For US Banks, Financial Inclusion Means BaaS

March 24, 2022

Banks, BaaS, and Financial Inclusion

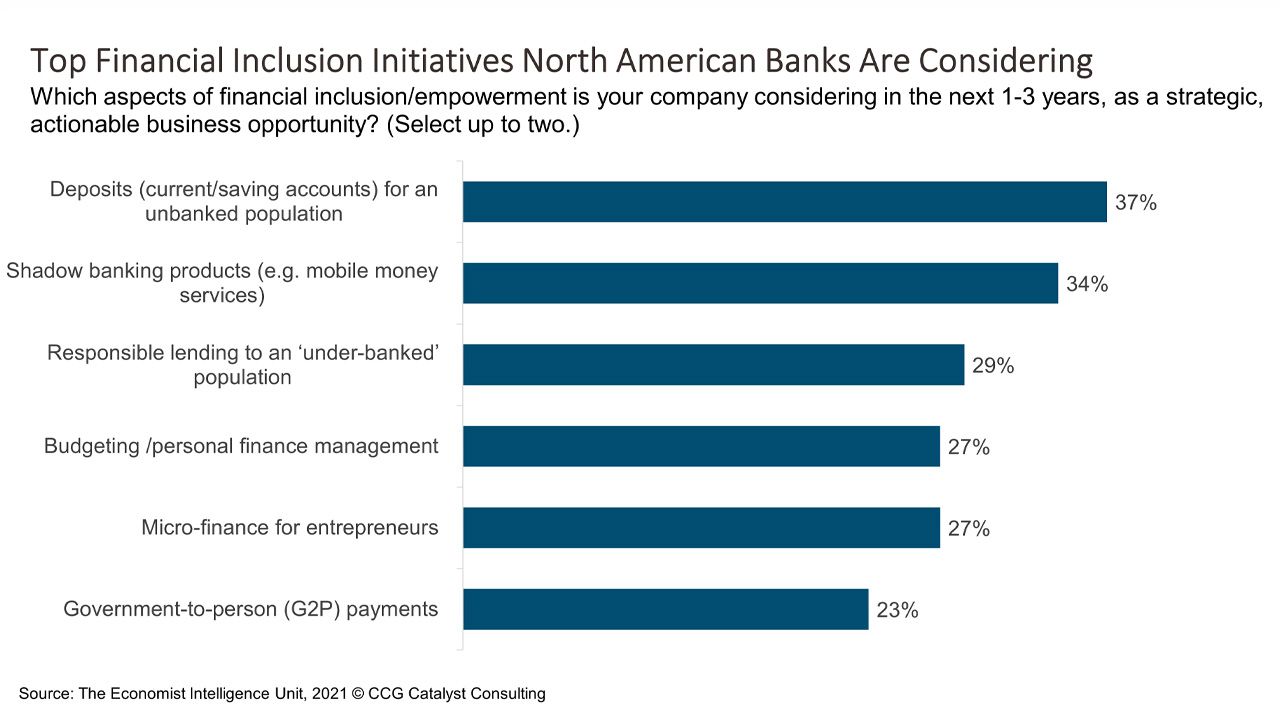

Financial inclusion is a pursuit often elevated by fintechs, especially neobanks, that target un- or under-banked populations. Examples of this are companies like Daylight, which is aimed at the LGBTQ+ community, or First Boulevard, built for the Black community. And there are many, many more. It seems, though, that traditional financial institutions are also showing interest in this area. Specifically, in a survey of North American banks conducted byThe Economist Intelligence Unit on behalf of Temenos, 37% said offering deposit products for an unbanked population is considered an actionable business opportunity for their company in the next 1 to 3 years, making it the top choice selected across a range of options.

The question is, how exactly are these institutions planning to target these communities? One answer could be through Banking-as-a-Service (BaaS). Neobanks have already made strides as community- or affinity-based organizations, demonstrating that they are able to serve the needs of niche customer groups with highly tailored customer experiences. Why exactly would traditional institutions try to replicate that? The value to such communities is in the digital customization of their services, which, let’s be honest, has never been a strength for the average bank. However, all of these fintech companies have a bank behind them. BaaS is effectively a way for a chartered institution to provide the regulatory umbrella necessary for a fintech or other nonbank brand to provide financial services. This means that, through a BaaS business model, a bank can reach new audiences (including the un- and under-banked) without having to build or create any new value propositions at all.

This brings us to a wider conversation about community. Many banks in the US are very good at serving geographic communities, generally through highly personalized, person-to-person services. Neobanks aren’t that different in this sense — they are simply using technology to serve communities that are dispersed and bonded by something other than where they live. This is essentially the next phase of community banking. And, through BaaS, it’s being propelled by some of the country’s most forward-thinking institutions. Daylight, for example, is backed by MetaBank, while First Boulevard is working with Central Bank of Kansas City. So, while the intent to put more emphasis on financial inclusion when it comes to deposit products is a good one, it may be worthwhile to think about this feat creatively.

Maybe it’s wiser to leave the product development to those who’ve made it their mission to reach these groups. It doesn’t mean there isn’t room for you to play, as well, in a different capacity. There’s a real synergy between community banks and neobanks in the way they approach customers; it’s really on targeting and delivery where they diverge. And that dynamic offers a ton of opportunity for traditional institutions to go after new segments through the fintechs that are already there. Or, put another way, you don’t actually have to build it; you can power it instead.