into this pond as consumer adoption pushed forward and demand became clear and actionable. And it’s not just larger institutions getting involved in this asset class anymore — Oklahoma-based Vast Bank, which as just under $1 billion in assets, launched crypto banking services this past summer to allow its customers to buy, sell, and hold digital assets from within their banking app. Now, it plans to take this capability to other financial institutions through a crypto Banking-as-a-Service (BaaS) offering.

The adoption of crypto among banks large and small signals that this is no longer an area on the fringes of the industry. That means the third of respondents to Bank Director’s survey that have not even discussed crypto in the past year are likely way out of the loop. Of course, not every bank needs to offer crypto today, but it’s important to be talking about it. At the very least, it’s time to have a perspective.