It’s Time To Learn More About Your Customers

September 22, 2021

By: Kate Drew

Banks Need More Customer Data

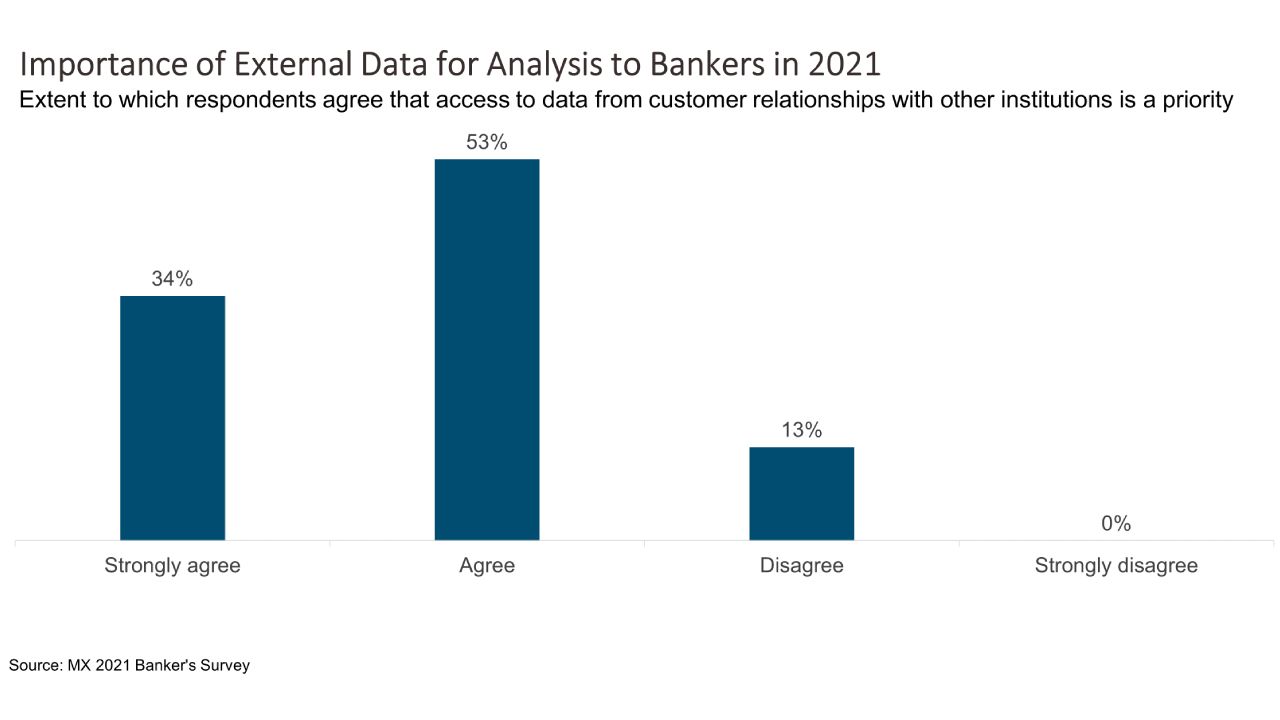

Most of the time, our conversations about open banking center on getting data out of an institution. How do we get the bank or financial institution (FI) to a point where they can easily share data with fintechs and other third parties? How do we do this with security in mind? This is a worthwhile discussion — the ability to share data within the bank is critical to supporting open banking in the traditional sense (giving consumers the ability to share their data as they please), as well as central to pursuing best of breed strategies. However, the ability to ingest data from other institutions is also rapidly becoming an imperative for FIs. In fact, according to data from MX, a whopping 87% of bankers surveyed recently said they either strongly agree or agree that increasing externally held data (transactional data from relationships customers have with other providers) available for analysis is a priority in 2021.

The ability to ingest data from other institutions your customers may work with offers a couple of important advantages:

1. Ability to deliver better insights. The most immediate reason to ingest data from other institutions is to enable better insights for customers. Today, clients have accounts all over the place, which can make it difficult to get a full picture of their entire financial life — all of their deposit accounts, loans, investments etc. Pulling in data from their other providers to deliver a 360-degree view can help customers to make better decisions, increase their feeling of comfort and security, and ultimately, make them more engendered to the FI that is aggregating everything on their behalf. Layering analytics on top is a bonus.

2. A richer customer picture. Having a better understanding of how your customers interact outside of your organization can help generate insights for the bank into their behaviors and needs. For example, say a customer recently took out a mortgage with another provider on a property outside the city in which their primary residence is, they may now also be considering purchasing a car. That might make them a candidate for an auto loan. The more data you have on your customers, the easier it is to determine how you can best serve them.

Data is perhaps the most valuable asset to banks today. That is true of the data inside the bank, and it’s true of the data outside the bank. Developing a data strategy is critical to the success of banking institutions going forward — that is probably not all that debatable at this point. But what we mean when we talk about data is still on the table for conversation. As we think about designing strategies around data, it’s important that those discussions include both the internal and external sides of the coin to maximize value and ensure institutions fully understand what the opportunities are.