Millennials Are Switching Banks

October 6, 2021

By: Kate Drew

Bank Switching By Generation

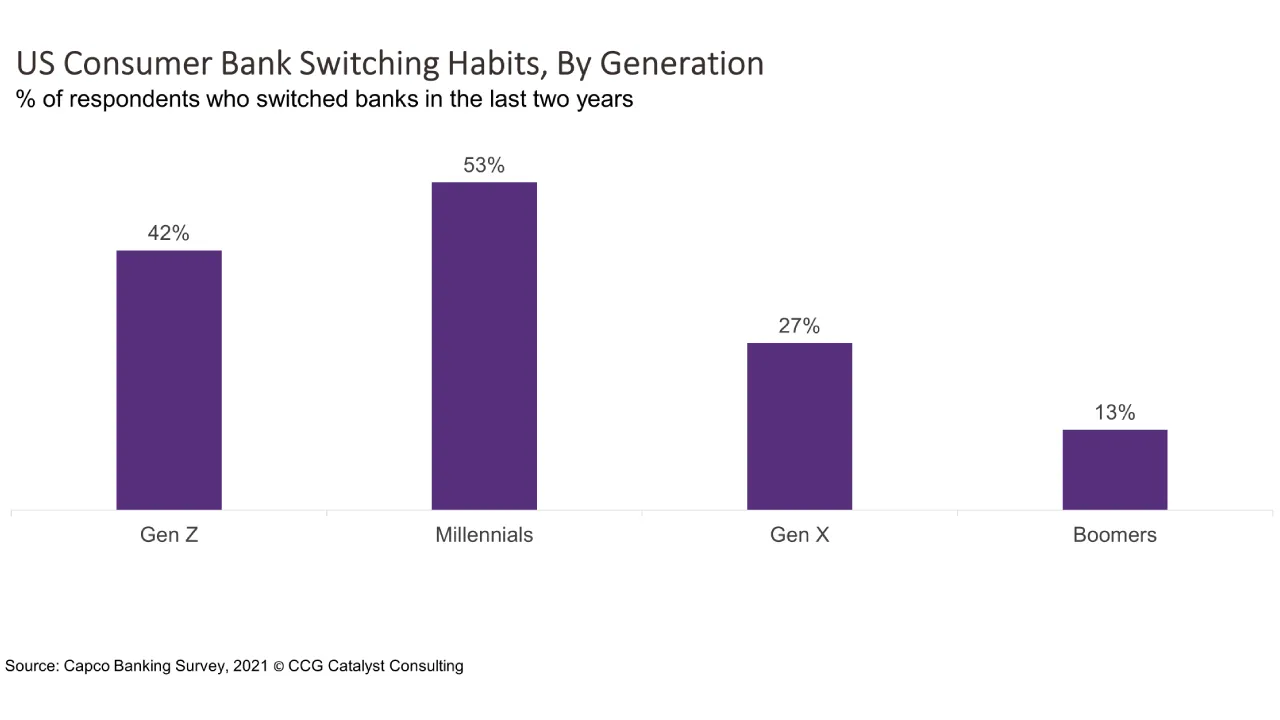

Do consumers ever really switch banks? For a long time, the anecdotal answer to this question has been, “No.” Banking institutions and pundits alike generally tend to believe that, while consumers will add new accounts, rarely do they actually take the leap of switching their primary financial institution. This belief, in turn, has a hearty impact on how many institutions approach innovation. However, new survey data from Capco suggests they’ve got the wrong answer, especially when looking at younger generations. According to the 2021 study, 53% of millennial respondents switched banks in the past two years. Gen Z respondents were slightly less likely to switch at 42%, followed by Gen X and boomers at 27% and 13%, respectively.

This data is somewhat staggering because it upends a long-held belief about customer loyalty, and for a particularly important group. The millennial generation is maturing, making up a greater portion of the workforce, and is expected to increase its earning power by almost 75% in the next couple of years, according to The Economist. That means failing to retain them would be extremely detrimental to business. Part of the problem is that millennials (and their younger counterparts in Gen Z) are the primary targets of digital-only challenger banks’ slick and targeted marketing efforts touting fee-free accounts, transparency, and generally, “a better way to bank.” And it’s working — neobanks like Chime have amassed millions of users in the past few years. Moreover, they’ve been able to win primary customers, especially in the midst of the Covid-19 pandemic, by offering things like early access to stimulus money in exchange for the coveted direct deposit. While it may be easy to discount these challengers as not a real threat, as their overall market share remains small, their ability to pull in younger users, who will grow more important over time, should not be overlooked.

The question now is, “How do we reach these users?” One answer may be to look at where neobanks are achieving success and replicate their approach. These upstarts do a very good job making consumers feel heard, especially younger demographics. That comes from a fierce commitment to user research and agile development. The Capco study also shows that millennials are particularly open to financial incentives — their top driver for switching in the survey was rewards, followed closely by interest rates. This makes a whole lot of sense set against the success of neobanks’ approaches to stimulus checks this past year. It seems the key to reaching these all-important customers is not all that complicated really: Understand their needs and communicate effectively how you can serve them. This means perhaps putting greater focus on customer surveys and focus groups as well as targeted marketing campaigns. One thing is for sure, though, expecting these customers to stay just because it’s a hassle to leave isn’t the right way to go. You’re going to have to fight for them.