Fintech Funding Appears Back Down to Earth

November 9, 2023

By: Tyler Brown

Banks and Corporate Venture Capital

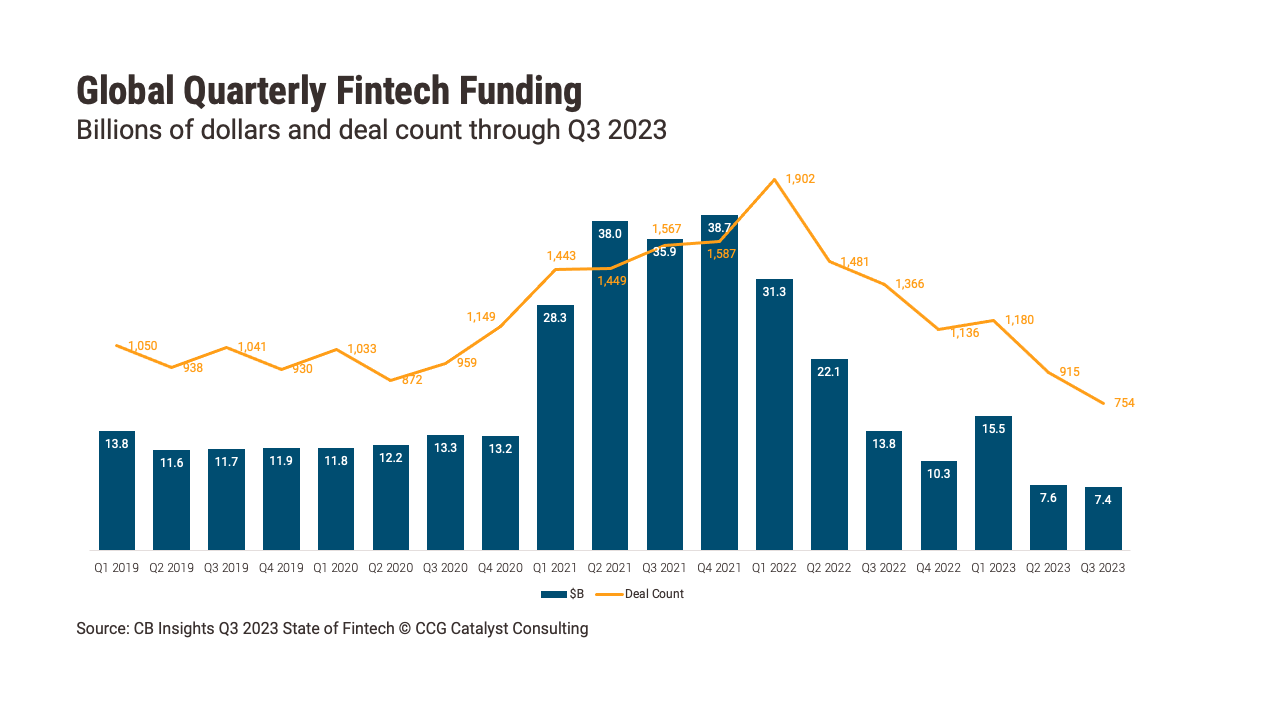

Global fintech funding keeps sliding, but slowly. According to CB Insights, the cumulative $30.5 billion in global fintech funding year-to-date is smaller than peak quarterly funding in 2021. Last quarter, we asked, “Has fintech funding hit rock bottom?” After another quarter of sub-$10 billion in global fintech funding, that looks increasingly to be the case. We may have reached the “new normal” for fintech funding, barring a major change in the macroeconomic environment.

Valuations are also back down to Earth, for the most part. Even business-to-business (B2B) fintechs with firm footing are shaving value: Stripe’s valuation collapsed to $50 billion from nearly $100 billion when it raised money in Q1 this year. Ramp had among the biggest deals in Q3, raising $300 million in a Series D. But its $5.8 billion valuation was about 28% lower than in August 2022. That said, some of the highest fliers of the fintech bubble are hanging onto large valuations because they haven’t publicly raised money since 2021. Chime, for example, is still publicly valued at $25 billion, but it hasn’t tested that valuation. It last raised money from outside investors in August 2021. Revolut, valued at $33 billion, hasn’t raised outside capital since summer 2021 either. As a result, big consumer fintechs have kept a lid on likely struggles, but they will have to face the music eventually.

Amid the fintech funding doldrums, however, there are bright spots. Besides Ramp, the biggest global deals in Q3 were for Micro Connect, a Hong Kong microfinance marketplace that serves primarily China, Perfios, an Indian financial data analytics platform, and Amartha, an Indonesian microfinance marketplace. This small sample reflects strong prospects for B2B2B fintech in developed markets and enthusiasm for developing markets. These may not be the most exciting deals, but they could represent where the fintech story is headed in the near term — toward plain but targeted use cases that offer sustainable value over promises of enormous growth.

There is a role for banks to play in this funding environment. Fintech funding can benefit from experts’ investment in use cases that are more complicated than consumer apps, and fintechs themselves stand to benefit from carefully considered partnerships. Within consortia, financial institutions can partner with venture capital and private equity firms to match the right fintechs with the right financial institutions, either as investors or as technology partners. As we took away from Bank Fintech Fusion 2023, banks’ expertise can lead to better strategic matches and better returns on investment.

As those strategic investors, banks first need to decide on the problems they’re trying to solve, or as purely financial investors, where they know there’s a gap in the market. Maybe they’re looking at problems related to front-office functionality, maybe related to digital banking or customer service, or to back-office functionality like account processing or fraud management. Maybe they see issues banks face, related to warehousing and processing data, for example, that apply across multiple industries. Citi Ventures is a good example of this mixed philosophy (according to the same CB Insights report, Citi is tied for being the most prolific corporate investor in fintech in Q3).