Has Fintech Funding Hit Rock Bottom?

August 10, 2023

By: Tyler Brown

Fintech Funding

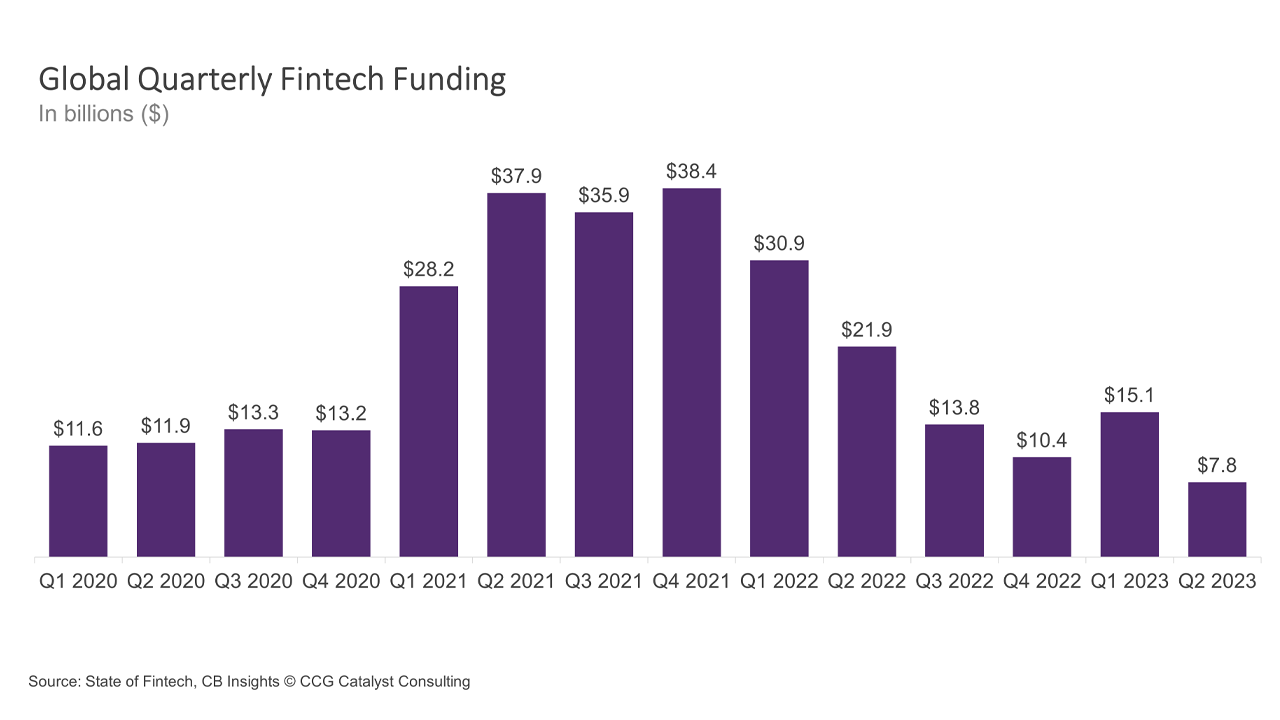

Global fintech funding declined in Q2 2023 to $7.8 billion, the smallest amount since 2017, according to CB Insights. As we’ve covered previously, it followed a steep downward trend over the preceding five quarters — except for a brief respite in Q1 thanks to Stripe’s $6.5 billion mega-round. That performance period also included big deals for Treasury Prime and Moov.

The question is, has fintech funding bottomed out? Potentially, yes. In fact, despite taking another tumble (excluding the anomalous pop due to the Stripe deal), the fall in funding actually slowed during the quarter, dropping only an adjusted 9% from Q1 to Q2, after a 17% fall from Q4 2022 to Q1 2023. This suggests the dramatic contraction from the euphoria of 2021 and early 2022 may be turning to caution. Barring any major shifts in the macroeconomic outlook, we should see declines taper further.

Meanwhile, venture capital has found a new focus. Big exits with inflated valuations have vanished, and investors are showing real preference for profit potential over growth. As a result, high-flying, unprofitable unicorns in business-to-consumer (B2C) fintech have fallen from grace, and capital allocators are increasingly rewarding business-to-business (B2B) firms and lesser-known, early-stage companies with better prospects for black ink.

B2B fintechs that raised early-stage funding in Q2 included, according to TechCrunch:

- Tipalti (accounts payable for mid-market companies)

- Nymbus (cloud-native core banking)

- Clara (expense management)

- Spiff (sales commission software)

- Episode Six (payments infrastructure)

This trend, which we’ve written about quite a lot recently, represents a major opportunity for banks as fintech becomes more of a partner than a competitor. Additionally, the success of these players on the funding scene sheds light on where innovation is consolidating in financial services. For example, two of the companies above — Nymbus and Episode Six — speak to areas that are particularly hot and applicable to traditional institutions: cloud-based core banking and modernized, application programming interface (API)-native payments.

For bank executives, investors’ growing focus on such firms should clarify your competitive priorities: You should expect new technical solutions to pay dividends, and partnerships with B2B fintechs will be fundamental to capitalizing on those possibilities. Unfortunately, many institutions are struggling to engage with the fintech community at the moment, especially if they don’t feel they have enough experience to drive confidence. As such, it is going to become extremely important that these institutions work hard to educate themselves on the utility of new technologies, the business models of these companies, and how they might augment their bank. There is a lot of promise today, but only those who can articulate it well will be able to play effectively.

They will be strongest in the long run.