Is Fintech Funding in Freefall?

August 4, 2022

By: Kate Drew

Fintech Funding

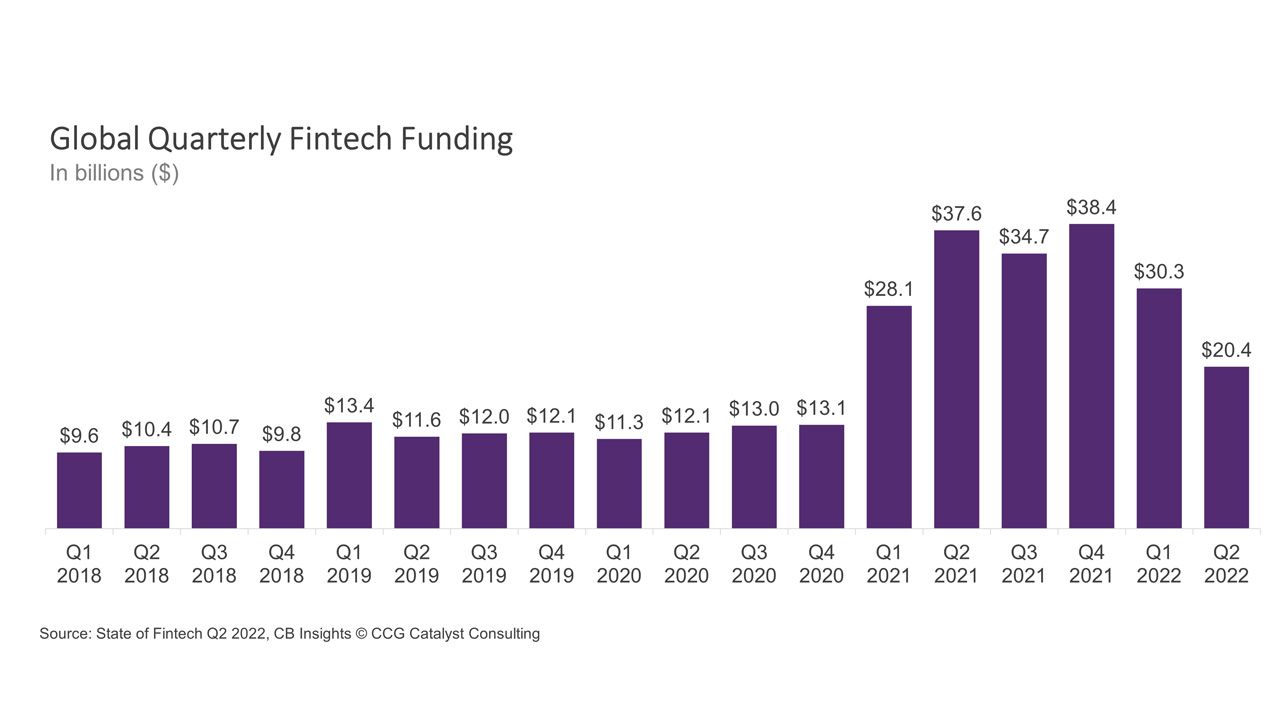

Against a tough economic backdrop that’s seeing slashed valuations and tighter funding across the technology sector broadly, fintech is no exception. In fact, according to data from CB Insights, global fintech funding fell for the second quarter in a row in Q2 2022, dropping from $30.3 billion in Q1 to $20.4 billion. That’s a nearly 33% decrease. It’s worth pointing out that funding is still well above 2020 levels, and 2021 was certainly a banner year for fintech around the world. But the current downward trend points to a correction that has serious implications for these companies and anyone working with them, including traditional banking institutions.

The reason this pullback is so important for banks is because, as we’ve discussed before, each relationship a bank inks with a fintech provider is essentially a bet. It’s a bet on a new technology or product or idea. A bet that a newer player can somehow help bring the bank into the future, be that through traditional vendor-client relationships or more novel models of engagement like Banking-as-a-Service (BaaS). When funding and valuations are high, it’s easier to place these bets. More funding means more room to run as a company builds. That means more time to get it right. Now, though, as the funding environment retracts, there will be greater pressure on these companies to demonstrate viability and a path to profits — or, put another way, it will be harder to get cash, and the runway will shorten. Some (if not many) of these companies will fail entirely. In turn, placing the right bets becomes a lot more important.

Honestly, we should have been doing this all along, taking a measured approach to engagement, whether that be as a bank or investor or whatever. It doesn’t mean that we should shy away from risk; it just means we have to be thoughtful and diligent about the moves we make. It’s so easy to get carried away by the promise of opportunities. If you’re thinking of Icarus right now, that’s entirely the right image. We must be careful not to fly too high, even when it feels like falling is impossible. Troublingly, though, at the exact same time, we cannot be too conservative or else we will miss the winners. Banks tend to sit at the middle of this divide — no one is going to characterize the banking industry as too risk tolerant, but the last couple of years have made things that are risky seem much less so and objects especially shiny. Now, as the environment changes, it’s going to become crucial to keep the risk-reward pendulum in balance.