Bankers Prioritize Digital Account Opening in 2021

September 1, 2021

By: Kate Drew

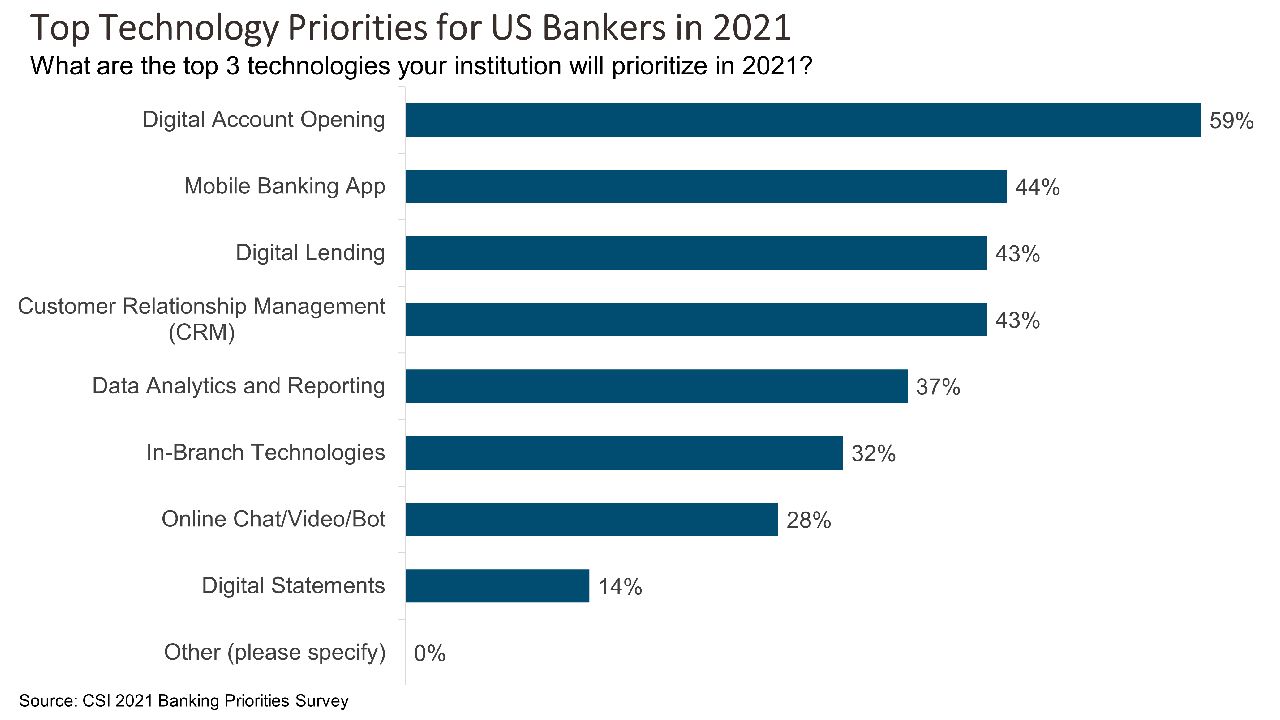

Digital account opening is at the top of the list for US bank execs today. In fact, according to a survey by CSI, 59% of respondents put the capability in their top three technology priorities for 2021, making it the most selected response, followed by mobile banking app at 44%. This isn’t particularly surprising — the Covid-19 pandemic forced banking institutions of all shapes and sizes to rethink how they onboard new customers in a remote, and increasingly distributed, world. That means digital account opening moved front and center, pushing organizations to find solutions quickly.

However, digital account opening isn’t a new trend. Larger institutions and neobanks like Chime and Varo have offered the feature for quite some time. Chime, for instance, is well known for its ability to open an account on mobile in under 5 minutes. For those that got their start during the pandemic, it’s important to remember that we’re seeing the acceleration of an existing shift toward the digital funnel. And, perhaps more importantly, the ongoing evolution of this capability, as things like speed and ease become competitive battlegrounds. As a result, “prioritizing digital account opening” doesn’t mean much today. Institutions will really have to think through and define what digital account opening means for their bank — and their customers.

For some, simply the ability to open accounts digitally isn’t likely to be sufficient for much longer. Those looking to compete for customers across geographies and demographics will need to focus on reducing friction and maximizing the flow in order to keep up with fintech startups and the big guys. This isn’t going to be true for all institutions, though. Smaller ones will probably do perfectly fine with a basic solution, at least for now. The point here is that digital account opening doesn’t refer to just one thing. It’s a broad term that can manifest in many different ways. Implementing digital account opening effectively will first require determining who you’re trying to attract and what they want out of the experience. Yet, again, we are reminded of the nuances that characterize the many choices in banking, and the importance of having a strategy first. Intention really, really matters. A well-defined approach helps to make sure you don’t under-build, but also that you don’t overbuild, either.