It’s Time To Talk to Regulators About Fintech

February 2, 2022

By: Kate Drew

Regulators and Fintech

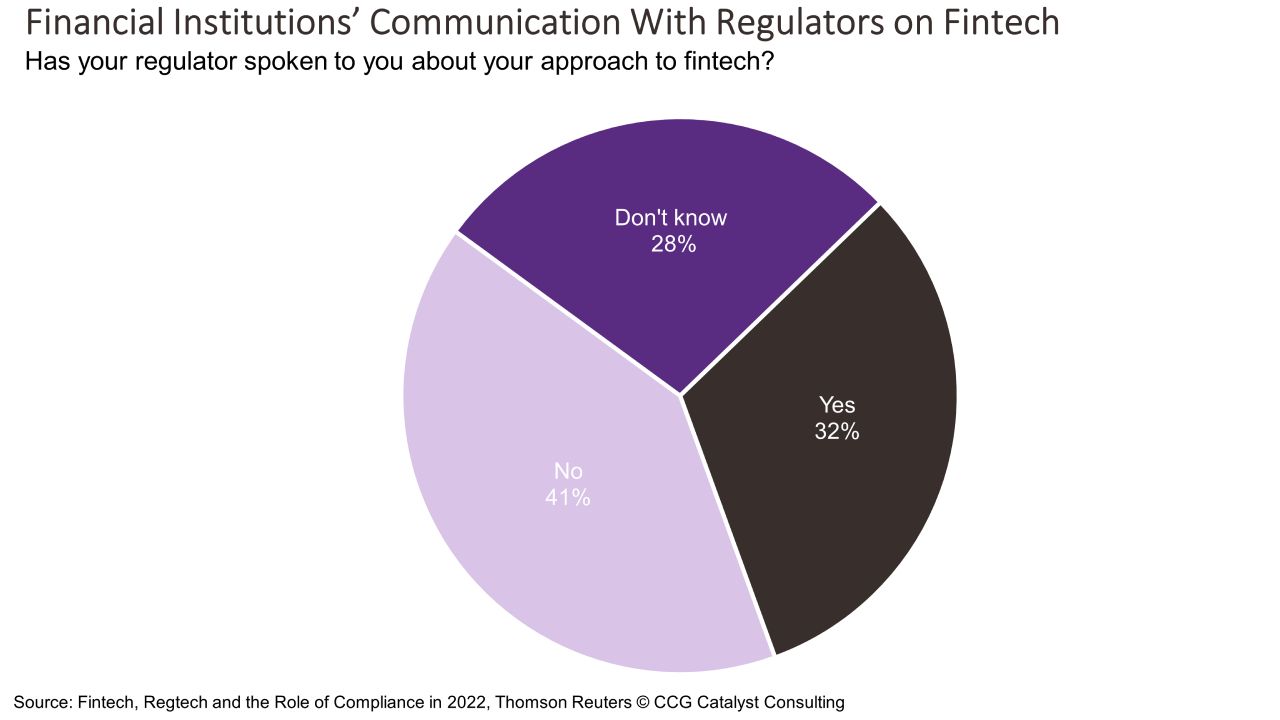

When traditional banking institutions are reluctant to engage with fintech providers, their reasoning is very often tied to the regulatory landscape. Or, put more bluntly, the risk that they will fall afoul of their regulator. This is not a new phenomenon; it’s been this way for ages. But what if those fears are not entirely founded? What if, rather, they are actually stemming from a lack of communication? New data suggests that might be the case: According to Thomson Reuters’ Fintech, Regtech and the Role of Compliance in 2022 report, only about a third of financial institutions (FIs) surveyed reported that they had actually spoken with their regulator about fintech. That is a terribly low number, especially given the central role fintech is playing in the industry.

Banking is a highly regulated arena — there’s no doubt about that. And many of the fintech initiatives of the last decade (or two) are pushing those boundaries hard. Concepts like Banking-as-a-Service (BaaS) and open banking tout the benefits of fintech engagement in the form of improved customer satisfaction and returns but also open up the door to concerns about new business models, risk, and security. And, of course, the all-consuming question, “What if our regulator doesn’t like how we’ve done this?” It’s an important one, but as the Thomson Reuters’ report suggests, it’s one that may well be overcome simply with a little forethought and outreach. In fact, some of the most successful banks in the fintech realm are those that brought the regulator in early. Piermont Bank, for example, a de novo bank in New York, worked closely with regulators on its BaaS plans from the start, and it’s been able to scale that operation to include partnerships with over 30 fintech companies.

Talking with your regulator about fintech is a small but important step that can help to ensure everyone is on the same page. It seems like a no brainer, right? Honestly, everyone should be doing this — and that is something we rarely say in banking. The truth is, though, not only can this approach mollify concerns about upsetting those charged with oversight, but it can also give the bank insight into how they are thinking about fintech and the banking industry more broadly. That insight can inform strategies and help to reduce risk overall when it comes to execution, making sure your bank is prepared to engage in new projects safely and responsibly. And that is the ultimate goal — to implement new technologies that can drive benefits without compromising the security of the bank’s systems or customers’ data and assets.