Moving Forward in a Post-SVB World: Part IV

July 6, 2023

By: Kate Drew

Bank Failures and Stability

This is the fourth and final post in our Moving Forward in a Post-SVB World Series, based on CCG Catalyst’s Banking Stability and Innovation Study 2023, which surveyed 108 C-level bank executives in the US between May and June. We’ve already explored overall sentiment following recent bank failures like SVB and Signature Bank, how executives feel these events impacted their business, and how their bank is approaching adjustments to strategic direction and plans for innovation going forward. Now, we’re wrapping up with what specifically is next on the agenda as we explore business priorities for the next five years.

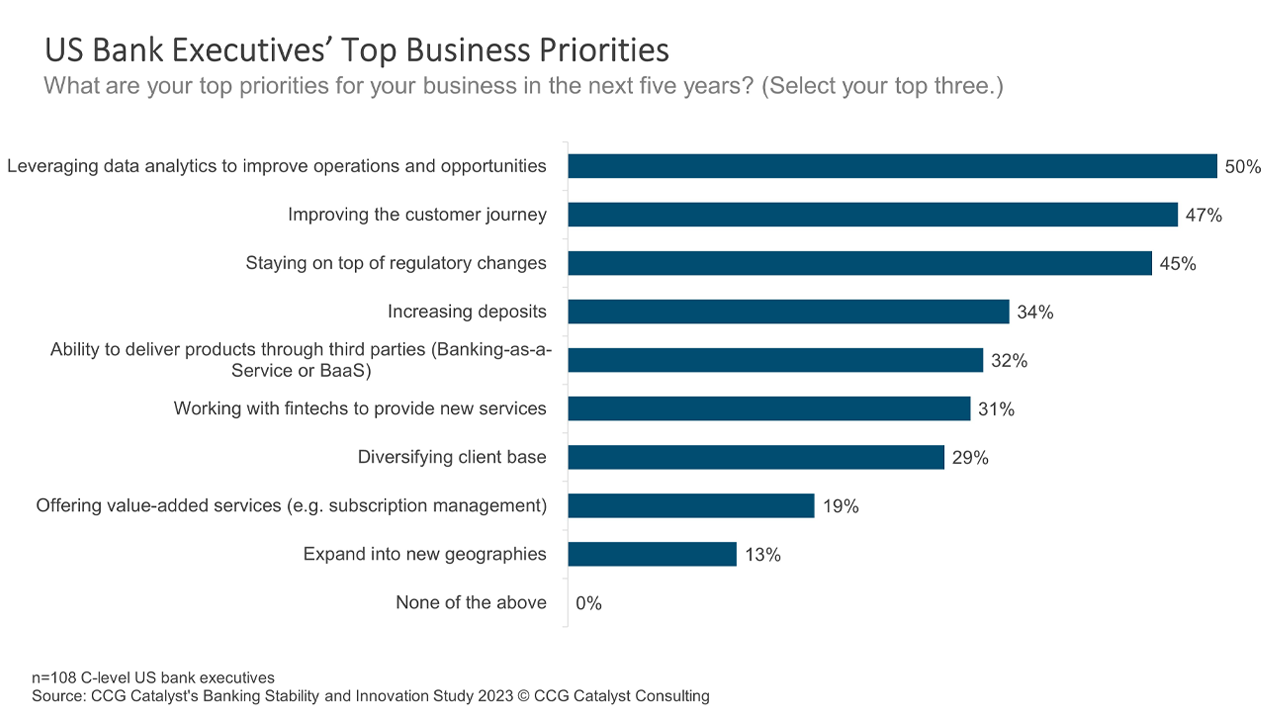

We asked respondents to select their top three priorities for their business from a list of choices. Selected most often were leveraging data analytics to improve operations and opportunities, improving the customer journey, and staying on top of regulatory changes. The emphasis on data analytics is quite interesting, because it is likely tied to the flurry of activity recently related to artificial intelligence (AI), spurred in large part by the late 2022 launch of ChatGPT. It also speaks to the second-most-selected priority, improving the customer journey, as data analytics (whether incorporating AI or not) is a key lever in driving highly personalized and automated experiences. Together, these priorities indicate that bank executives are still very much focused on the customer and how to compete in a differentiated way. Meanwhile, staying on top of regulatory changes is an unsurprising top-three titleholder given that recent events as well as renewed scrutiny of fintechs over the last year or so are leading to a lot more interest from regulators, particularly when it comes to innovation.

Another key point is that those top two priorities — leveraging data analytics and improving the customer journey — also support the fourth-place imperative, increasing deposits. Ultimately, both represent ways to create stickiness that keeps customers happy. And this is likely what’s really at the heart of the intentions we’re seeing, bringing us back to a discussion we’ve been having a lot lately about winning the war for deposits as competition heats up. In a post a few weeks ago, we talked about this in the context of engagement, specifically when it comes to driving engagement through communication and delivery, and that holds true here, too. Whether you are issuing personalized offers or designing better journey flows, you’re essentially working to improve the way you connect with customers and the way you serve them.

At the end of the day, it’s very likely that competition is only going to accelerate — 73% of banking execs surveyed recently by IntraFi believe deposit competition will intensify over the next 12 months. And that means having a plan for the future that is extremely customer centric. Funnily enough, that’s also been a major theme of the last few years and is the raison d’être of the fintech industry to begin with. (We’ve come a long way, to be fair; even the most traditional of banks are now online in some capacity, for example.) Now, though, institutions are really going to have to step up their game and think outside the box to get to the next level. Real differentiation is not easy, and it’s the way forward. To that end, bank executives do seem to be focused on the right things, which is a positive sign. Breath is bated now for the execution.