Launching a Digital-Only Bank Isn’t Easy

June 9, 2021

By: Kate Drew

The digital-only bank is a hot topic. Many traditional institutions today are exploring the idea of creating a standalone subsidiary, or a greenfield bank, built on modern technology that can serve as a proving ground for new infrastructure and help them to better compete in a digital-first world. (For a full explanation of the greenfield approach, please see our recent snapshot here.) This strategy feels very attractive as it offers a way for banks to experiment with new tech and digital propositions without disrupting their traditional business in the process. It also generally comes at a lower cost than a “rip and replace” of the core. However, that doesn’t mean it’s easy either — building a digital-only bank comes with its own hurdles, as well.

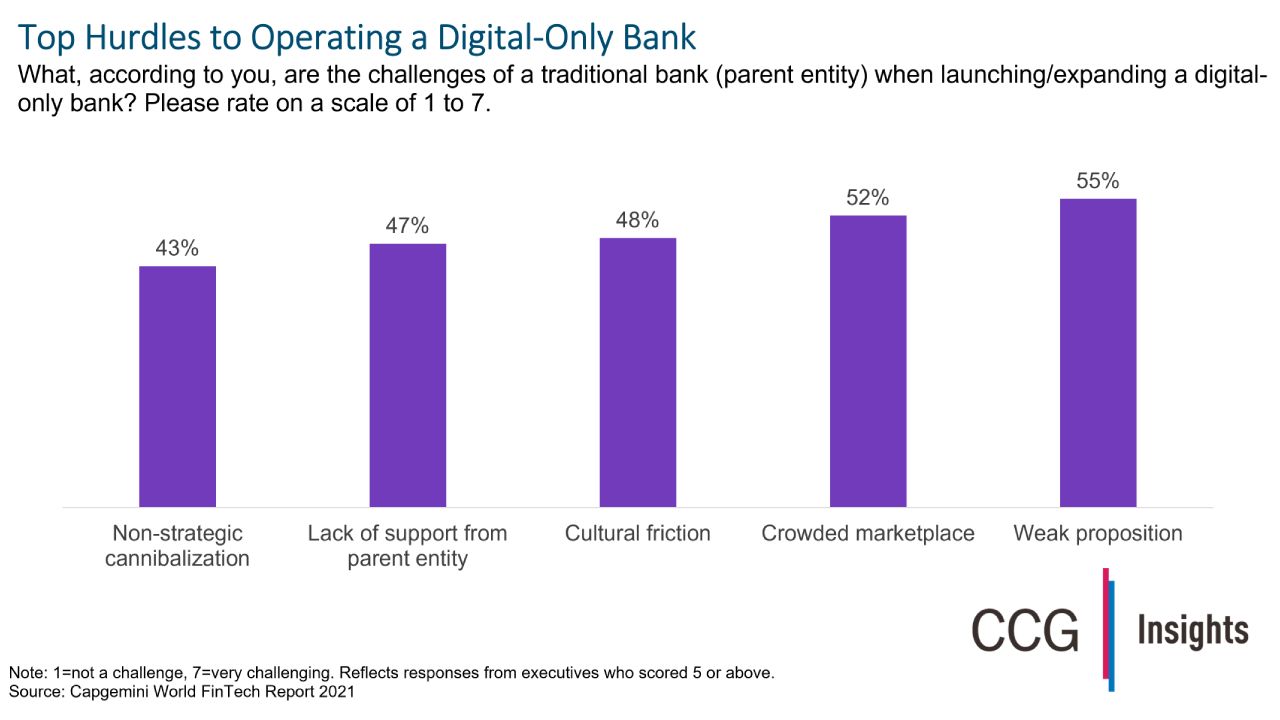

A recent survey of global bank execs by Capgemini revealed several top challenges to introducing a digital-only subsidiary, including the proposition is too weak, the marketplace is too crowded, and cultural friction between the new brand and the traditional business. Lack of support from the parent entity and nonstrategic cannibalization also made the top five. All of these issues are important to consider, especially as there have been quite a few splashy failures in the greenfield space already, including Chase’s Finn and RBS’ Bo. What’s interesting, though, is that the majority of these impediments are typical business challenges and, as such, can likely be avoided with the right forethought and planning.

For example, the most successful digital banks have a very clear value proposition from the start — Marcus by Goldman Sachs came on the scene in 2016 with a mandate to bring the behemoth’s services, previously reserved for high net worth individuals on the retail side, to the mass affluent. The unit ended 2020 with $97 billion in deposits. Meanwhile, cultural friction can be managed by creating cross-functional teams that pull from existing business units, rather than staffing an in-house upstart only with new blood, as well as creating a real understanding throughout the business of how the two brands complement each other and are meant to coexist. The key here lies in thinking beyond the technology to all of the business elements that go into launching a digital-only bank, before jumping in to begin with.

Truthfully, there is probably no way to head into the future that isn’t going to have bumps along the way. And the greenfield approach is not for everyone — those that cannot afford to fail here will likely be turned off. But, for those looking to experiment with cutting-edge technology that’s not yet proven, while keeping costs down, it will probably at least be a point of discussion at the table. When going down this path, it’s important to remember the business considerations that are critical to success. Winning here isn’t all about the technology. The most successful startups in the world know this very well, and if you’re going to build one, you need to understand it, too.