Community Banks Warm to Best of Breed, Slowly

December 15, 2022

By: Kate Drew

Community Banks and Digital Banking

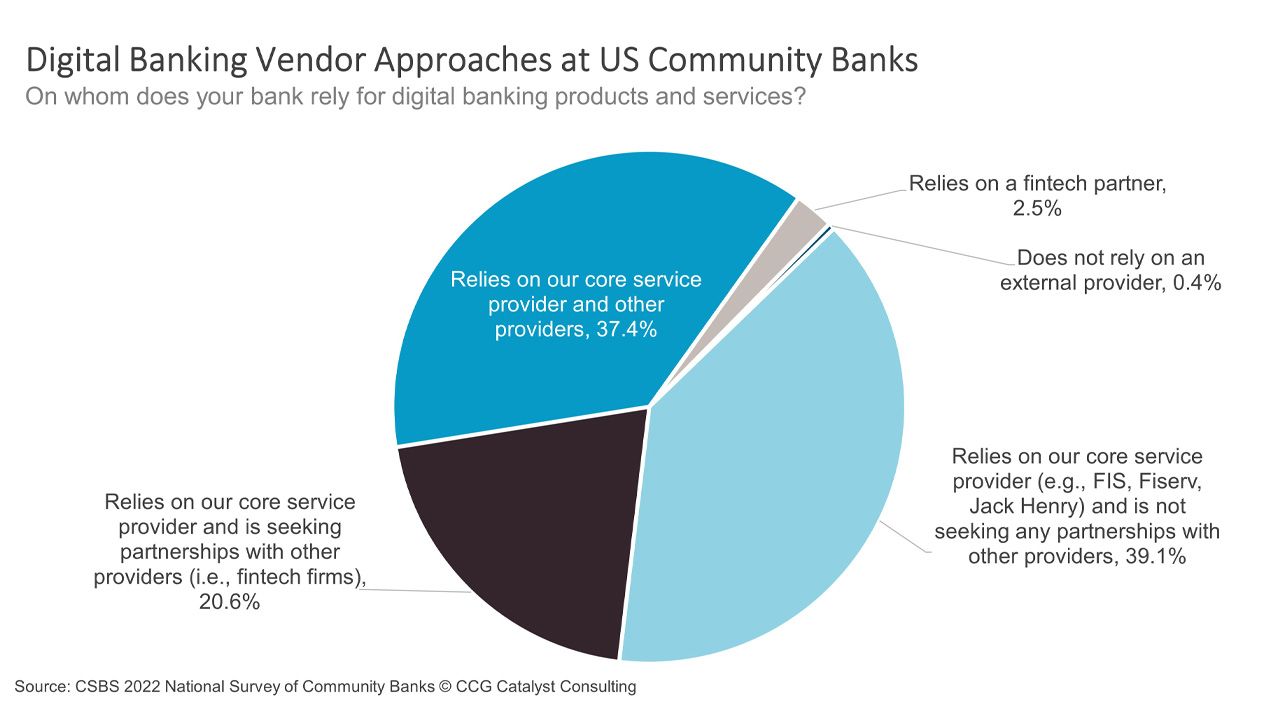

Last week, we talked about the ongoing importance of digital banking. This week, we are taking a look at exactly how banks are executing on the digital imperative, specifically with regard to community institutions. In particular, there’s a lot to unpack when it comes to who these banks turn to for help — for instance, according to CSBS’ 2022 National Survey of Community Banks, a majority (39%) are still reliant on their core provider for digital banking products and services and not interested in additional partners, while 37% say they rely on their core and other providers, and another 21% say they rely on their core provider but are seeking partnerships with others.

This data reflects a moderate but critical embracing of the best of breed approach to technology, by which institutions shop around for the most suitable solutions for specific functions or use cases, rather than getting everything from a single vendor, a strategy generally termed best of suite. Best of breed has been gaining momentum lately, and it offers great promise because it means banks can begin to differentiate across functions based on what matters most to their customers. Or, put another way, it provides the flexibility to compete more effectively. However, as we often discuss, doing this well can be very difficult due to one particularly prickly thorn: integration.

We keep coming back to this again and again because it is so important — not just for digital banking, but for virtually everything. The ability to plug and play with different solutions, especially in an environment that’s constantly evolving, is a central component for long-term success. Think about it, there are providers out there today building technology that solves very specific problems; if you’ve got one of those problems, wouldn’t you want to go to the someone working on that particular issue? Wouldn’t you want to go to the expert for that thing? You wouldn’t go to your GP if your eyesight was blurry. This is the same idea, except heading to the eye doctor is a whole lot easier than integrating a loan analytics solution into legacy tech.

As with most things that are hard, though, it’s all about taking that first step. And that’s making a commitment. Institutions need to commit to creating flexibility in their infrastructure and go from there. This data illustrates the beginnings of that, but there is still a long way to go. Of course, there will always be those who argue their goal is simply to stay current, and no one is disputing that there are different ways to approach the future and different levels of flexibility that might be necessary. However, staying current is eventually going to require some level of integration capability beyond what exists at a lot of these institutions. So getting your infrastructure to a point where it doesn’t balk at the idea of a new tool isn’t optional. The digital world is not static, it changes rapidly. We need to be able to change, too.