Is the Bank Branch Dead?

December 15, 2021

By: Kate Drew

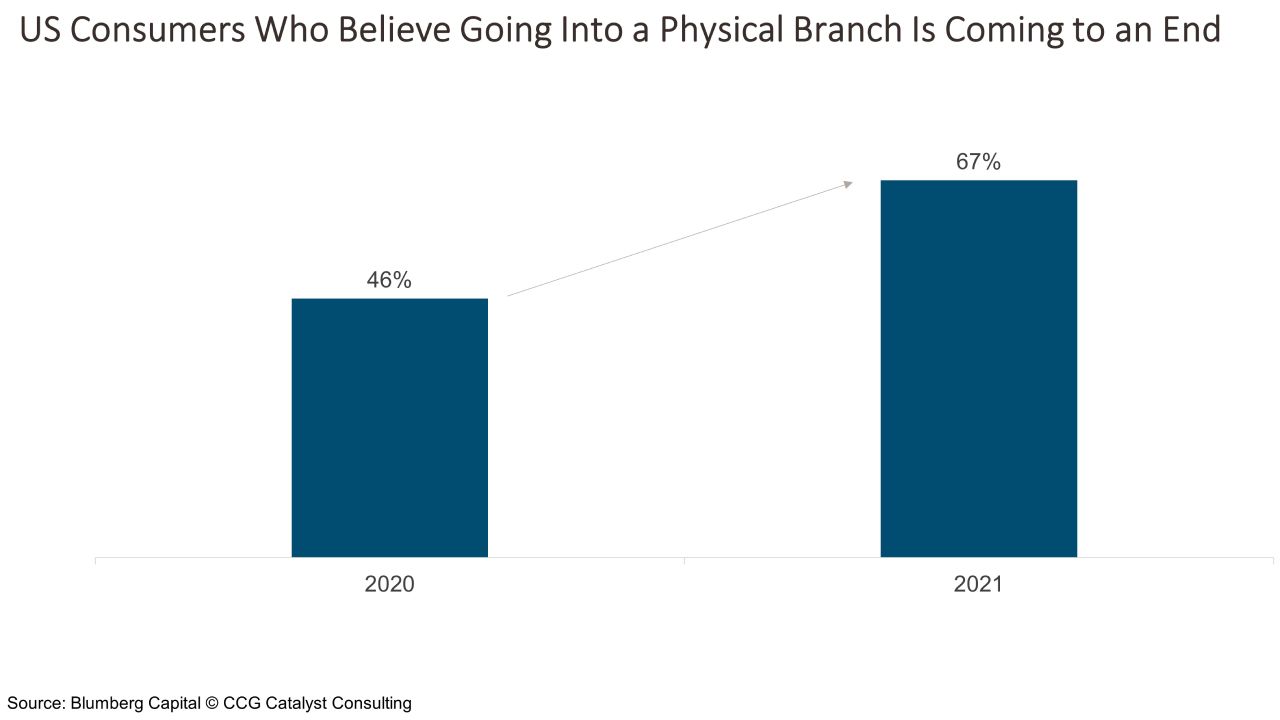

Consumers tend to believe the days of going into a physical bank location are coming to an end, according to new data from Blumberg Capital, which surveyed 1,000 US-based customers over the age of 21. Specifically, the survey found that 67% of respondents think physical visits are on their way out, up from 46% last year. This is especially telling as 2021’s dramatic increase in this area came despite the year being filled with far fewer restrictions than 2020, when the pandemic was still very much at its height. As such, the data suggests consumers generally believe their embracing of digital, in many cases spurred by Covid-19, is here to stay.

All those who invested heavily in their digital channels over the last two years or so are probably (and should be) feeling pretty good, right now. However, it’s important to remember that waning visits to the branch doesn’t necessarily mean customers are done with human interaction entirely. In fact, according to the same study, 74% of respondents said that, when it comes to managing their financial and personal information, they still have more confidence in human employees. This suggests that customers’ perception of how they like to interact with their bank remains nuanced — they are typically looking to operate primarily within the digital channel with the option to pull in a human when they see fit. CCG Catalyst data reinforces this idea: In our 2021 US Banking Study, 40% of bank executives said their retail customers primarily interact with their bank via a combination of digital and in-person interaction, making this by far the most selected response. At the end of the day, it’s all about choice.

So, how do you create a really great hybrid experience? You’ve got to understand how your specific customers interact with your bank. What do they do digitally? What do they come into the branch for? Then, you can begin to optimize your various channels based on those needs and interactions. This can include things like employee training on common customer issues in the branch as well as iterating on digital functionality that is used often. In the branch, it’s really about making things as efficient as possible while concentrating on what customers need from a functional standpoint. We’re probably a long way off from the widespread removal of branches, to be honest. But we should be thinking about what purpose they serve in an evolving environment and how we can ensure they are designed to support that purpose. Maybe that means a greater focus on relationship management, or it could mean ensuring employees are equipped to help a customer finish an application started online. There are many permutations, and the answer will be different for every bank. It’s time, though, to take a really hard look at what “branch of the future” means for your organization.

Is the bank branch dead? No. Is it in need of some reimagining? You bet.