Few Banks Satisfied with Core Costs

March 18, 2021

By: Kate Drew

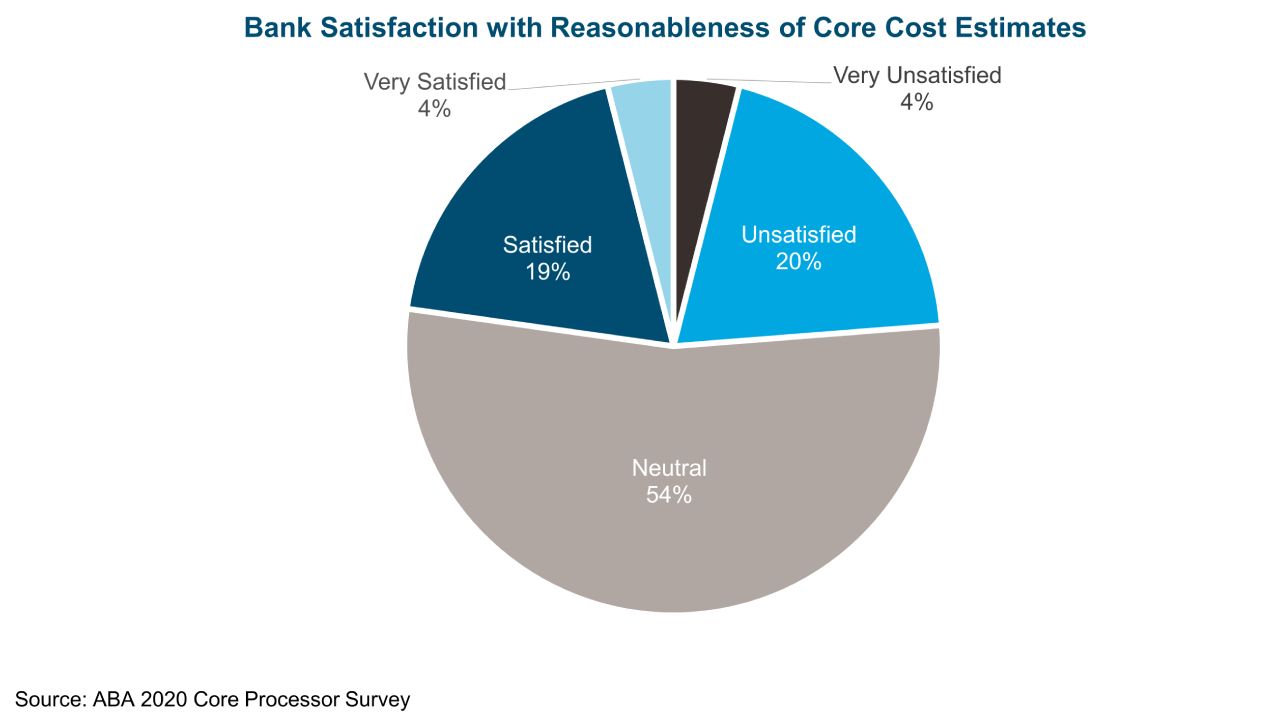

Not many banks are satisfied with their core costs. In fact, just under a quarter of respondents to the ABA’s 2020 Core Processor Survey reported satisfaction with the reasonableness of their core cost estimates. Banks spend millions of dollars annually to maintain these systems, and they’re usually locked into contracts that last years. That means making sure your terms are beneficial upfront is key, especially in an environment where technology is advancing at a such a quick pace. Being satisfied with your costs is no longer just about a fair price for maintenance, there are many ancillary services that now come into play — for example, API access is a critical component in today’s world, but, if a bank is paying per call, they’re likely overpaying right there.

The most productive way to ensure your costs are reasonable is get it right at the negotiating table. Things like flat-rate access to API gateways can be baked into your core contract, eliminating volume-based fees that could drive overall costs up. Moreover, it’s never too early to start thinking about these negotiations. As we’ve said before, starting to plan for your contract renewal and renegotiation 36-48 months prior to the current contract’s expiration is ideal. That’s because the bank needs time to fully assess how its current technology is meeting its current needs, and perhaps more importantly, how well suited it is to meet its future needs. It also gives the bank time to evaluate whether or not they need to make a change in vendor.

It’s hard to look into the future; no one has a crystal ball. But there are new value propositions coming to market every day, especially from fintechs unencumbered by legacy infrastructure, and keeping up will require access to the latest technology as it becomes available. Banks would do well to think about their roadmaps when approaching these conversations and take a proactive approach to securing what they need to succeed down the line. Satisfying a bank on cost is not the job of the vendor, their job is to provide reliable technology; it’s on the bank to come to the negotiating table prepared to get a deal they’re satisfied with. That means taking a hard look at your overall strategy, the customers you want to serve in the years ahead, and how you plan to meet their needs. It likely means looking further ahead than is comfortable, but the reward is a favorable agreement and as futureproofed a business as possible.