Can Banks Overcome Core Issues To Use Their Data?

September 28, 2023

By: Tyler Brown

Data and Core Modernization

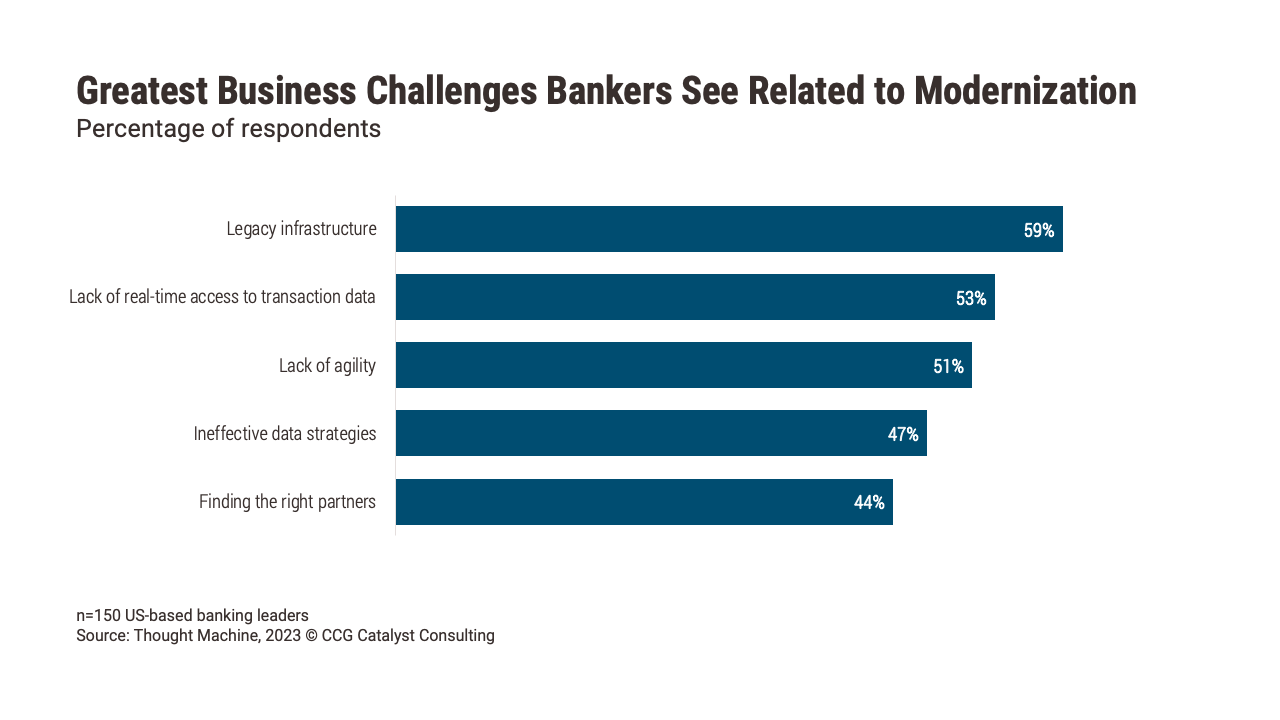

Much of the banking sector believes its customer data is a competitive advantage, according to a Thought Machine survey conducted by Forbes Insights. But it’s only a strength when it’s usable. Data should be easy to extract from the right place within a bank’s tech stack, process, and once it’s been processed, be accessible in the future. But unfortunately, that’s rarely the case. In the end, the issue can be chalked up to the complexity of banks’ core systems: 59% of banking leaders see legacy infrastructure as a business challenge impacting modernization, according to the study.

As we wrote in our just-published report, “New Frontiers in Banking 2023,” banks must anticipate the technology needs of disruptive trends in the industry — and many of those are data centric. Open banking, for example, requires a tech stack that can support data-sharing with third parties (like fintechs) through application programming interfaces (APIs). This is a particularly hot topic right now with the prospect of regulation looming. Another area where strategies are quickly developing is artificial intelligence, which will allow for conversational chatbots, greater personalization in marketing, and improved fraud prevention and underwriting — but only if banks can effectively leverage their data stores. Unfortunately, banks’ data is often siloed in different systems, and batch processing is commonly used to extract it. That doesn’t work when data needs to be available instantaneously to take advantage of new technologies.

That weakness starts to disappear when banks take the leap to a next-generation core banking platform. Unlike traditional core banking systems, whose services are bundled into one software application (making it complicated and risky to make changes), next-generation cores use “microservices,” which operate independently from one another and can be used across different business functions handled by the bank’s technology. With microservices, one piece of data can be accessed from different “domains” at the same time and used immediately to individualize the customer experience. An example, according to 10x, is how products and services are recommended to customers based on their transactions, demographics, and any other data they may have provided the bank about their life stage and financial goals.

But bankers aren’t keen to overhaul their core. To most bankers, modernization means applying incremental solutions — smaller changes to legacy infrastructure that can make a difference over time. As we’ve articulated previously, one popular way to do this is to build a middleware infrastructure and migrate replacement applications. Another option would be to move to a new core in a phased migration or through a greenfield approach. Banks might even take baby steps toward modernization by collaborating with their peers and existing providers to get things they need, like improved analytics and product offerings, real-time account processing, partner integrations, and more frequent releases. That could help solve the modernization problem in pieces without forcing banks to take on the risk of dramatic — and expensive — transitions.

No matter how you go about it, though, continuing to operate on legacy systems is simply not going to cut it. The future is going to rely heavily on data-driven propositions, and the ability to operate on modern infrastructure built to handle that data will be key. Understanding this crucial element is an important part of beginning to get a plan in place.