Gen Z Faces Financial Barriers

February 2, 2023

By: Kate Drew

Gen Z and Financial Barriers

Gen Z gets a lot of attention in financial services — or rather, it gets a lot of lip service. This is because these young consumers, generally those aged 16-25 today, represent the next major cohort of customers for the country’s banking providers. But, for all the talk going on, many institutions are still struggling with how exactly to reach the fledgling generation. In trying to tackle this problem, it’s important to understand what makes Gen Z tick, what it is they really need. And that appears to be very simple: help.

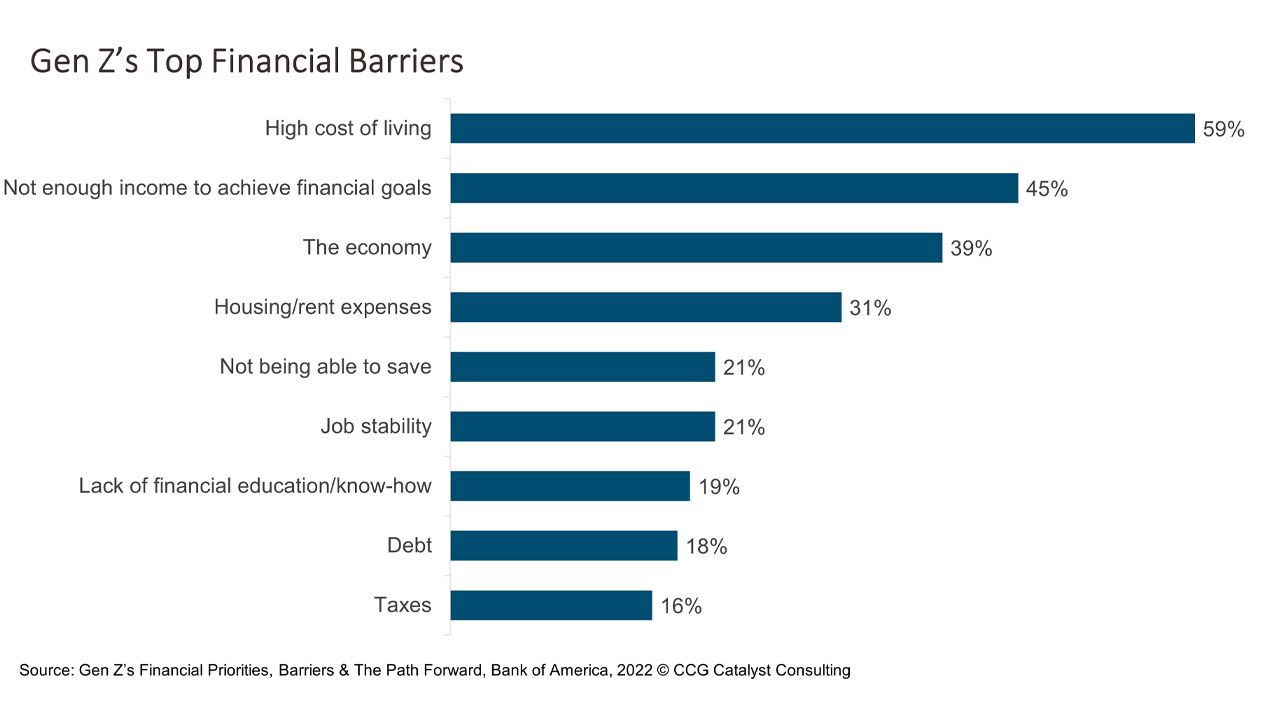

According to a recent survey conducted by Bank of America, 85% of Gen Zers say they face a financial barrier. And, among that group, the top two issues are high cost of living and not enough income to achieve their financial goals. This data strengthens an idea we’ve discussed before, that Gen Z is less focused on swanky digital interfaces than their millennial counterparts and looking for financial tools that will enable them to achieve security. As such, for those attempting to win over these users, providing education to increase financial literacy and offering strategies for building long-term wealth are likely to go a long way. As Katrin Kaurov, cofounder and CEO at Gen Z-focused finance app Frich, told CCG Catalyst back in October, “A lot of financial services companies don’t understand that Gen Z manages their money totally differently than any other generation. Gen Z is not looking for a neobank that has a pretty design — they need financial tools that actually teach them how to manage their money.”

The question then becomes, what’s the best way to equip Gen Zers with the right tools? Well, that is going to require creativity. This is a digitally native generation — maybe they aren’t searching for the most beautiful design, but they probably aren’t terribly eager to walk into their local branch, either. Institutions that really want to connect with these users will have to be willing to think outside the box and meet them where they are. For example, data from Credit Karma shows that Gen Z shows a particular proclivity for turning to social media for financial advice, with nearly half of respondents saying they do so. Understanding such behavior presents a huge opportunity for financial institutions to tap into the needs of this group and begin to serve them. Ever heard of the “financial cleanse” trend on TikTok? It might be time to look it up.

The bottom line is that Gen Z operates differently than other generations. They want financial advice, and they are exploring unconventional channels to get it. Banks are very well positioned to provide the tools they need, but they will need to get comfortable operating on these other mediums. It’s not only about providing help and advice; it’s also about the delivery of that help and advice. Surely, banks are able to provide insights and strategies that rival those of social media influencers. They just need to figure out how to translate those ideas in a way that will resonate.