How to Think About Today’s Fintech Opportunity

February 8, 2024

By: Tyler Brown

Venture Capital and Startups

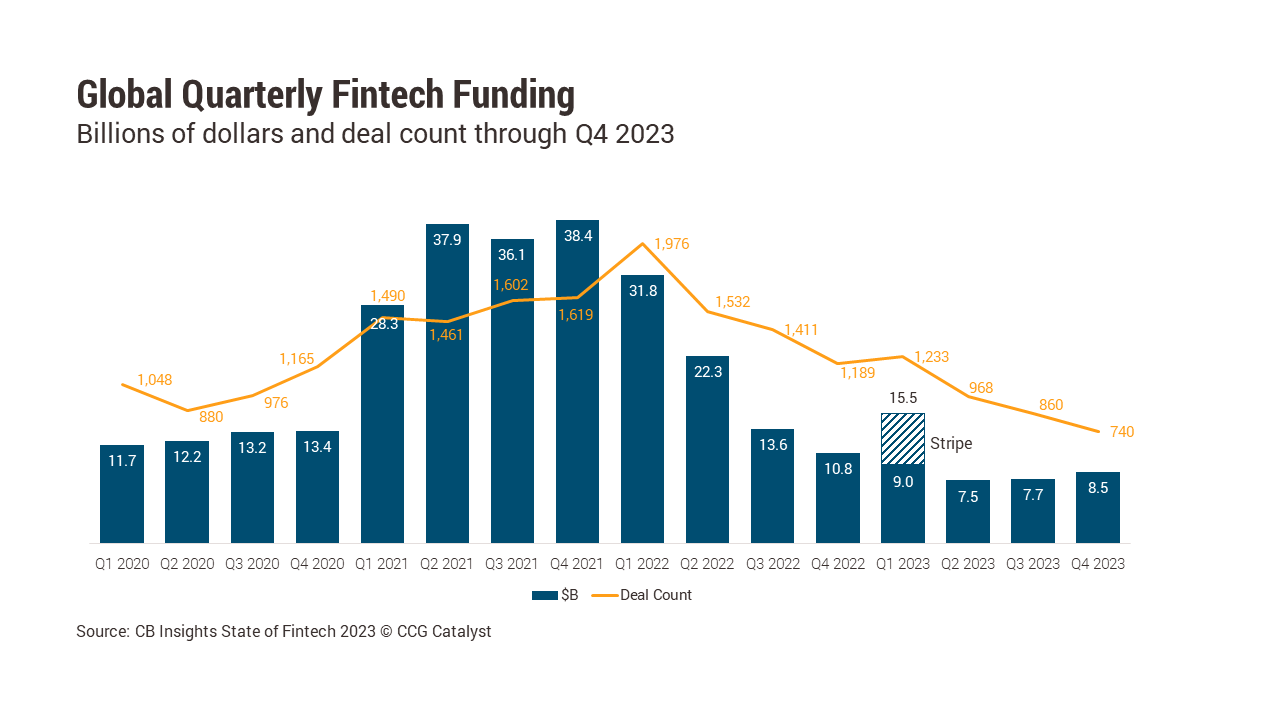

Fintech has had a hard time of late. Fintech funding dropped off dramatically from its highs in 2021 over the last two years. And, amid a tighter capital environment and tough macroeconomic outlook, we’ve seen major layoffs at even some of the most well-known firms. PayPal and Block laid off about 3,500 employees between them in late January, for instance, while Brex laid off 282 employees, 20% of its total. Some fintechs have shut down completely.

This has led to a general malaise across the industry, and it could impact bankers’ perspective on opportunities in fintech. However, it is important to remember that the issues the fintech industry is dealing with right now are largely cyclical and will likely create a more resilient sector in the process. In fact, there may be some light at the end of the tunnel already: According to CB Insights, in Q4 2023, global fintech funding perked up from its low of $7.5 billion in Q2, rising 13%, to $8.5 billion.

It’s too early to tell if a true rebound is in the cards, and overall deal count still declined slightly, but that fintech activity appeared to liven across verticals and in different parts of the globe is at least some positive news against an otherwise dreary backdrop.

Here are some highlights of the names that raised money in Q4:

- Metropolis, a US quasi-embedded payments startup that uses computer vision to initiate payments using cars, raised $1.05 billion in Series C capital. It’s a tantalizing use case for artificial intelligence (AI) and a futuristic application of embedded finance, although the company’s core solution is paying for parking. Metropolis combined its fresh funding with $650 million raised in debt to buy the company that owns Parking.com. With that purchase, it acquired a footprint of over 400 parking facilities.

- Tamara is a Saudi Arabian shopping and Sharia-compliant buy now, pay later (BNPL) app operating in Persian Gulf countries. (It earns money by charging fees to merchants that partner with it.) Tamara took in $340 million in Series C funding in Q4. It has reportedly partnered with Saudi brands like SACO, Whites, and Nice One, and UAE brands like Namshi and Floward.

- Investree, an Indonesian peer-to-peer lending marketplace that aims to reduce barriers to financial access, raised a $231 million Series D round. On the borrower side, the company handles loan application and approval, and on the lender side, it manages loan funding and repayment. Investree is reportedly participating in a joint venture in Qatar, signaling growth ambitions in the Persian Gulf and perhaps beyond.

- Imprint, a US embedded payments (branded credit card) program manager, raised $75 million in Series B capital. Imprint appears to target small- and medium-sized businesses and offers services that include targeted marketing, rewards, a white-labeled application workflow, and an analytics dashboard. Today, it cites five active programs, including a Texas regional grocer; a hobby shop for planes, boats, and trains; and a budget timeshare brand.

Going forward, we may never again reach the euphoria once seen in fintech funding. But that’s not necessarily a bad thing. As we wrote in November, a quieter fintech market with lower valuations is an opportunity for both strategic investors, including banks, and investment funds. What we’re witnessing now is essentially a cutting of the wheat from the chaff, providing investors with the chance to step back and more carefully determine which propositions have merit. It will likely take time for funding (and the market) to fully stabilize, and more pain is possible in the meantime. But those who have kept their nerve and identified long-term winners will have the most to gain.